View the latest contribution from TechCentral cartoonist Jerm.

Browsing: Naspers

On TalkCentral this week, Duncan McLeod and Regardt van der Berg are joined by special guest Aki Anastasiou to talk about the week’s big technology news, and plenty more besides. On the podcast, the trio have

Naspers’s video entertainment segment – in effect, the MultiChoice business – has grown revenue by 8% to US$3.7-billion in the year ended 31 March 2018, despite warning of tougher competition from online streaming video

Naspers has put aside the proceeds of share sales in Chinese Internet giant Tencent and India’s Flipkart to pay for new investments due to the abundance of opportunities in its preferred media and technology markets

Indian start-up Swiggy has raised US$210-million (about R2.9-billion) in a round led by South Africa’s Naspers and investment house DST Global, setting a stage for a battle between well-funded players in the

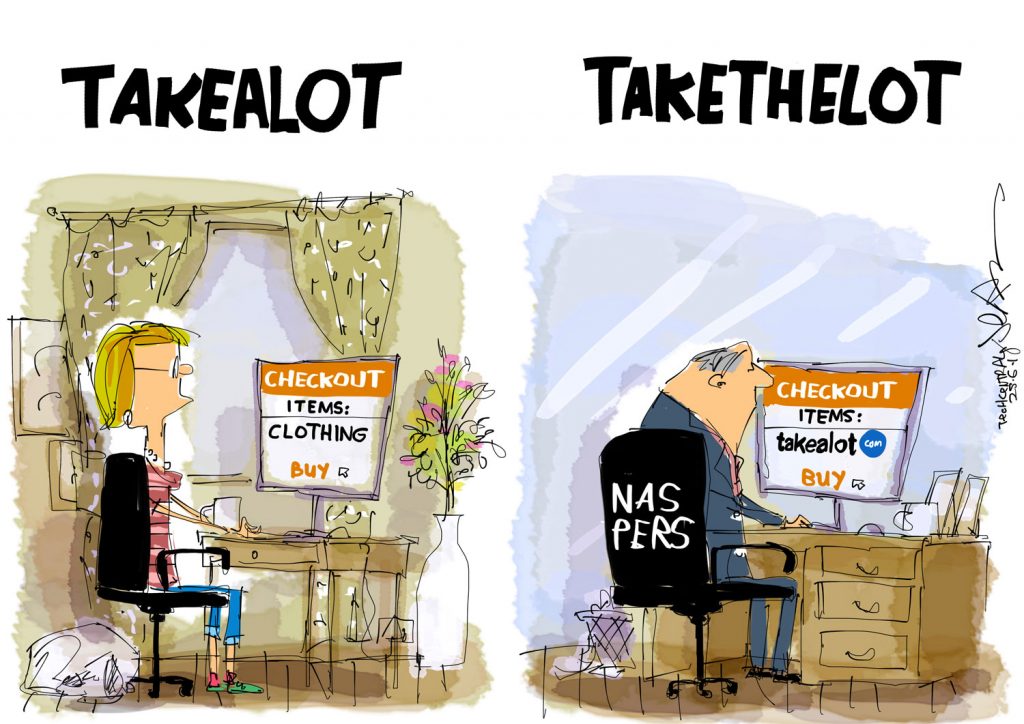

The late Monday afternoon announcement that online fashion retailers Spree and Superbalist would merge ought not to have caught anyone unawares. Both e-commerce players are already majority owned by Naspers: it owns

Media24 and Takealot will merge their online fashion stores Spree and Superbalist to create a new platform for the sale of fashion goods on the Internet. The new venture will be held 51% by Media24, Spree’s current

Naspers expects to report an increase in earnings for its most recent financial year, bolstered by Chinese Internet giant Tencent and various e-commerce businesses. Core headline earnings per share, which exclude

Traders in China are unwinding positions in Tencent Holdings faster than ever, turning to other targets amid a lack of reasons to push Asia’s biggest stock any higher. Mainland investors sold a net $81m

Tencent Holdings surged after delivering record profit that topped analyst estimates, calming investors who’d braced for a big hit to margins. The stock climbed as much as 7.1% in Hong Kong, its biggest