The job of the long-term investor is, ultimately, to distinguish whether a company’s prospects are being influenced by noise or signal, and then to understand whether the prospects are reflected in the price. This is particularly true when it comes to the current situation regarding Facebook and the furore surrounding improper sharing of users’ data by the company.

While Facebook undoubtedly needs to learn from this experience, its core offering remains true: as a powerful, nearly irreplaceable platform for users to participate and connect with the world around them.

Facebook has been a boon for investors since its listing. The owner of the Facebook, Instagram and WhatsApp platforms listed at US$38 in May 2012 and rose to $176/share by December 2017, achieving a 31.4% annualised return over the period versus 16% for the S&P 500.

The rather “un-tech”-like returns have been driven by old-fashioned revenue generation, strong operating margins and earnings growth. Facebook generates revenue by selling access to — and knowledge of — its 2.2bn-strong user base. Its addressable market is enormous and businesses across the globe are looking to reach consumers on the Internet, switching their ad dollars from old media to new. With low associated costs, Facebook operating margins have leapt from 10.5% at listing to 50% as of 2017.

The knowledge that Facebook has of its users is deep and far reaching. In return for access to the platform, users allow Facebook to track their location and record their activity on the platform, including who they interact with, how they interact and what they like and dislike. These vast data reams are aggregated and deciphered to make sense of consumer trends, analysing how they think and participate with the world around them.

This is powerful stuff. Advertising executives have flocked to Facebook to achieve the Holy Grail of marketing: a way to reach the right consumer (known as “targeting”), interact with them and measure the interaction. Revenue has poured in from $5bn in 2012 to $40bn last year, $5bn more than renowned Naspers investment Tencent earned in the same year. This revenue has been backed by earnings growth, with Facebook earning $0.01/share in 2012 and $6.16/share as of 2017, despite shares in issues expanding 36% over this period.

Shares tumble

However, since its peak on 2 February 2018, the share price has fallen 18% on news that Cambridge Analytica, a firm linked to US President Donald Trump’s 2016 election campaign, managed to get its hands on the data of 87m Facebook users in a suspicious, and possibly unlawful, way.

The timing couldn’t have been worse for Facebook. According to the Pew Research Centre, a think-tank, the majority of Americans distrust social media firms. News reels are awash with stories about fake news originating from social media platforms, and in particular the ongoing saga of Russian interference in the US presidential campaign. A new study suggests that fake news played a big role in depressing support for Hillary Clinton on election day. According to the Washington Post, fake news could have cost Clinton about 2.2 or 2.3 points apiece in Michigan, Pennsylvania and Wisconsin. This is meaningful considering Clinton lost Michigan by just 0.2 points and Pennsylvania and Wisconsin by 0.72 and 0.76 points respectively.

On top of this, European regulators, taking a far firmer stance on data privacy and regulation, are threatening Facebook with everything from digital revenue taxes to antitrust claims.

