In the social and political saga surrounding the question of network neutrality, what is often overlooked is the data war going on behind the scenes. The real fuel behind the debate is the enormous volume of data we generate with each search and click.

As a marketable commodity, large-scale audience data has completely transformed the global economic landscape in less than a decade. The emergence of Google, Amazon, Facebook and Apple germinated a disruptive new business model that capitalises on what many consider to be the new oil: data.

Based on a study published by eMarketer in September 2017, we can see how user-data companies (UDCs) now hold the top five positions among the largest brands in the world.

In 2006, five of the top 10 brands were retailers. By 2017, nine of the top 10 brands in the world were UDCs.

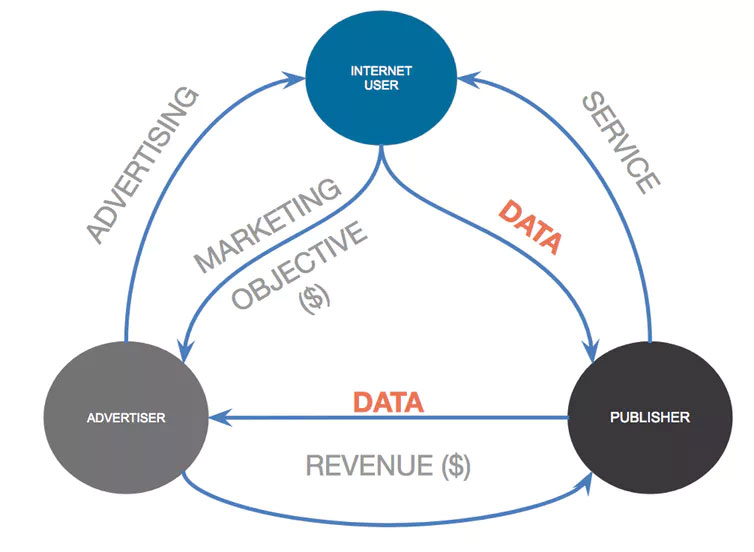

The nature of the data business model can be understood by the relationship between its three core pillars: the Internet user, who generates the data; the content publisher, who offers the Internet user a service (often free) in exchange for personal data; and the advertiser, who buys data from content publishers in order to run more effective marketing campaigns.

The schema below attempts to illustrate the nature of this Internet user data paradigm:

Clearly, the winners in the 2017 repeal are the large US telecommunications companies, who happen to be the glue, as Internet providers, between the Internet user and the publisher (Google, Facebook). They stand to gain an enormous strategic advantage with the end of net neutrality.

By having more control over an individual’s Internet usage, those companies are in a position to adjust prices in ways that could significantly benefit their bottom line. For example, AT&T could decide that from now on, given the large bandwidth used by Netflix, the latter would have to pay a usage fee to maintain its regular website streaming speed.

Conversely, the Internet service provider could just as well charge Internet users an extra fee to maintain their Netflix streaming at a regular or faster speed. In an extreme case of greed, the ISP could overcharge both Netflix and its user.

But there is more to it than that.

In 2015, Fortune purported what it deemed to be the “real reason Verizon bought AOL”. In that article, journalist Kevin Fitchard observed:

Verizon isn’t trying to create an Internet powerhouse with this investment. It’s likely just trying to gain some type of foothold in the changing online industry, as its traditional communications business slows down.

Fitchard is alluding to the dominance of the data business model that gave rise to Google, Amazon, Facebook and Apple. As such, we can see why telecoms companies like Verizon that control the Internet channels through which the data is transmitted would also want to control — and take advantage of — the data itself. As Fitchard further observes in the same article:

While AOL may be most known for its dial-up services and growing content empire — which includes The Huffington Post, Engadget and TechCrunch — it also has put together a sophisticated suite of advertising technologies for online and traditional media that no other company (aside from Google and Facebook) can match.

The advertising technology in question, commonly referred to as programmatic advertising, uses advanced machine learning and artificial intelligence (AI) on the data generated by online user behaviour, and tracked by browser cookies or device IDs stored in mobile applications. Much of the advertising performance offered by Google, Facebook, AOL and others is largely attributed to their investments in this kind of technology, which Verizon can now leverage.

