Now that cryptocurrencies are becoming more mainstream, is it possible that you’ve missed the boat? Are you wondering if the markets will still grow? Is it even worthwhile to start investing?

Now that cryptocurrencies are becoming more mainstream, is it possible that you’ve missed the boat? Are you wondering if the markets will still grow? Is it even worthwhile to start investing?

These questions may have crossed your mind over the last year. You might feel like you are stuck between a rock (believing it’s too late because crypto has become too expensive) and a hard place (seeing the rise and wishing you had invested in the crypto space earlier).

To get a deeper perspective on the future of crypto investing, we need to look back before we can look forward.

The crypto market since the pandemic

In the past two years, bitcoin has seen a 562% increase. In January 2020, it was trading just below US$7 350 and at the time of writing has a $38 684 price tag. Even that is still below the all-time high bitcoin was heading towards last year, where it very nearly crossed the $70 000 mark.

Bitcoin is not an outlier. Ethereum, cryptocurrency’s leading alternative coin, has risen by a whopping 1 962% over the past two years. At the beginning of 2020, it was trading around $135. Pver the course of the past two years (most notably in 2021), it has risen to nearly $2 800.

Even the slightly newer solana, which launched in 2017, has been making significant waves in the market. In early 2020, a person could have bought one Solana token at just under a dollar ($0.95). Now it’s valued at $111. That’s a monumental 11 684% gain.

Like bitcoin and ethereum, 2021 played a major role in solana’s increased value.

This “volatile” space, which has garnered criticism from moguls like Warren Buffett, has also picked up support from big-name financial and tech figures. Rich Dad, Poor Dad author Robert Kiyosaki took to touting cryptocurrency in 2020 as the pandemic rattled the economy in the US. Now major institutions and financial firms have jumped on board. We’ve seen names like Morgan Stanley Investment, JPMorgan Chase, Wells Fargo and Goldman Sachs embracing cryptocurrencies and allowing their customers to invest in them. Even Elon Musk’s Tesla added $1.5-billion of Bitcoin to its balance sheet towards the end of 2020.

Since the pandemic, there has been a flood of attention towards cryptocurrency. There are more possibilities for crypto and its investors than ever before. Bitcoin has gone from a strange concept that only some tech guys knew about (and that even stranger people actually bought) to a global asset worth billions.

But is it too late to start your crypto journey?

With each rise and rally in any market, there comes a point where it might feel like you have missed the opportunity and it’s “too late” for it to be worthwhile to invest. One way to get a different take, rather than only considering the increasing value of one asset, is to look at where value is accumulated in other assets and whether there is opportunity in those.

