South African organisations expect cybercrime to become the most disruptive form of economic crime in the next two years, according to new research by PwC.

The sixth South African edition of the Global Economic Crime and Fraud Survey, for 2018, found that 26% of respondents (the most of any category) expect cybercrime to the most disruptive to their organisations over the next two years. The next category, bribery and corruption, garnered a distant 14% of responses.

The survey, which is conducted roughly every second year, had 282 respondents in South Africa. Fifty-five percent of respondents were from the C-suite, the top management level of organisations which includes CEOs, chief financial officers and chief information officers. PwC received 7 228 valid responses worldwide for its research, which was conducted between 21 June to 28 September 2017.

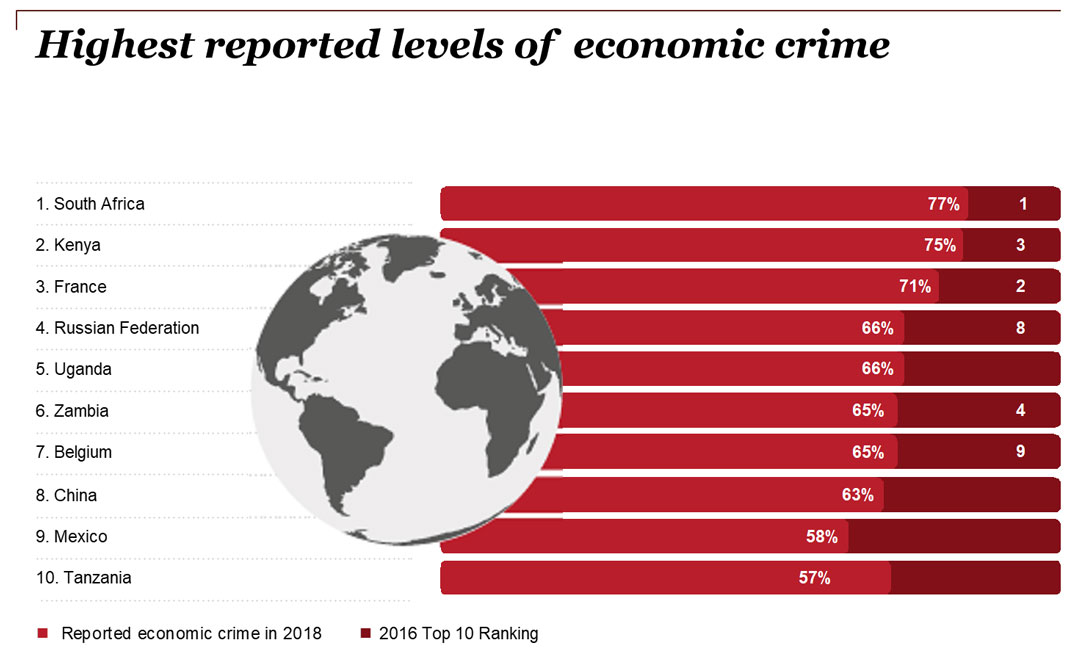

The survey found that economic crime is rising worldwide, including South Africa. But South Africa is the country with the highest incidents of this type of crime in the world.

Seventy-seven percent of South African respondents said their organisations had suffered an economic crime in the previous two years, up from 69% in 2016, 69% in 2014 and 60% in 2011.

However, “this is not a South African problem” only, said Trevor White, partner in the forensic services unit at PwC Southern Africa. “Worldwide, 49% of organisations were affected by economic crime, up from 36% in 2016, 37% in 2014 and 24% in 2011.”

Although South Africa has the highest rate of economic crime, it also has extensive knowledge of fraud incidents — 70%, compared to 60% globally, White said.

Several other African countries feature in the top 10 worst affected by this type of crime. Second worldwide after South Africa is Kenya, followed by France, Russia, Uganda, Zambia, Belgium, China, Mexico and Tanzania.

