If you’d invested R40 000 in the shares of Durban-based technology company Adapt IT five years ago, you’d be a millionaire today.

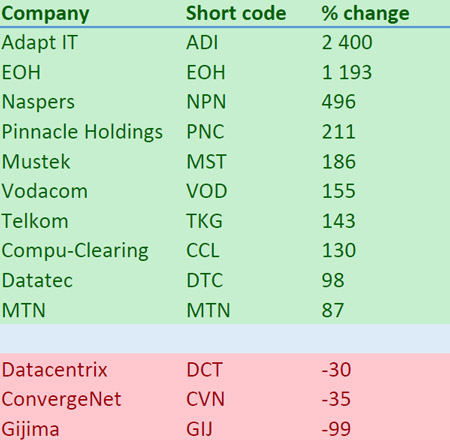

Adapt IT’s shares have risen by a spectacular 2 400% in the past five years, making it the best performing technology counter on the JSE over that period.

They’ve continued their upward momentum after Adapt IT published interim results earlier this month for the six months to 31 December 2015. Headline earnings per share climbed by 35% to 18,6c on the back of a 38% improvement in revenue to R261m.

While an investment in one of the biggest success stories in South Africa’s IT market in the past decade, EOH, would not have generated quite the same returns as money put into Adapt IT, the services company has nevertheless performed very strongly.

EOH has added almost 1 200% in the past five years, driven higher by a combination of strong organic growth and smart acquisitions. It’s the second best performing technology counter over this period.

Indeed, it handily beat the performance of stock market darling Naspers, where a R40 000 investment in 2010 would have turned into a tidy R238 000 today. That’s quite a performance for a company whose market capitalisation is now north of R700bn. A large part of that appreciation, of course, is due to Naspers’s one-third stake in China’s fast-growing Internet superstar, Tencent.

Two technology distributors, Pinnacle Holdings and Mustek, round out the top five technology performers over the past five years.

Vodacom is the best performing telecommunications stock, gaining 155% over five years, with Telkom a close second at 143% (thanks to the sharp appreciation in its value since mid-2013 when a new management team took the reins). MTN returned a relatively poor 87% over the same period.

Of course, these comparisons show only the share price performance and don’t take into account other factors like dividend payments.

In the past five years, Gijima performed worse, with investors losing just about all of their money over this period. ConvergeNet and Datacentrix were also poor performers. — © 2015 NewsCentral Media