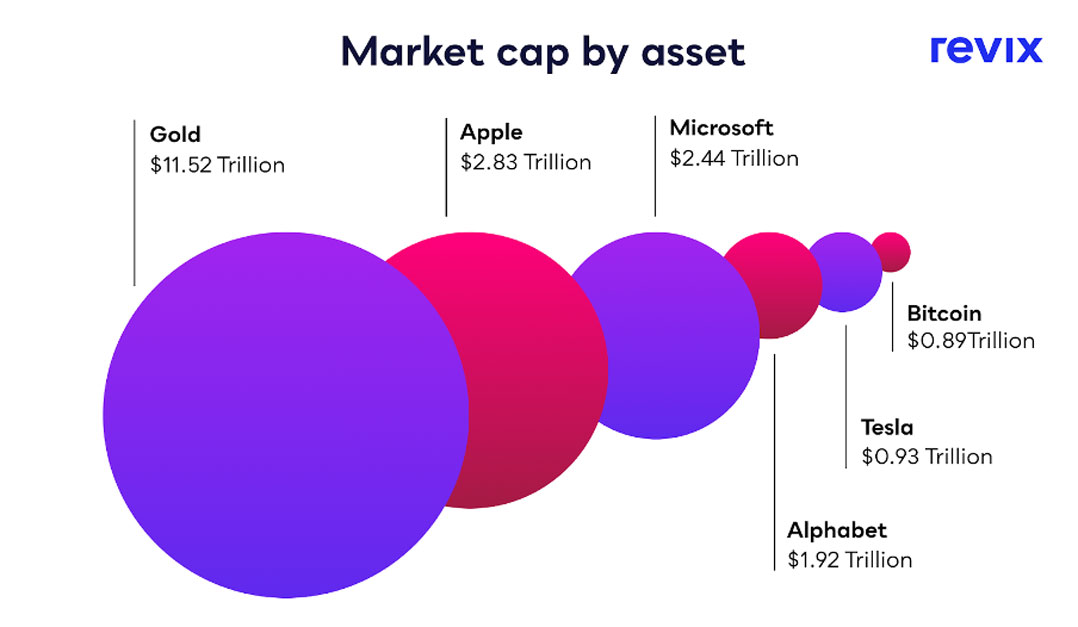

When you look at the market cap of different assets across the world, where a lot of the value is locked up, and where most investment is happening, bitcoin still has a huge amount of room to grow.

Comparing gold to bitcoin, at the beginning of 2020 gold was trading at $1 520/ounce. Now, one ounce will set you back $1 825. This gives valuable insight into the market:

- The value of gold is increasing and investors are still buying the precious metal to hedge against inflation (despite the fact that it’s wearing an “expensive” price tag).

- Gold has risen by just over 20% over the last two years. While this in isolation is impressive, it pales in comparison to bitcoin’s 470% gain.

- Crypto’s entire market cap is around $2.2-trillion. We can compare this to gold’s $11.5-trillion and the global stock market’s $121-trillion.

From the numbers, we can establish that the crypto market still represents only a fraction of the world’s asset base and that the growth rate is unparalleled. While cryptocurrencies might be expensive compared to where they were two years ago, there’s still an enormous growth potential that the crypto market hasn’t yet charted.

Taking advantage of the still-emerging opportunities

We’ve looked back at crypto over the past years and we’ve looked across at the state of current assets and their market caps. It’s time to look to the future and see the possible investment opportunities in cryptocurrency. By now you probably have new questions. How and where do I start? What crypto do I buy? How much should I invest and what if the crypto I buy doesn’t do well?

Luckily, there are ways to make sure you are buying the best cryptocurrencies at the time without worrying about whether it was the right choice. The best way to do that is to make sure you are building a diverse portfolio — making sure you’re investing in the top-performing crypto assets rather than putting all your eggs in one basket.

Building a diverse crypto portfolio (with ease)

Cape Town-based crypto investment platform Revix, which is backed by JSE-listed Sabvest, offers access to polkadot, uniswap, solana, cardano, ethereum and more.

On its platform, you can easily and seamlessly invest in bitcoin or take the guesswork out of investing with its ready-made crypto bundles. These bundles enable you to effortlessly own an equally weighted basket of the world’s largest and, by default, most successful cryptocurrencies without having to build and manage a crypto portfolio yourself. Revix offers three bundles: the Top 10 Bundle, the Payment Bundle and the Smart Contract Bundle.

The Top 10 Bundle is like the JSE Top40 or S&P 500 for crypto and provides equally weighted exposure to the top 10 cryptocurrencies making up more than 85% of the crypto market.

The Payment Bundle provides equally weighted exposure to the top five payment-focused cryptocurrencies looking to make payments cheaper, faster and more global.

The Smart Contract Bundle provides equally weighted exposure to the top five smart contract-focused cryptocurrencies like ethereum, solana and polkadot that allow developers to build applications on top of their blockchains, similar to how Apple builds apps on top of iOS.

Reap the rewards of financial fitness in 2022

Reap the rewards of financial fitness in 2022

This is the year to bulk up your investments and improve your financial fitness. Start the year off strong with the Revix 2022 Financial Fitness Challenge and build healthy wealth habits that last.

Earn bonus Revix Rewards points by referring at least two investing friends per week, making weekly deposits and investments. Earn an additional point daily just for holding your investment. The points you earn can be redeemed for bitcoin!

Take on the daily challenges and see how good it feels to be financially fit.

This promotion is valid from 14 January to 1 March 2022. Ts&Cs apply.

About Revix

Revix brings simplicity, trust and great customer service to investing. Its easy-to-use online platform enables anyone to securely own the world’s top investments in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time. For more information, please visit www.revix.com.

Disclaimer

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose and, before investing, please take into consideration your level of experience and investment objectives, and seek independent financial advice if necessary.

- This promoted content was paid for by the party concerned