There is a perception that load shedding would be far worse were it not for the disruption wrought by the Covid-19 pandemic and lockdown.

There is a perception that load shedding would be far worse were it not for the disruption wrought by the Covid-19 pandemic and lockdown.

This popular opinion resurfaces every time load shedding rears its head, especially on social media streets. The “theory” is that with the country locked in a recession, demand should “surely” be far lower than normal. Hence, were it not for the pandemic, we would be at stage 6 or even stage 8.

There are a few problems with this theory, not least of which is the fact that load shedding is the simple result of a mismatch between electricity demand and supply at a given point in time. While the equation itself is simple, the factors influencing the size of this mismatch (or whether there is even one at all) are far more complex. Chief among these is the erratic reliability within Eskom’s coal generating fleet. Many (most) of these power stations are old and to describe maintenance trends over the past decade as “poor” would be charitable.

But Eskom does have an idea of the reliability trend across its fleet.

It knows, for example, which units are stable and predictable, it knows which are not capable of running at full capacity (with partial load losses), and it knows which are unreliable and likely due for a long list of repairs.

With this information, Eskom is able to forecast demand fairly accurately. By definition, planned maintenance can also be correctly forecast.

The two areas where it can get caught out is when the reliability of the fleet craters and those units lost to “unplanned maintenance” spike to above normal levels or where, like last week, demand was higher than forecast.

Levers

In this situation, Eskom has a number of levers to pull: It can use pumped-storage schemes to augment supply, it can run its own emergency open cycle gas turbines (OCGTs) or ask independent power producers (IPPs) to also burn diesel, or it can cut demand with load shedding.

But when in this situation and multiple units trip (by default, unexpectedly!), it is forced to use whatever emergency generation capacity it has (which doesn’t last forever) and then remove demand to balance the power system.

That’s what happened last week, and is basically the sequence of events every time there is load shedding.

We know that multiple units tripped last week and that Eskom claimed that demand was higher than expected. But do we know that demand was categorically higher?

Normally we would have a limited view a week after the fact, when Eskom publishes its weekly System Status Report. This isn’t all that useful in that Eskom only shows the supply and demand picture as at the daily (evening) peak. There’s no information intra-day, and generation availability is aggregated to a weekly level (with only the average percentage of planned maintenance, plant breakdowns and generation capacity).

Normally we would have a limited view a week after the fact, when Eskom publishes its weekly System Status Report. This isn’t all that useful in that Eskom only shows the supply and demand picture as at the daily (evening) peak. There’s no information intra-day, and generation availability is aggregated to a weekly level (with only the average percentage of planned maintenance, plant breakdowns and generation capacity).

Thanks to pressure from the Organisation Undoing Tax Abuse (Outa), which filed a Promotion of Access to Information Act request in April, Eskom has this week started to publish a live view of the power system, which it has catchingly named “System status and other related data”.

The utility will likely contend that it was going to publish this data anyway, under the new leadership of André de Ruyter. Outa says while this is a good start, it falls far below what other global utilities publish.

