On 18 July, Microsoft announced yearly profits of nearly US$22bn. Its shares immediately plunged by more than 11% and have yet to recover. What has made investors so nervous?

On 18 July, Microsoft announced yearly profits of nearly US$22bn. Its shares immediately plunged by more than 11% and have yet to recover. What has made investors so nervous?

Part of the problem is around expectations. Investment analysts had been expecting an additional $1,35bn in profit from the last quarter of the company’s financial year. When Microsoft missed that target, it gravely disappointed investors.

Where did those expected profits go? A hefty $900m was swallowed by an “inventory adjustment” on Microsoft’s Surface RT tablets. That’s a euphemism for a large cut in the price of the device — from $500 to $349 for the entry level model — a clear indicator that sales have been slow.

The other half a billion dollars in profits was lost in a combination of factors currently plaguing the software giant: the latest version of its Windows operating system is still selling poorly, the launch of the next generation of its Xbox gaming console fizzled, and its online services continued to lose money (though at a much slower rate than before).

Still, an 11% drop in share price seems like an overreaction, particularly when the company in question is sitting on $77bn in cash, and has produced a net margin of over 25% for pretty much its entire 38-year history. But the share price reflects deeper currents in the industry that are not yet apparent in these numbers.

Sales of PCs, the bedrock on which Microsoft’s core business still rests, seem to be in terminal decline. Both IDC and Gartner, two prominent PC industry analysts, recently reported five consecutive quarters of decline in sales — the longest slump in the history of the market. In the latest quarter, PC makers sold almost 10m fewer units than in the same period in 2012, a decline of more than 10%.

The cause of this carnage is obvious: tablets and smartphones are replacing PCs for many consumers. Since consumers currently account for 65% of PC sales, that’s a serious problem for manufacturers and, by extension, Microsoft. Its Windows operating system still powers over 90% of PCs on the planet. A smaller PC industry can only hurt Microsoft’s bottom line.

There are bright spots in the results. Both Gartner and IDC report that businesses are still steadily buying PCs, and these users have long been Microsoft’s bread and butter. This explains why Microsoft’s business division continues to grow even as Windows shrinks. The same applies to its “server and tools” business — it has never looked healthier.

These trends are producing rumbles from some investors. They feel Microsoft should abandon the consumer market to the likes of Apple and Google and concentrate on the business market where it is still top dog. Its tablet business, in particular, continues to disappoint. Granted, the Intel-powered Surface Pro is selling far better than the beleaguered Surface RT — over 1,6m units in the first quarter of 2013 — but given that Apple and Android-powered tablets account for 47,3m units, it’s unlikely that Microsoft will make a serious dent in the market for some time.

Just before its results were announced, Microsoft embarked on a long-awaited reshuffle. The new structure is around functions rather than business divisions. The divisions were previously based around products (such as Windows and Office), which encouraged inter-divisional rivalries and duplicated costs.

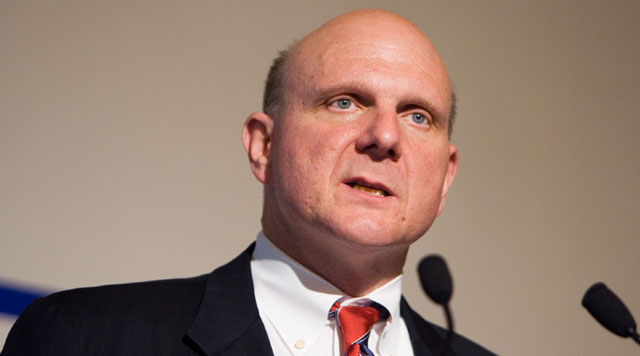

Although its executives are loath to admit it, Microsoft’s new structure most closely resembles Apple, its fiercest rival. Most industry analysts were lukewarm at best about the reshuffle. More than one quipped that the restructuring missed its most important opportunity: getting rid of CEO Steve Ballmer.

Ballmer is bombastic, abrasive and not well liked, but there are better reasons to want him out. Under his leadership, Microsoft’s share price has flatlined for more than a decade, and the company has missed out on two major revolutions — Web-based services and mobile devices. It has since made some progress in both areas, but Ballmer has yet to pay for his blunders.

Both the markets and the tech press are fond of hyperbole. Microsoft, depending on who you believe, is either doomed to irrelevance or poised for even greater dominance. The reality is somewhere in the middle. Microsoft will continue to dominate the business software market, and will establish footholds in the tablet, smartphone and online services markets through sheer attrition.

But what is clear is that Microsoft’s glory days are behind it. The company remains enormously important to the entire technology industry and continues to churn out profits, but its days of minting new billionaires are long gone.

Perhaps its grumbling investors are right: better to bow out of the consumer market gracefully than be the desperate, middle-aged company lurking by the bar in the hot new mobile club. — (c) 2013 Mail & Guardian

- Alistair Fairweather is the GM for digital operations at the Mail & Guardian

- Visit the Mail & Guardian Online, the smart news source