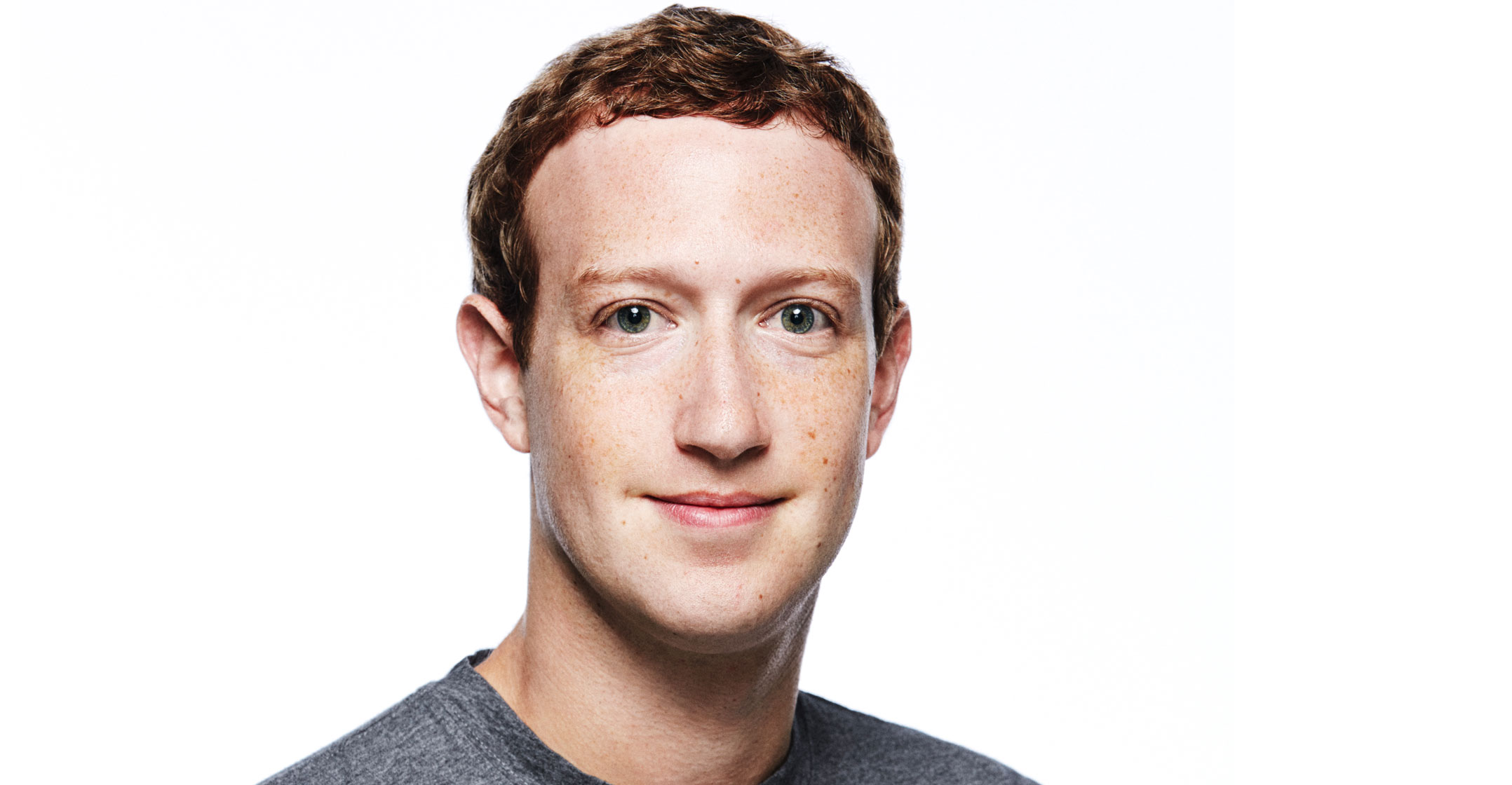

Facebook is beginning to learn that with its great power comes great responsibility. It needs to learn from the trust concerns it has found itself facing, and learn quickly. Mark Zuckerberg, Facebook’s CEO, should reflect on how his start-up has grown from being merely a platform to like your friends’ photos into one that provides the world with much of its online interaction, with world-resonating consequences.

Encouragingly, though, we see signs of contriteness. Facebook, for example, plans to comply with — and apply worldwide — most of the measures contained in the General Data Protection Regulation, a new European law that will give users more power to opt out of being tracked online and to stop their information being shared with third parties. Zuckerberg has furthermore promised strict auditing of certain apps, as well as plans to restrict developers’ access to data and help users control which apps have access to their data. Privacy has become number one on his agenda, as it should be.

The rise of the Internet and the social networking and messaging made possible through its protocols have quite literally changed the world. Although it has only been 12 years since the launch of Facebook, and just over 10 years since the launch of the first iPhone, the impact has been enormous. Today, nearly a third of the global population participates with the world around them through the medium of a social network, and Facebook is the dominant social network of the day.

Facebook must be very careful in how it handles users’ data, and how it manages its relationships with regulators, an issue many companies must deal with around the world.

However, the evidence suggests to us that Facebook’s core business and value proposition remain intact. Its market opportunity remains large and, although the future is uncertain, the recent news flow is more noise than signal. The most likely long-term implications of the improper sharing of users data will be stronger regulation around individual data protection, much in line with what Europe has recently legislated. The recent sell-off has thus provided an opportunity to add to our portfolio position at a very attractive valuation — at time of writing 19x next year’s expected earnings.

- Peter Hundersmarck is co-manager of the Old Mutual Titan Global Equity Fund at Old Mutual Investment Group