The Trump administration is considering adding tech giants Alibaba and Tencent to a blacklist of firms allegedly owned or controlled by the Chinese military, two people familiar with the matter said.

Browsing: Tencent

US President Donald Trump has signed an order banning US transactions with eight digital Chinese payment platforms including Ant Group’s Alipay in 45 days, when he’ll no longer be in office.

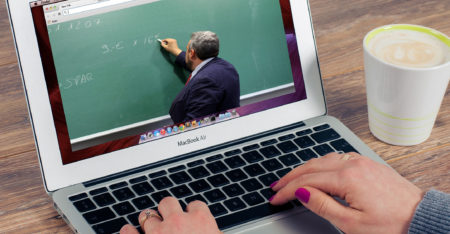

Chinese technology giant Tencent is a lead investor in a funding round that valued the online education start-up Udemy at more than $3-billion, according to people familiar with the matter.

Prosus, the giant investor in online classifieds, food delivery and payments, expects to report a 16.9% to 22.7% growth in earnings per share for the six months to the end of September, it said on Monday.

Tencent joined much of China’s Internet sector in a $290-billion selloff on Wednesday after Beijing signalled its strongest intentions yet to rein in Big Tech. Yet it’s in some ways better shielded than its peers.

China’s technology industry, one of Donald Trump’s main targets in Washington’s tussles with Beijing, hopes Joe Biden can create a more constructive relationship – but few think the rivalry will de-escalate.

The mid-level bureaucrats left China’s richest man waiting as they prepared for a meeting that would send shockwaves across the financial world.

Chinese President Xi Jinping has called for setting up independent and controllable supply chains to ensure industrial and national security, just as the US moves to cut China off from key exports.

Honour of Kings, Tencent’s flagship videogame, announced a record 100 million daily active users worldwide and said it was expanding into other genres.

Naspers spin-off Prosus, which became Europe’s largest technology company this week, has always been something of a Gordian knot for investors.