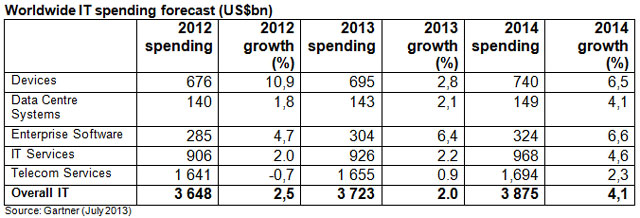

Worldwide spending on information technology products and services will rise by only 2% in 2013, reaching US$3,7 trillion, analyst and research firm Gartner said on Tuesday.

The growth rate has been revised downward from the 4,1% figure Gartner has expected previously. The reduction reflects the impact of recent fluctuations in the value of the dollar. Growth in constant currency terms is forecast at 3,5% for 2013, down only slightly from previous estimates.

The forecast includes the IT hardware, software and services markets as well as telecommunications.

“Exchange rate movements, and a reduction in our 2013 forecast for devices, account for the bulk of the downward revision of the 2013 growth,” said Gartner managing vice-president Richard Gordon in a statement. “Regionally, 2013 constant-currency spending growth in most regions has been lowered. However, Western Europe’s constant-currency growth has been inched up slightly as strategic IT initiatives in the region will continue despite a poor economic outlook.”

Gartner has revised down its forecast for spending on devices dramatically, lowering growth expectations from 7,9% to just 2,8%. The decline in PC sales, recorded in the first quarter of 2013, continued into the second quarter with little recovery expected during the second half of the year. While new devices are set to hit the market in the second half of 2013, they will fail to compensate for the underlying weakness of the traditional PC market, the researcher said. The outlook for tablet revenue for 2013 is for growth of 2,8%, while mobile phone revenue is projected to increase by 7,4%.

Enterprise software spending is expected to grow by 6,4%. Growth expectations for customer relationship management have been raised to reflect expanded coverage into e-commerce, social and mobile. Expectations for digital content creation and operating systems have been reduced as software as a service and changing device demands affect traditional models and markets.

Telecoms services spending is forecast to grow by 0,9%. Fixed broadband is showing slightly higher than anticipated growth. The impact of voice substitution is mixed as it is moving faster in the consumer sector, but slightly slower in the enterprise market. — (c) 2013 NewsCentral Media