It was a long wait, but Thursday morning finally looked like the time to congratulate HTC on a smart move. Except I can’t. HTC messed up. Taiwan’s iconic smartphone maker is selling 2 000 of its best and brightest engineers to

Google agreed to buy part of HTC’s engineering and design teams for US$1.1bn, taking on a cadre of veterans that worked on the Pixel phone and could bolster its nascent hardware business. Google is taking on

The Reserve Bank unexpectedly kept its benchmark lending rate unchanged because it’s concerned about higher inflation expectations. The rand rallied. The central bank’s monetary policy committee

Google is close to acquiring assets from Taiwan’s HTC, according to a person familiar with the situation, in a bid to bolster the Internet giant’s nascent hardware business. By owning a manufacturer outright, Google could gain tighter

South African start-up Project Ubu, which is working to combine the idea of a universal basic income (separate from government-led initiatives) with a blockchain-housed cryptocurrency, has announced plans to

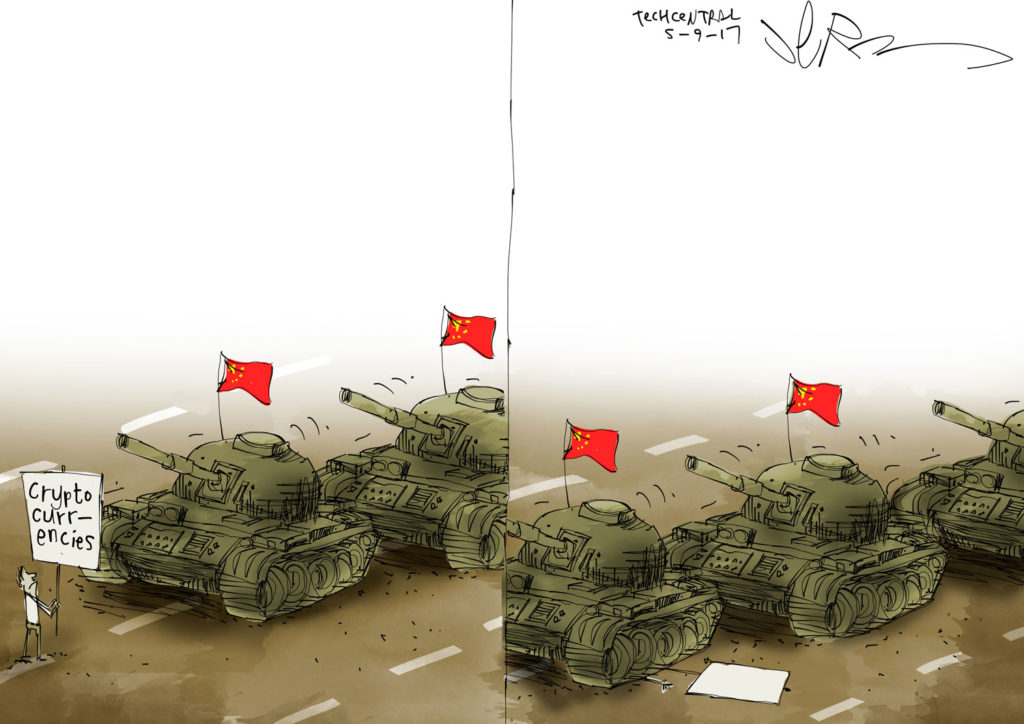

The Chinese government’s decision to order several bitcoin and other cryptocurrency exchanges to close shows how much of a threat they are perceived to be to financial stability and social order in China. The

Bitcoin will probably see another splintering off in November as miners and developers debate how best to scale the cryptocurrency’s rapidly growing marketplace, says investor Roger Ver, CEO of Bitcoin.com. In

Last week, the Financial Services Board granted the fourth new stock exchange licence issued in the past two years. The licence was awarded to Equity Express Securities Exchange, and follows those given to ZAR X

South African programmes to add coal and gas power generation from independent providers should wait until policies are updated and the nation’s future needs are clearer, said energy minister Mmamaloko Kubayi

Bitcoin start-up Luno has announced plans to expand into 35 new markets in Europe after securing R120m (US$9m) in a Series B funding round led by London-based Balderton Capital. Rand Merchant Investments