As described in an e-mail by John Cosley, director of marketing for Microsoft search advertising, digital ads are “perhaps by far the most lucrative application of AI and machine learning in the industry”.

To maximise the power of these advertising algorithms, companies need to secure big data. Since Internet users are the prime generators of this precious raw material, publishers need to continually increase the number of visitors coming to their websites or mobile applications.

In a move to secure that expansion, shortly after its acquisition of AOL, Verizon bought Yahoo, Google’s competitor in the search engine market. Yahoo also has access to the entire Microsoft advertising network and its user data.

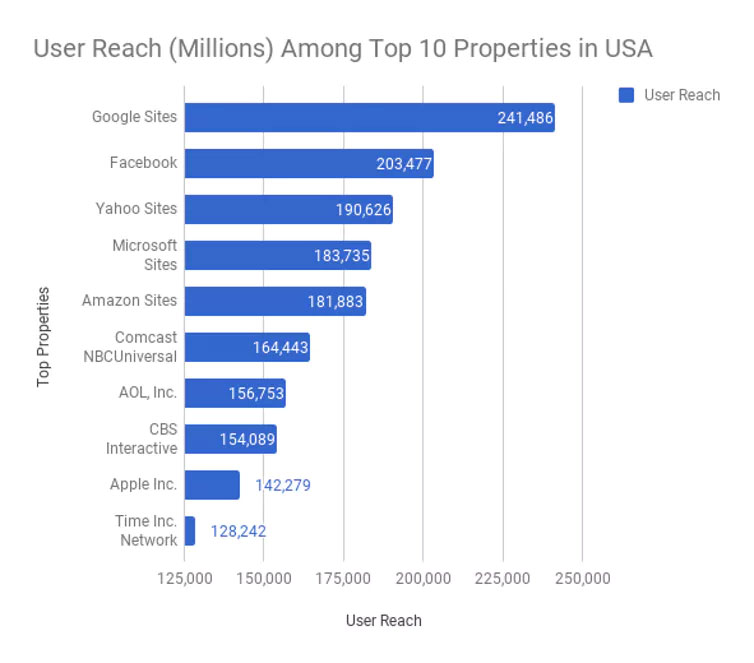

To assess the impact of this streak of acquisitions on total user reach of Verizon vs Google and Facebook, we used comScore data from May 2017, made available courtesy of Adviso Conseil. The comScore platform is essentially an audience analytics software used to track the data coming from most of the large desktop and mobile publishers in the world.

The data pulled for this graphic shows the distribution of unique visitors across all the top platforms in the US. The chart clearly shows Yahoo and Microsoft competing closely with Google and Facebook in terms of user reach.

The competitive advantage of this merger — now a super-entity called Oath by Zerizon — stands out immediately when one looks at the combined reach of AOL, Huffpost and Yahoo.

The best way to illustrate the direct relationship between data and net neutrality is to simply ask the following question: if a telecoms company like Verizon were in a position to compete with Google and Facebook for data dollars, what happens if it also controls the data pipeline used by its competitors?

The answer is obvious. If US telecoms firms can capriciously control Internet access, while also controlling platforms that compete with Google, Amazon, Facebook and Apple, what stops them from impeding the pipeline of their competitors? Absolutely nothing.

Back in 2014, German Chancellor Angela Merkel spoke out against net neutrality. We expect the recent decision in the US to further affect the polarity of opinions on net neutrality in that region and in the rest of the world.

We should also note that Google, in an obvious pre-emptive response to the end of net neutrality, launched its own ISP infrastructure in 2010 called Google Fiber.

In the end, with the reigning status of the global top 10 brands on the line, the data war is undoubtedly what drives the debate over net neutrality.![]()

- Written by Roger Kamena, principal consultant, Digital Media and Data Science, L’Université TÉLUQ; Daniel Lemire, professor, L’Université TÉLUQ; and Nicolas Scott, Université de Montréal

- This article was originally published on The Conversation