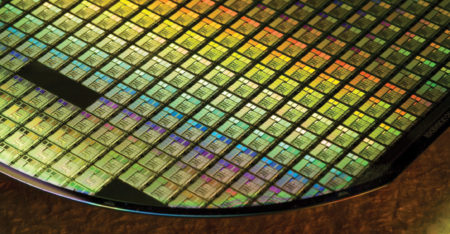

TSMC spent a record $30-billion last year on factories that churn out the world’s most advanced chips. It seems even that wasn’t enough.

Author: Tim Culpan

Lobbyists for Samsung Electronics deserve to drink magnums of the finest champagne after pulling off a fabulous deal.

An extremely expensive game of one-upmanship is being played out in the semiconductor industry where the winners will look like heroes and the rest may not even survive.

The latest data from the world’s biggest chip maker hints that strong demand is beginning to look like industry stockpiling. That could be a massive problem.

Investors ought to be clamouring over GlobalFoundries’ $1-billion initial public offering. Except the company is struggling to make money in a chip boom.

The decision to embrace, rather than reject, the trappings of the 21st century went on to become a key to the movement’s survival and eventual retaking of the landlocked central Asian nation.

The world’s most important chip maker expects revenue to climb 20% this year. But the incredible cost of meeting outsize demand is starting to eat away at the bottom line.

Just three months after Taiwan’s TSMC shocked investors with a record spending plan, the world’s most important chip maker doubled down with an even bigger budget.

He may not be the leader of the free world, but Pat Gelsinger has just put himself at the helm of the Great American Revival amid a technology cold war that the US is paranoid it will lose.