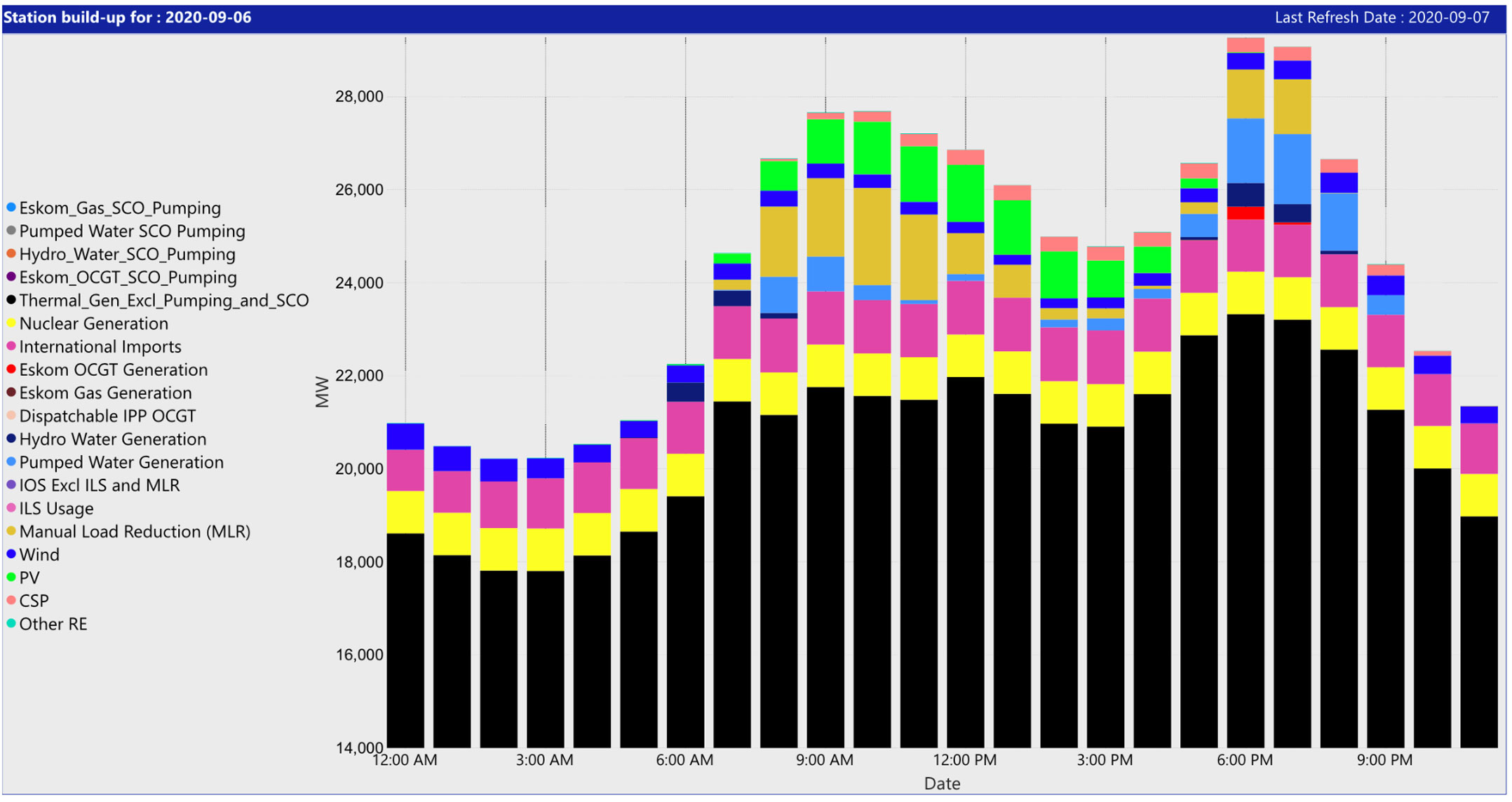

For the first time, we have a system-level view (but not a power station one) via a series of dashboards showing:

- Actual and forecast hourly demand (for the past and coming seven days);

- The supply picture for the most recent full day (in other words, yesterday);

- The supply picture for the past seven days;

- Pumped-storage usage for the past seven days;

- OCGT generation over the past seven days (Eskom and IPPs);

- Hourly renewable generation for the current and previous month;

- Weekly unplanned outage picture;

- Hourly unplanned outage trend for the past 14 days;

- Generation outages by type (per month); and

- Monthly emissions data.

From these dashboards, we now know – definitively – that electricity demand had already started returning to “normal” forecast levels at the start of June.

The deviation (green line) on the chart shows how much below or above the forecast actual demand has been.

It is clear that in level-5 lockdown, demand was as much as 10GW below Eskom’s forecast. In level 4 (May), demand had begun its trajectory back to normal as mines and factories re-opened. By the middle of June, demand was firmly exceeding what Eskom had forecast. As forecasting is never exact, this trend will never track the deviation line perfectly. Rather, expect to see it clustered closely to the deviation line for the remainder of the year, which means demand is for all intents and purposes back to “normal” levels.

(The separate weekly system status reports also show that peak demand was at ±30GW at the end of August, the same level as the same week last year.)

The big jump in early September was the result of the unexpected cold snap, plus possible pent-up demand from industry operating at lower than normal levels. With far cheaper summer tariffs kicking in on 1 September, this may have yielded additional demand in a year that’s been anything but normal.

Now, whether demand would be 2GW or 4GW higher in an economy growing at 2%, 3%, 4% or even 5%/year is a separate debate entirely.

For now, the supply picture (particularly from the problematic coal fleet) has stabilised.

By lunchtime on Monday, Eskom was only reducing around 700MW of load, which improved to 69MW by 4pm. At these negligible levels, it would be able to cover the shortfall with other reserves. The evening peak was still a problem, but generating capacity remained stronger than it had been for days, resulting in load shedding (unofficially) being terminated earlier than expected. The situation improved further on Tuesday.

This is a far cry from the 5.2GW of manual load reduction at 5pm on Friday.

Quite how Eskom managed this level of load reduction while operating under stage-4 load shedding, which seeks to cut up to 4GW of demand, remains a mystery.

- This article was originally published on Moneyweb and is used here with permission