The new accelerator programme for financial technology (fintech) start-ups backed by Barclays Africa and US accelerator Techstars has announced the names of 10 companies that have been selected to take part. More than 400 applications had been received.

The Cape Town-based Barclays Accelerator joins similar Barclays-backed programmes in New York, London and Tel Aviv. It now intends taking the selected start-ups through an intensive 13-week programme.

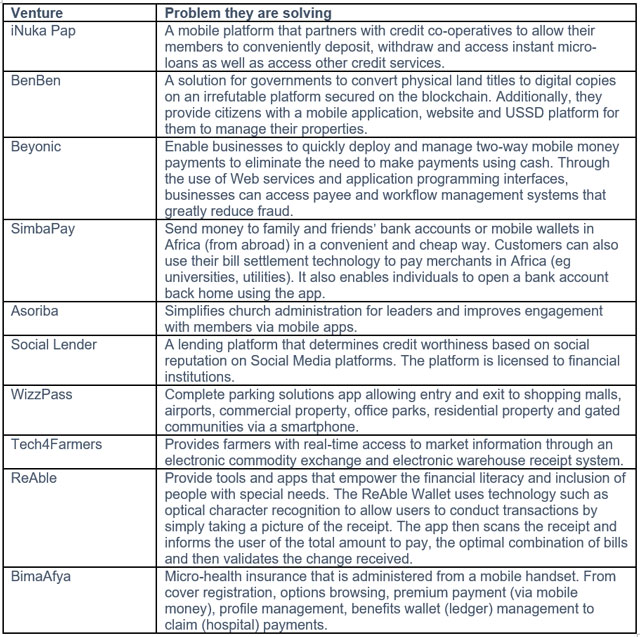

According to a report by Forbes, the companies selected are Inuka Pap (from Kenya), BimaAfya (Tanzania), Social Lender (Nigeria), Beyonic (US, but focused on Uganda and Kenya as its initial markets), tech4farmers (Uganda), Asoriba (Ghana), Reable (Lebanon), BenBen (US, focused on Ghana and a co-founder originally from Ghana), WizzPass (South Africa) and Simba Pay (UK and Kenya with Kenyan founders and focused on Kenya and Uganda). See the table below for a description of each start-up.

Former Synaq MD Yossi Hasson is heading up the Cape Town accelerator as MD.

The focus is specifically on fintech start-ups. Barclays hopes to use the programme to work with technologists who could end up disrupting the financial services industry.

The 10 businesses accepted into the accelerator will now have access to senior Barclays executives, have early access to the bank’s technology and systems, and be given access to its global networks. They will also have access to any of the Barclays accelerators and can raise funding in any of those networks.

Techstars, which describes itself as a mentorship-driven start-up accelerator, was founded in 2006 by David Cohen, Brad Feld, David Brow and Jared Polis and has to date taken 762 companies through its programme. The business has overseen more than US$2bn in funding to start-ups, with 90% of them still operationally active.

The Techstar founders realised that entrepreneurs needed more than just capital to be successful, Hasson said in an interview with TechCentral in January. “They built the idea of taking 10 start-ups and putting them through an intensive three-month programme where they get access to seasoned entrepreneurs as mentors and industry experts.”

The first month of the programme involves intensive mentorship, while the second month focuses on taking feedback and advice received and building traction by adapting strategy and, where necessary, changing the product or service being developed.

The final month is about raising capital — focusing, for example, on how to pitch to venture capitalists. This leads to a “demo day”, where the start-ups pitch their business to a large audience made up of, among others, venture capitalists and angel investors.

Those who go through the programme successfully become part of the broader Techstars network.

Techstars will invest US$20 000 in successful applicants. This money will help pay for start-up teams to be physically present in Cape Town for the duration of the programme, which is one of the requirements of acceptance. In return, Techstars takes 6% equity in the start-up.

A further $100 000 in the form of a convertible note (short-term debt that converts into equity) is also available from the Barclays Seeker Fund. — (c) 2016 NewsCentral Media