Nokia and BlackBerry handsets continue to dominate the SA market but worldwide the picture is very different. A new report from Gartner shows Samsung Electronics is pulling further and further ahead of Nokia and Apple in terms of unit sales.

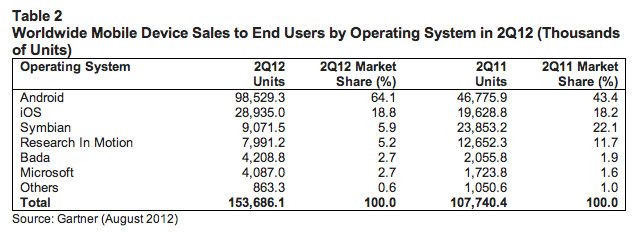

Moreover, Google’s Android operating system is now by far the most popular mobile OS with a staggering market share of 64,1%.

The data is contained in a new Gartner report released this week and showing worldwide sales for the second quarter of 2012.

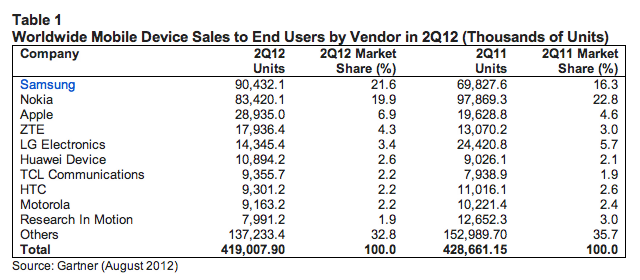

Sales of mobile phones reached 419m units in the second quarter of 2012, a 2,3% decline from the second quarter of 2011. However, smartphone sales accounted for 36,7% of total mobile phone sales and the number grew by 42,7% year-on-year in the second quarter of 2012.

Gartner says the decline in global mobile sales during the period is as a result of poorer economic conditions and consumers postponing their upgrades to take advantage of high-profile device launches and promotions available later in the year.

Demand for feature phones continued to decline, a move that Gartner says significantly weakened the overall mobile phone market.

Samsung dominated second-quarter sales with a 29,5% increase in unit sales compared to the same period last year, extending its lead over both Apple and Nokia quarter-on-quarter. The Korean company’s market share is 21,6%, up from 16,3% in 2011. That puts it ahead of Nokia, which enjoys a 19,9% market share, a decline from its 22,8% last year.

Gartner says Samsung’s growth was driven mainly by sales of its Galaxy range of smartphones. Smartphones now account for 50,4% of all Samsung mobile devices, or 45,6m units.

Demand for the recent Galaxy S3 handset — Samsung’s flagship Android device — exceeded even the manufacturer’s own expectations according to Gartner, with Samsung reporting 10m unit sales in the two months after its release, making it the best-selling Android product in the quarter.

In the second quarter of 2012, demand for Apple’s iPhone weakened as sales fell by 12,6% from the first quarter of 2012. However, the device still enjoyed 47,4% growth year-on-year.

“Samsung and Apple continued to dominate the smartphone market, together taking about half the market share, and widening the gap with other manufacturers. No other smartphone vendors had share close to 10%,” says Gartner principal research analyst Anshul Gupta.

Despite continuing to dominate the SA market, Nokia’s mobile phone sales worldwide declined by 14,8% year on year. Gartner says the Finnish company is having to battle emerging device manufacturers, including Chinese manufacturers ZTE and Huawei, to defend its feature-phone sales.

Nevertheless, Nokia’s feature-phone sales grew quarter on quarter. However, Gartner says Nokia’s Lumia devices “continue to struggle to find a place in consumers’ minds as a replacement for Android”.

“Declining smartphone sales are worsening Nokia’s overall position as it had already lost the number-one position to Samsung in the previous quarter and is facing reduced profitability due to continuous declining sales of premium smartphones,” says Gupta.

Android extended its lead as the dominant smartphone operating system with a 20,7% increase in market share since 2011. Apple’s iOS market share increased by only 0,6% during the same period.

Gartner says the next iPhone should encourage many Apple users to upgrade, but may also mean a similarly poor third quarter performance for the Californian company. — (c) 2012 NewsCentral Media