The stock market is a weighing machine of companies’ potential rather than their current circumstances. That is doubly true for Amazon.

The stock market is a weighing machine of companies’ potential rather than their current circumstances. That is doubly true for Amazon.

Amazon.com on Tuesday briefly reached a stock market value of US$1-trillion (R15.3-trillion at the time of writing). It’s a meaningless (and unoriginal) milestone but a notable symbol for a company that until recently hardly looked like a world-shaking giant. Amazon’s market cap is six times what it was at this point in 2014, or a gain of $840-billion. It took Google 14 years to reach that stock market value, and Amazon has padded its total by that much in just the last four.

It’s a stunning ascent up the ranks of the world’s most valuable companies. But Amazon at $1-trillion rests in part on a vision of a company that doesn’t exist. The mirage of a much more profitable, even more sprawling and powerful Amazon may be real eventually, but it isn’t today.

Amazon’s stock value isn’t entirely about the future, of course. Amazon also harvested seeds it planted years ago. Businesses that flourished in the last decade, including the Amazon Web Services cloud-computing services, Prime shopping club, fees from letting merchants sell their goods on Amazon and the company’s line of hardware, all generate larger profits from each dollar of sales than Amazon’s original business of selling products at a markup.

Even purchasing a supermarket chain last year most likely boosted Amazon’s notoriously puny profit margins. The company’s 5.6% operating profit margin in the second quarter was the highest in 13 years, and that’s largely because of Amazon’s entry into businesses that seemed like odd and expensive distractions at first.

