The financial world offers a broad spectrum of investment options, and while stocks often steal the limelight, commodities present equally intriguing possibilities.

The financial world offers a broad spectrum of investment options, and while stocks often steal the limelight, commodities present equally intriguing possibilities.

Commodities such as gold, oil and agricultural goods have long been integral to global economies and are becoming increasingly accessible for individual investors.

For more information visit us at www.easymarkets.com

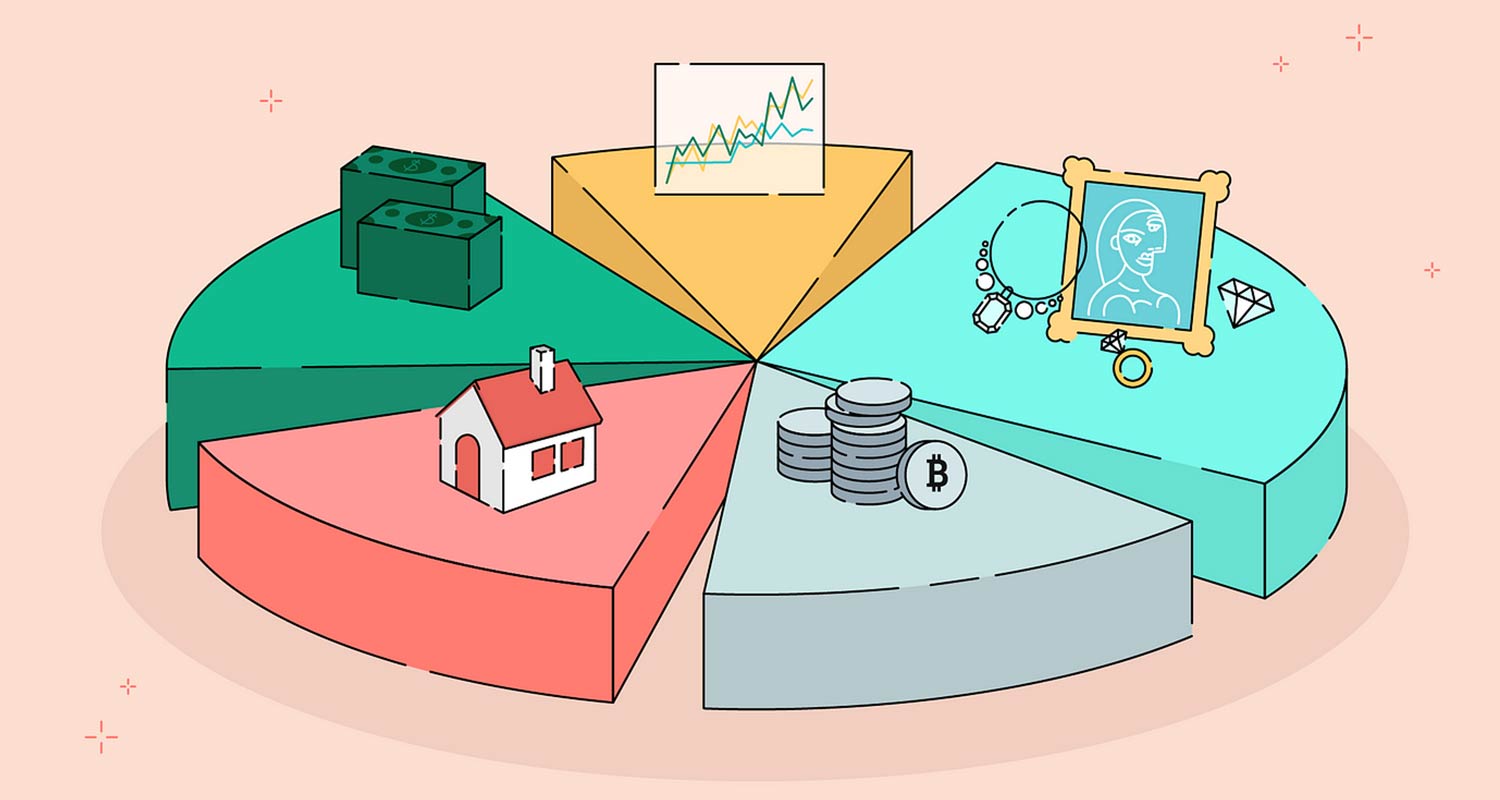

This article dives into the various aspects of investing in commodities, offering insights into an asset class that offers both diversification and growth potential.

