Have we seen the peak of Internet banking in South Africa? Although the banks are tight-lipped about their usage numbers, I suspect that the number of customers using a desktop computer to do their banking is declining.

Have we seen the peak of Internet banking in South Africa? Although the banks are tight-lipped about their usage numbers, I suspect that the number of customers using a desktop computer to do their banking is declining.

We know that most logons come from office workers, but we also know that the number of employed people (including government workers) in South Africa is stagnant. While many upmarket homes have a desktop PC or a laptop, and optical fibre services have been introduced in certain suburbs, the growth rate of fixed broadband Internet (at less than 2m connections) is very low.

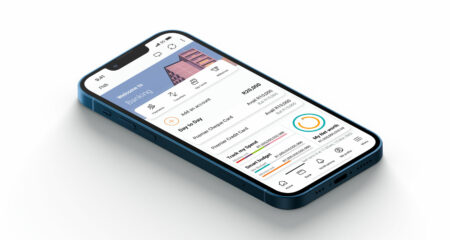

The smaller screens are where the action is: banks have been marketing their mobile apps aggressively over the past few years, and now collectively claim that 11m customers have adopted this channel. This adoption of the mobile phone for banking marks the fastest and most pervasive technology adoption in the history of banking.

Standard Bank recently confirmed that the number of in-branch transactions has declined, clearly because of mobile banking. In Kenya, the number of payment card payments has halved over the past three years. The volume of mobile money transactions over the same period has doubled, and the value transacted is now more than twice that of card payments. The success of M-Pesa in Kenya has not yet been replicated in other countries, but it is a striking example of how customers change their payment behaviours.

For most banks, the business case for launching Internet banking was based on the assumption that user numbers would just keep growing. There are high fixed costs (dollar-based software licences, servers and staff) that banks must keep investing in, even as Internet banking usage declines. It could be argued that some IT staff could be cross-skilled into app development, but typically the mobile banking IT platforms run on different software and infrastructure and mobile banking infrastructure is also costly. The SMS notifications that banks have been providing to customers have become a big expense for them – together they are the single biggest customer of mobile operators.

The switch from big screen (desktop Internet) to small screen (mobile phone and tablet) also requires a change in user experience design. You simply cannot fit all the functionality of a high-resolution monitor screen into a mobile phone or smartwatch. You certainly can’t fit all the marketing messages, phishing warnings and terms and conditions!

The design paradigm for mobile phone apps is to cleanly offer a single function (hail a taxi or send a message). That lesson has not yet been learnt by some award-winning banks, with apps that require you to scroll down on the first page and take three separate screens to delete a message. With so many competing internal business units (very appropriately called “divisions”) and having built so much functionality over the years, they are challenged to simplify their interface to what most customers need. We are starting to see a “re-fragmentation” of the mobile banking channel — a wide range of distinct apps from the banks, each focusing on distinct activities.

Can the banks continue to afford to offer customers this buffet of channel and device choice? Will they aggressively direct customers into the most appropriate self-service channel or device and start really trying to use their staff to generate sales?

There are signs both locally and abroad that banks are starting to cut back on human-centred service. Royal Bank of Scotland in the UK and First National Bank locally are both cutting back on branch staff, and several financial institutions are exploring using robo-advice (algorithms or “bots”) to handle simple queries. Could this be an opportunity for a savvy digital-only bank without the legacy cost structures and plethora of products? There are indications that more than one new offering will launch in 2017.

- About Angus Brown is founder of Banking Acumen, Centbee and Cygnet. He co-founded eBucks.com