It has been an eventful year in South Africa, characterised by power cuts, parliamentary confrontations about wasteful expenditure and student fee protests. There has, however, been an elephant in the room that has impacted all these issues but enjoyed surprisingly scarce attention. The idea, vigorously driven by government, is for the country to build nuclear plants with an expected price tag of R1 trillion.

This equates to 4 000 times the controversial costs to upgrade President Jacob Zuma’s Nkandla residence and 400 times the shortfall the tertiary education sector will experience in 2016 because of the freeze in university fee increases.

The expansion of South Africa’s power generating capacity is a necessary condition for economic growth and housing development.

Delays in its implementation, as well as the collapse of ageing power utility Eskom’s infrastructure, have forced frequent scheduled power outages. The expansion programme is guided by the department of energy’s Integrated Resource Plan for Electricity 2010-2030.

The plan proposed transforming the South African energy generation mix from the current completely coal dominated one to a more balanced setup in 2030. The aim was that by then 10,3% and 10,7% would be allocated to wind and solar renewable energy technologies; and 12,7%, or 9,6GW in generating capacity, to nuclear.

The Fukushima nuclear catastrophe resulted in a worldwide critical re-evaluation of the safety and necessity of nuclear energy. Some new projects were cancelled. Germany went as far as adopting a road map that would lead to the eventual closure of all its nuclear power stations.

In South Africa, too, the need for the continued inclusion of nuclear power in the energy mix was being re-examined. In addition to the negative public sentiment towards nuclear, it was also noted that energy demand was increasing at less than the projected rate. This was partly due to a depression of the mining and heavy industry sectors.

This led to an update of the resources plan in 2013. Configurations without nuclear energy were shown to be optimal in several of the scenarios investigated in the document. It concluded:

The nuclear decision can possibly be delayed. The revised demand projections suggest that no new nuclear base-load capacity is required until after 2025 (and for lower demand not until at earliest 2035).

But in late 2014 the government took an about-turn in its approach to the nuclear build, displaying a sudden urgency to seal a large deal with Russia. The speedy and secretive manner in which government initiated a process with massive and long-term cost implications, and the inexplicable decision to declare Russia as a preferred partner ahead of other potential options, immediately led to intense suspicion of corruption.

With reference to a previous scandal-enveloped acquisition mega-project, the nuclear build became labelled as a new arms deal “on steroids”.

Government soon denied the Russians were the designated preferential suppliers. It quickly arranged a series of “nuclear vendor parade workshops”, where other countries could showcase their products. Nonetheless, the perception remains that the Russian nuclear developer Rosatom has already been assured of its frontrunner status.

The opaqueness of the process is further illustrated by the vagueness of the construction plans, including the plant locations and specifications. The proposed nuclear plant locations have not been fully disclosed. An initial study in 2007 compared five coastal sites: Duynefontein (near the existing Koeberg plant in Cape Town), Bantamsklip (between Gansbaai and Cape Agulhas), Thyspunt (close to Jeffrey’s Bay) and two localities on the Namaqualand shoreline.

At a press briefing in July 2015, department of energy and Nuclear Energy Corporation of South Africa representatives disclosed that there may eventually be as many as eight nuclear plants, with unnamed sites in the province of KwaZulu-Natal now also under consideration. Most recently, a draft environmental impact assessment presents Thyspunt as the preferred site for a 4GW nuclear plant dubbed “Nuclear 1”.

The ongoing construction of two mega coal power stations at Medupi and Kusile amply illustrates what could happen with the nuclear build. Work on Medupi commenced in 2007, and was initially projected to be completed in 2011. Its new completion date is given as 2019, meaning the construction period is likely to be at least three times that initially declared.

The costs have also spiralled to over R150bn, double the initial estimate. If similar circumstances prevail in the nuclear build, that would result in a construction process of 20 years or more and a price tag of R1 trillion or R2 trillion (at current rand value, given the current R500bn to R1 trillion cost estimate). Some funding models only require later payment, but these will then saddle the future generation with a huge debt burden.

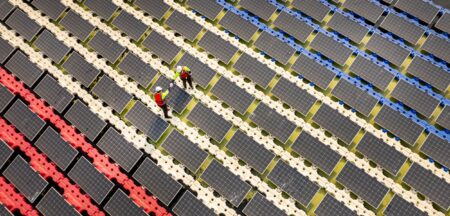

The nuclear build is a very risky exercise with numerous potential pitfalls. And there are alternatives. The shortfall in the projected nuclear capacity can be covered by a 50% larger than planned renewable energy investment. Wind and solar energy plants have been operationalised on schedule, and solar panel prices continue falling. The intermittence of renewable energy availability is considered manageable. Finally, energy saving strategies have yet to be fully explored.![]()

- Hartmut Winkler is professor of physics at the University of Johannesburg

- This article was originally published on The Conversation