What are commodities?

The basics

Commodities are raw materials or primary goods that have value and can be traded on exchanges. Unlike stocks, you’re investing in tangible items, whether that’s precious metals like gold and silver or agricultural products like wheat and soybeans.

Types of commodities

- Metals: Gold, silver, copper, aluminium

- Energy: Oil, natural gas, coal

- Agricultural: Corn, wheat, soya beans, coffee

- Livestock: Cattle, pigs, poultry

Why invest in commodities?

Diversification

One of the primary benefits of including commodities in your portfolio is diversification. Because commodities often have an inverse relationship with equities, they can act as a hedge against stock market volatility.

Inflation hedge

Commodities like gold are considered excellent hedges against inflation as their value often rises when the value of money decreases.

Supply and demand

The principles of supply and demand often have a direct impact on commodity prices. For example, if there’s a shortfall in the production of wheat due to weather conditions, its price is likely to go up. Understanding these dynamics can give you a trading advantage.

How to start trading commodities

Traditional methods

Before the advent of the internet, commodity trading was mostly conducted through futures contracts on exchange floors. Such methods still exist and are employed mainly by institutional investors.

Modern trading platforms

With platforms like TradingView, getting into commodity trading has never been more accessible. If you’re wondering how to trade on TradingView, you’ll find that the platform offers a variety of tools and real-time data to aid your decision-making process. It caters to both beginners and experienced traders, with features such as paper trading, advanced charting capabilities, and a broad community of traders who share their insights and strategies.

Political and economic considerations

Big fight over Cape Town electricity prices

Investing in commodities is not without its risks, especially those influenced by political and economic factors. Events can lead to volatility in commodity markets and serve as a lesson to investors about the need to stay updated on current events when investing in this asset class.

International relations and trade wars

Political tensions and international relations can significantly impact commodity prices. For instance, oil prices often fluctuate based on geopolitical tensions, trade agreements and even the mere possibility of conflict. Understanding these aspects is crucial for any investor interested in commodities.

Seasonal factors

Agricultural commodities, in particular, can be affected by seasonal trends. Understanding these can offer lucrative trading opportunities. For instance, knowing when harvest seasons occur around the world can give you a leg up in anticipating price changes in agricultural commodities.

Risks and how to mitigate them

Risks and how to mitigate them

Market volatility

Commodities are subject to market risks, including supply and demand fluctuations, which can result in high volatility. Investing in a diversified portfolio and leveraging tools like stop-loss orders can help mitigate these risks.

Speculative nature

Some commodities are often the subjects of speculative investment, which increases the risk factor. To mitigate this, investors should aim for a balanced portfolio, carry out thorough research, and use risk management tools and strategies like options and futures contracts for hedging.

Currency risks

Many commodities are priced in dollars. Fluctuations in currency values can affect your investment returns. Be sure to account for this risk, particularly if you’re trading from a non-dollar-denominated account.

Strategies for investing

Long-term investing

Some investors prefer a long-term approach, holding onto commodities like gold as a store of value. They might use instruments like ETFs, which offer exposure to commodities without requiring physical storage.

Active trading

Day traders and swing traders focus on short-term price movements. They utilise technical analysis and chart patterns, often relying on platforms like TradingView for real-time data and analytics.

Conclusion

Investing in commodities offers a path towards diversification and potential returns that can act as a counterbalance to equities in your investment portfolio. While there are unique challenges and risks, being mindful of political events and utilising platforms that make trading more straightforward, like TradingView, can empower you to explore this fascinating asset class effectively.

By understanding the dynamics of commodity markets and leveraging the tools available for modern trading, you can position yourself for a more diversified and potentially rewarding investment journey.

For more information visit us at www.easymarkets.com or follow us on Instagram, Facebook, X, LinkedIn or YouTube.

Investment disclaimer

This article is for informational purposes only. Stock values can be as unpredictable. Past trends don’t promise future gains. Diversify wisely, think long-term, and consult a financial expert. TechCentral is not responsible for market fluctuations or any investment decisions made based on this content.

- This promoted content was paid for by the party concerned