Naspers’s video entertainment segment — in effect, the MultiChoice business — has grown revenue by 8% to US$3.7-billion in the year ended 31 March 2018, despite recently warning of tough competition from online streaming video providers such as Netflix and Amazon Prime Video.

Naspers’s video entertainment segment — in effect, the MultiChoice business — has grown revenue by 8% to US$3.7-billion in the year ended 31 March 2018, despite recently warning of tough competition from online streaming video providers such as Netflix and Amazon Prime Video.

The segment grew earnings before interest, tax, depreciation and amortisation, or Ebitda — a measure of operational profitability — by 21% to $627-million, from $520-million a year ago. It delivered a trading profit of $369-million, an increase of 29% on 2017’s $287-million, Naspers said.

The media and technology group, which owns 31.2% of the giant Chinese Internet company Tencent, said that although the macroeconomic environment in sub-Saharan Africa was “relatively stable” in the second half of the year, the video entertainment business “continued to face challenging conditions”. A stronger rand impacted positively on the numbers, however. Results were affected by the 25% devaluation of the Nigerian naira and a 7% devaluation of the Angolan kwanza over the period.

The video entertainment segment added more than a million direct-to-home satellite subscribers and 520 000 digital terrestrial television (DTT) subscribers. The total base across Africa stood at 13.5 million households as of 31 March 2018.

“The business continued to build on the success of its value strategy to grow the subscriber base, and further reduced costs,” Naspers said. “DTT subscriber growth was supported by a partial analogue switch-off in Zambia and launch of a popular package, GOtv Max, which generated increased average revenue per user from upgrades and new customers.”

The focus continues to be on optimising cost structures and reinvesting for its online future, the group said.

“Through continued efforts to save on content costs and overheads, it reduced operating costs by over $70-million. Sports rights investments included renewing the English Premier League, South Africa’s Premier Soccer League and the UEFA Champions League. Cost savings were partially reinvested in subscriber acquisition, production of local content and scaling Showmax.”

Showmax, which sits in the MultiChoice stable, is Naspers’s online streaming video platform akin to Netflix.

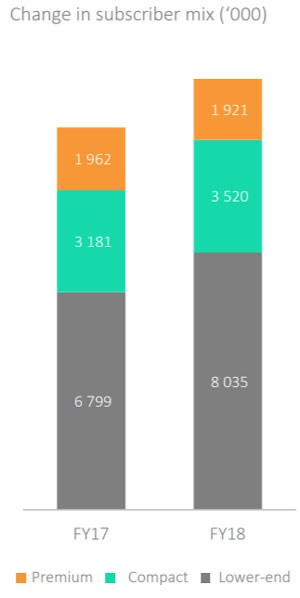

While the lower-end segment showed strong growth, the DStv Premium tier did less well. The number of Premium subscribers fell to 1.92 million from 1.96 million previously. Compact subscribers rose from 3.18 million to 3.52 million and lower-end subscribers jumped from 6.8 million to 8.04 million.

South Africa

The lower end (not Premium or Compact) now makes up 60% of total subscribers in South Africa.

Average revenue per user in the country declined from R353/month to R344/month year on year. The number of personal video recorder decoders grew by 9% to 1.4 million, representing an 81% penetration on Premium and 12% on Compact.

Higher South African subscriber revenue on the back of a 9% growth in subscribers and a stronger rand drove profitability. The South African business generated $522-million in free cash flow.

The Naspers group reported full-year revenue for $20.1-billion, up 38% compared to 2017 (or 39% in local currency and adjusted for acquisitions and disposals). “This is a meaningful growth acceleration of which e-commerce and Tencent were key drivers.”

Group trading profit rose 47% to $3.4-billion (or 52% in local currency and adjusted for acquisitions and disposals). Core headline earnings, the board’s measure of operating performance, were up 72% to $2.5-billion. – © 2018 NewsCentral Media