Ant Group has reportedly used Chinese chips to develop techniques for training AI models that would cut costs by 20%.

Browsing: Ant Group

Tencent shares have nearly doubled from a recent low on growing signs that China is preparing to end its crackdown on major tech firms.

Ant Group’s founder Jack Ma will give up control of the Chinese fintech giant in an overhaul that seeks to draw a line under a regulatory crackdown.

China has issued a sweeping warning to its biggest companies, vowing to tighten oversight of data security and overseas listings just days after Didi Global’s contentious decision to go public in the US.

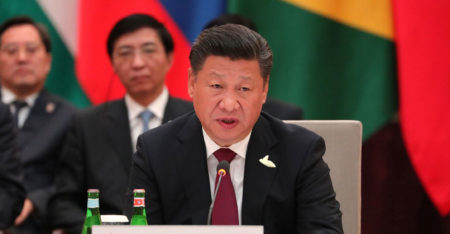

President Xi Jinping’s government is reining in the country’s most powerful corporations and their billionaire founders, including Alibaba Group, Tencent Holdings and Didi Global. But why?

China’s top leader has warned that Beijing will go after so-called “platform” companies, a sign that the months-long crackdown on the country’s Internet sector is only just beginning.

Alibaba and Ant co-founder Jack Ma has resurfaced after months out of public view, quashing intense speculation about the plight of the billionaire grappling with escalating scrutiny over his Internet empire.

The Trump administration is considering adding tech giants Alibaba and Tencent to a blacklist of firms allegedly owned or controlled by the Chinese military, two people familiar with the matter said.

Tencent joined much of China’s Internet sector in a $290-billion selloff on Wednesday after Beijing signalled its strongest intentions yet to rein in Big Tech. Yet it’s in some ways better shielded than its peers.

China’s move to halt Ant Group’s massive stock debut could reduce the fintech giant’s value by as much as $140-billion, according to analysts’ revised estimates.