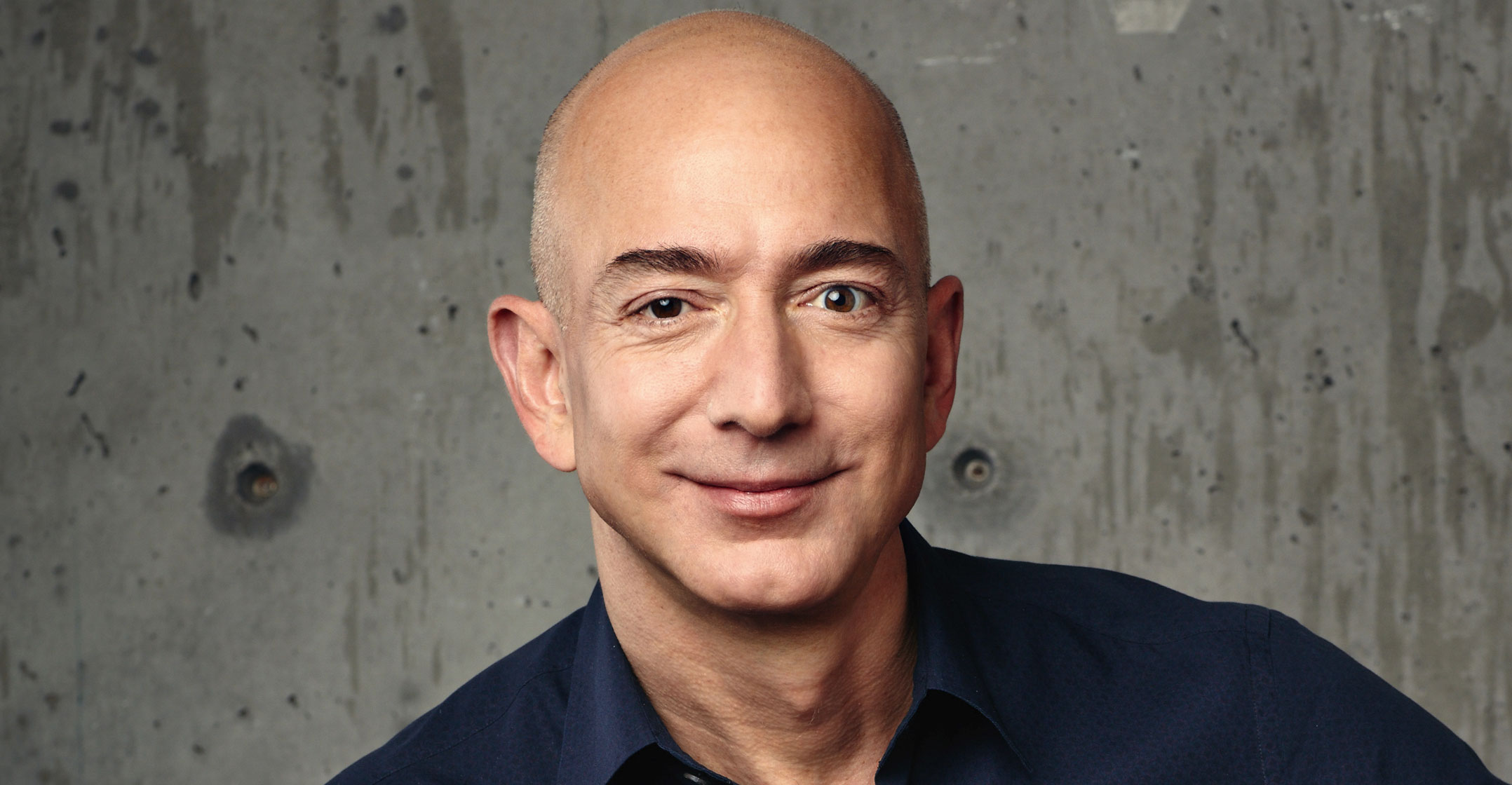

That’s about the payoff of past decisions. Amazon’s rise to $1-trillion also shows how investors believe the company’s current strategy will make it more muscular than Jeff Bezos’s surprisingly bulging biceps. Some of those hopes are too aggressive.

Few things have got investors more hopeful than Amazon’s advertising business. Today, most of that pool of several billion dollars in annual revenue comes from paid nudges on Amazon’s vast shopping mall. Procter & Gamble, Colgate-Palmolive and Unilever, for example, pay up so when someone searches for “dish soap” on Amazon, those companies’ products appear at the very top of the results.

Ad business

This is less like the digital advertising businesses that made Google and Facebook into titans, and more of an additional tax on the businesses that are selling on Amazon. That makes it tough to value Amazon’s paid product placements as investors do independent digital ad firms like Google.

But that is how Amazon watchers evaluate the company’s ad business. Morgan Stanley analysts, for example, estimate Amazon’s ad business is worth about $125-billion, based in part on multiples of Google’s ad sales. Amazon definitely has the potential to join the Google and Facebook ad big leagues, but what Amazon is doing today isn’t conventional advertising and shouldn’t be valued that way.

Like advertising, Amazon’s bets on e-commerce in India, its growing package-delivery network and projects in health care all could eventually justify Amazon’s $1-trillion market value. But those projects will be costly and may take many years to bear fruit. Amazon also has plenty of potential if it can expand the roughly 1-2% of global retail spending it captures today. Again, there are no assurances there.

Stock watchers, however, have become incredibly hopeful. Of the 51 stock analysts who track Amazon, 47 recommend investors buy the company’s stock, according to Bloomberg data. The share of “buy” ratings was below 60% in 2014 — which counts as deep pessimism on grade-inflation Wall Street. That was just before Amazon’s stock started to surge.

The trouble is that outsiders haven’t been adept at predicting Amazon’s path. Even just a year ago, stock analysts expected Amazon to post a 2018 operating profit of $6.6-billion, based on the average of estimates tabulated by Bloomberg. The operating income estimate for 2018 is now is more than $11-billion. If analysts were so wildly off one year ahead, how confident should investors be in estimates of surging profit for 2020 or beyond? Those are the figures that investors use to justify Amazon’s market value at about 65 times the company’s estimated earnings next year.

There’s a lot of promise in Amazon, and its track record makes it hard to doubt that the company will fulfil the most optimistic visions. But be sure that a $1-trillion market cap for Amazon — more so than it was when Apple hit that milestone — is a big bet on the company continuing its makeover into a more ambitious, more profitable company even further removed from its wild-spending, low-margin retail roots. That’s the potential. And potential doesn’t always pay off. — Reported by Shira Ovide, (c) 2018 Bloomberg LP