For all the talk about Intel’s entry into the chip foundry business, and the world’s over-reliance on Taiwan’s TSMC, it’s easy to forget there’s another competitor plugging away in South Korea.

Samsung Electronics is one of the most ubiquitous gadget companies on the planet, churning out components, displays and even branded products. On Thursday, it sent out signals that its made-to-order chip business isn’t to be forgotten, either.

“The company aims to exceed market growth by expanding capacity at advanced nodes, adjusting prices and adding new customers,” it said in a statement announcing fourth quarter earnings.

TSMC also said earlier this month that it expects to outpace the broader market in 2022 and is spending a record US$44-billion to allow that to happen. Companies don’t tend to tell people if they expect to underperform, but when you have the two biggest names — accounting for at least two-thirds of the foundry market — making the claim, you know they can’t all be right.

Yet Samsung’s confidence ought to be taken seriously. Its technology isn’t very far behind TSMC’s, and even matches or beats it in some regards, while it’s been successful in quietly building its client list and offering an alternative to its Taiwanese competitor.

That focus helped Samsung’s foundry division post record sales, it said on Thursday without giving a figure.

Capex

Traditionally, most of its capital expenditure in semiconductors, amounting to ₩43.6-trillion (US$36-billion) last year, goes towards memory chips. That’s a product type that TSMC and Intel barely touch. But both rivals do face competition, not only from Samsung’s foundry business, but its System LSI division. That’s just a fancy term for the unit which makes non-memory chips such as processors, sensors and display components. This part of the company also posted record sales for the quarter.

Every chip developed and made internally by Samsung is one not designed by a rival like Qualcomm and sent to TSMC for manufacture. So growth here is also a risk, even if it’s not directly stealing a foundry customer. This division is also expanding its horizons and partnering with TSMC clients such as AMD.

This month, it launched Exynos 2200, the latest in its line up of smartphone chips, which features graphics technology developed by AMD. A win-win for both companies. That introduction faced a bit of controversy earlier in the month when its product event didn’t go ahead as scheduled, but that’s likely to be a short-term marketing hiccup.

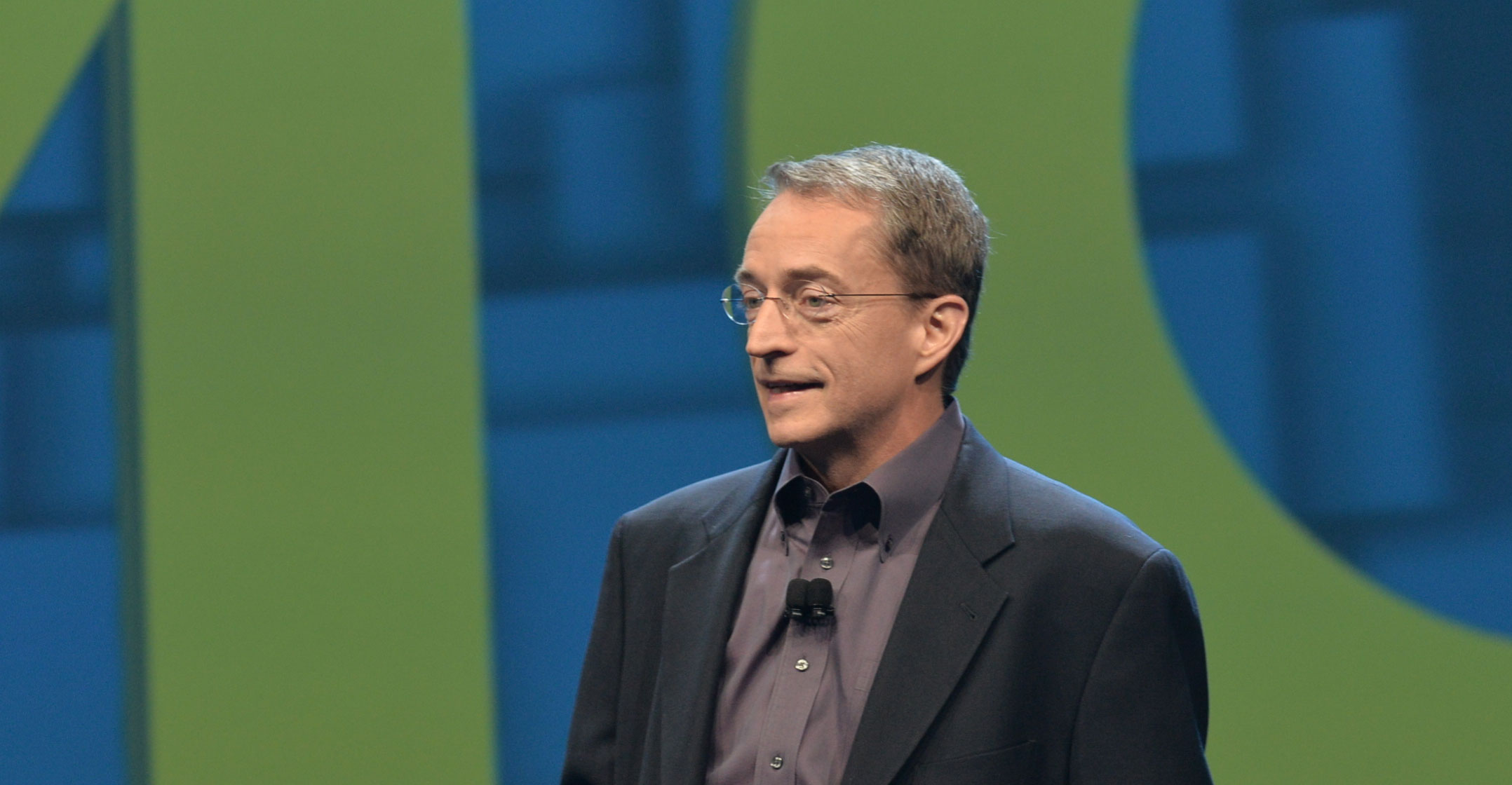

Then there’s Intel. The US chip leader is unique in that its business is built around designing and manufacturing almost all of its own chips, and not taking orders from external clients. But its new CEO, Pat Gelsinger, decided last year that he, too, wants to be a player in the foundry market. So at some point he’ll be needing to steal clients from TSMC and Samsung.

That’s not going to happen anytime soon. In its earnings conference on Wednesday, the company talked about its coming foundry business, but admitted that most of its capacity to supply outside customers won’t come online for a few more years. With the world facing a chip shortage today, and TSMC working furiously to expand capacity and keep its technology at the leading edge, Samsung sees a clear window of opportunity and is ready to pounce.

With such a showdown on the cards, it’s shaping up to be a very exciting year for the world’s semiconductor giants. — (c) 2022 Bloomberg LP