South Africa signalled a shift in budgetary policy, backtracking on planned tax increases as it switched focus to reigniting the coronavirus-battered economy by bolstering consumption and investment.

Finance minister Tito Mboweni reversed a decision to raise an extra R40-billion over the next four years, allocated funds for Covid-19 vaccines and set more ambitious debt-consolidation targets, while sticking to a pledge to freeze state workers’ wages. He also announced inflation-beating relief for individuals, whose taxes have been raised in five of the past six years, and a one percentage point cut in corporate tax from April 2022.

“We agree that tax increases must be kept to a minimum as we stabilise our public finances,” Mboweni said in his budget speech to lawmakers in Cape Town on Wednesday. “We will not rest until we have fundamentally altered the structure of this economy.”

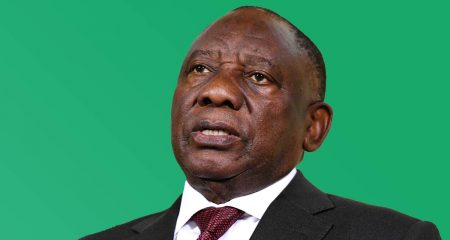

The approach is a stark change from a decade of swelling civil service costs and bailouts to state companies that proved an increasing drain on the economy. It’s the clearest sign yet that President Cyril Ramaphosa is intent on averting a debt crisis and driving through reforms needed to galvanise private investment and tackle record-high unemployment.

The pivot toward a lesser role for the state is also politically risky and may suggest the president has stamped his authority on the deeply divided ANC, which is preparing to contest local government elections later this year. Ramaphosa’s rise to power in 2018 was backed by the party’s powerful labour union allies that vociferously oppose the three-year moratorium on wage increases and favour even higher taxes for the rich.

Could have been worse

While South Africa’s finances remain precarious, the situation isn’t as bleak as it was at the time of the mid-term budget in October, thanks to a commodities boom and a partial rebound in consumption and employment. The economy likely contracted 7.2% last year, the worst in almost a century, but less than the 7.8% previously forecast. It’s expected to expand 3.3% this year and 2.2% in 2022.

National treasury expects to collect R99.6-billion more in the year to March than it projected four months ago, reducing the forecast for the budget deficit to 14% from 15.7%. Higher excise duties were imposed on fuel, alcohol and tobacco sales and a levy on scrap metal exports was introduced. The corporate tax rate will be reduced to 27% next year, the first reduction since 2008.

The anticipated peak for state debt was reduced to 88.9% of GDP in fiscal 2026. A primary budget surplus, which excludes interest costs, is seen by 2025 — a year earlier than previously announced.

The anticipated peak for state debt was reduced to 88.9% of GDP in fiscal 2026. A primary budget surplus, which excludes interest costs, is seen by 2025 — a year earlier than previously announced.

Mboweni committed R10.3-billion to buy and administer coronavirus vaccines, an allocation aimed at helping the government meet its target of inoculating two-thirds of the population of 60 million. A further R9-billion will be placed in a contingency reserve, and can be used to fund shots if needed. — Reported by Mike Cohen and Prinesha Naidoo, (c) 2021 Bloomberg LP