Actual numbers

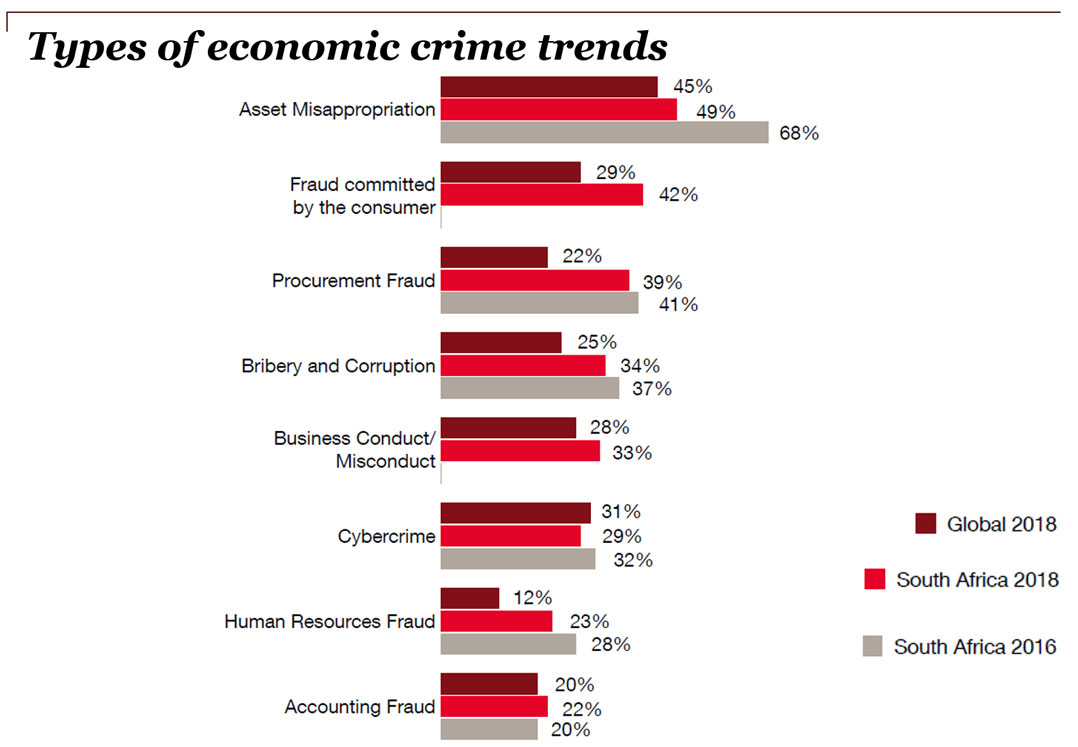

Although South African respondents expect cybercrime to be the most disruptive form of economic crime over the next two years, they said the same in the 2016 survey, only for it not to top the list in the 2018 report. In fact, cybercrime affected 29% of South African respondents in the latest survey, down from 32% in 2016.

Incidents of accounting fraud in South Africa, which typically results in the biggest losses for organisations, rose to 22% from 20% in 2016. “This is where the senior people are involved and where the numbers and losses are the most significant,” White said.

Asset misappropriation continues to remain the most prevalent form of economic crime, reported by 45% of respondents globally and 49% of South African respondents.

Despite higher levels of understanding and reporting of fraud, blind spots still prevail. About 46% of respondents globally said their organisations have still not conducted any kind of risk assessment for fraud or economic crime. Only three in four South African organisations said they had conducted any kind of fraud or economic crime risk assessment. Additionally, only 37% of respondents had conducted an anti-bribery/anti-corruption risk assessment.

White said he expects South Africa’s high economic crime rate to come down, with newly appointed President Cyril Ramaphosa saying he will make fighting it a top priority of his administration.

“But we can’t blame everything on state capture. It’s not possible for any sphere of government to commit fraud and corruption … without he private sector being a willing participant,” he said.

“We believe a fall in corruption is strongly on the radar given the changes in the past two months. But corporate South Africa needs to do its part.” — © 2018 NewsCentral Media