After a decades-long run as one of the world’s best-performing stocks, Apple is on the verge of reaching US$3-trillion in market value. That’s bigger than the entire German equity market. Or the UK economy.

After a decades-long run as one of the world’s best-performing stocks, Apple is on the verge of reaching US$3-trillion in market value. That’s bigger than the entire German equity market. Or the UK economy.

The iPhone maker needs to rise just another 6.8% to become the first company to achieve the milestone, less than four years after it first surpassed $1-trillion.

“It’s a phenomenal achievement and highlights the incredible dominance of US tech firms,” said Craig Erlam, senior market analyst at Oanda. “And there’s so much still to come from Apple, which makes you wonder what milestone they’ll pass next and how big they can become.”

Apple became the world’s most valuable business thanks to a steady stream of products that have captivated consumers. Now, with markets wobbling because of concern that higher interest rates and the coronavirus will undermine economic growth, investors view the company as a relatively safe place to park their money thanks to its consistent sales growth and hefty cash balance.

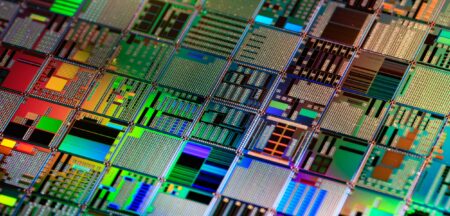

Since the end of the 1990s, Apple shares have returned a whopping 22 000%, equal to about 28%/year. The S&P 500 has returned 7.5% annually in the same period. A few other tech stocks have done better — Nvidia, a maker of graphics processing chips, has returned 31% annually, while streaming giant Netflix is up 39%/year since its 2002 initial public offering — but Apple dwarfs them both in size.

The iPhone maker jumped 3.5% to $171.18 on Tuesday to lead the advance in the Nasdaq 100 and S&P 500 stock indexes. The Cupertino, California-based company trades at 30 times profit projected over the next 12 months, compared with an average of 22 times for companies in the S&P 500.

Undervalued

Morgan Stanley analyst Katy Huberty argues the stock is undervalued when considering revenue contributions expected in coming years from new products like augmented and virtual reality and autonomous vehicles.

“Apple should benefit from a flight to quality, especially as upside from new product categories gets priced in,” said Huberty, who raised her price target to a Wall Street high $200 on Tuesday.

It wasn’t always so: In late 2000, Apple had a market value of just $4.5-billion, and investors were fleeing the stock, which traded for almost the value of the cash the company had in the bank. Co-founder Steve Jobs had returned to the helm in 1997 but had failed to revive its fortunes, and the iPod and the iPhone were still off in the future.

Apple is in that sweet spot of not being too expensive, having a nice mix of products and services, and being a great innovator

Now investors can’t get enough of the stock. In a sign that mom-and-pop traders are chasing Apple, short-term bullish call options saw extreme buying activity. Four of the 10 most-active options contracts on US exchanges on Tuesday were calls on the iPhone maker.

What’s more, its shares got another boost from a late-breaking Nikkei report that the company asked suppliers to ramp up iPhone output from November to January.

Apple “is kind of in that sweet spot of not being too expensive, having a nice mix of products and services, and being a great innovator across its entire product line”, said Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder. — Jeran Wittenstein and Thyagaraju Adinarayan, (c) 2021 Bloomberg LP