Government is considering selling a green infrastructure bond worth tens of billions of rand as part of its biggest drive ever to kick-start private investment in projects ranging from energy to water reticulation.

Government is considering selling a green infrastructure bond worth tens of billions of rand as part of its biggest drive ever to kick-start private investment in projects ranging from energy to water reticulation.

The proposed instrument is one of several mechanisms the country could use to raise finance for projects worth as much as R1.5-trillion over the next decade, said Kgosientsho Ramokgopa, head of the presidency’s investment and infrastructure office.

“A idea that’s finding traction is a green infrastructure bond,” he said in an interview on Monday. “It will be substantial.”

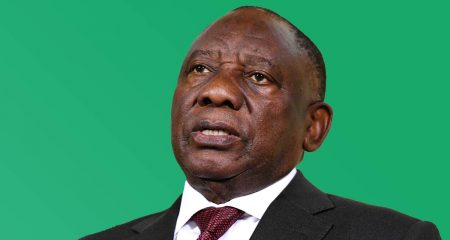

The infrastructure programme will be officially unveiled at a symposium in Pretoria on Tuesday, where President Cyril Ramaphosa will announce investment commitments by private investors and international finance institutions. It is seen as a way of trying to counter the fallout of the coronavirus outbreak, which the central bank expects to cause a 7% economic contraction this year.

With a debt-to-GDP ratio that’s expected to exceed 100% by 2025, according to a national treasury document, the state has little room to fund infrastructure despite South Africa’s need for everything from power plants to additional housing and water supply. State companies also have limited scope to fill the gap because they, too, are already saddled with billions of dollars of debt.

More involvement

Ramaphosa has previously announced plans for a R100-billion infrastructure fund and is now pushing for more involvement from private investors, who have more funding capacity. Privately held mutual funds oversee about R2.5-trillion in assets, according to the Association for Savings and Investment South Africa, while the Public Investment Corp, which mainly manages the pensions of state workers, has R2.1-trillion.

Futuregrowth Asset Management, the country’s biggest specialist fixed-income money manager, has said the projects could attract investment if returns are attractive.

The green infrastructure bond could make it easier for private investors to participate as the security could be bought and sold easily when they need access to their funds.

The government could use the infrastructure fund to make the first investment in key projects to reduce risk for private investors, Ramokgopa said. It may also seek to have private investors fund projects and then repay them over several years while simultaneously providing them with a return.

The government could use the infrastructure fund to make the first investment in key projects to reduce risk for private investors, Ramokgopa said. It may also seek to have private investors fund projects and then repay them over several years while simultaneously providing them with a return.

Ramokgopa’s office began engaging private investors in February and pitched projects to them late last month at an event that had 230 attendees from 60 institutions, he said. Senior representatives from the New Development Bank, the World Bank and the African Development Bank will attend Tuesday’s meeting.

As many as 88 of the 272 infrastructure projects in the pipeline may be bankable, while the rest need additional work and some may not prove viable, according to Ramokgopa.

“We want to get the economy going,” he said. — Reported by Antony Sguazzin, (c) 2020 Bloomberg LP