The South African Reserve Bank has approved the Post Office’s first-level application for a banking licence for Postbank.

The awarding of the licence means that the Postbank is closer to offering more than just savings accounts as it will be able to offer banking cards and other services.

Officials expect the next and final level for the licence to be completed within 12 months.

Subsequent steps in the process will include the approval of the Postbank board nominees, the registration of it as a company and the transfer of business from the Post Office to the new company.

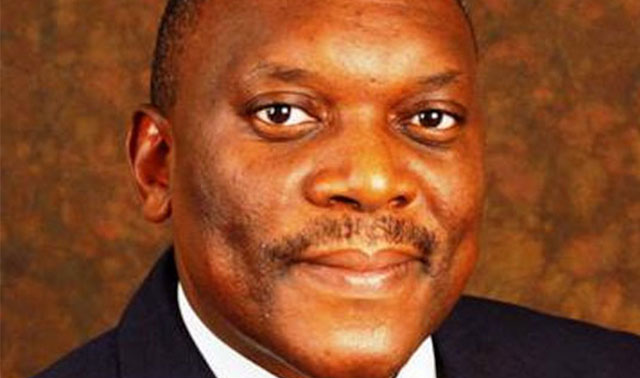

Telecommunications & postal services minister Siyabonga Cwele said the awarding of the first-level application brings government closer to its realisation of a state bank.

“I think we are coming closer to that realisation,” said Cwele at a media briefing in Houghton, Johannesburg.

“It should be clear that this bank is not in competition with commercial banks,” he added.

Postbank is set to serve government’s development agenda, explained Cwele.

The bank is further expected to tap Post Office retail outlets across the country, turning them into branches.

The Postbank is also set to become a subsidiary of the Post Office, but with its own governing structure, said Cwele.

Meanwhile, Post Office CEO Mark Barnes said that the company has secured a three-year loan facility of R3,7bn from major financial institutions such as Standard Bank.

The facility comprises a floating interest rate of 2,5%.

The funding was also secured via guarantees made available to the Post Office by national treasury as the state-owned company seeks to return to financial sustainability, after it recorded a R1,5bn loss earlier this year.

The Post Office has also struck a deal with unions to ensure that “qualifying bargaining unit employees will be paid a once off, taxable and non-pensionable back pay in full for eight months” for the period of April-November 2014.

While there will be no salary increases for the Post Office’s approximately 22 000 staff for the 2015/2016 financial year, the company has committed to an overall increase of 6,5% on actual basic salary or total cost to company effective from 1 April 2016.

These payments will be effected on 25 August 2016.

Finally, the company said it has moved to convert permanent part-time employees to permanent full-time status effective from 1 August 2016. Casual employees are planned to be converted to permanent part-time employees effective from the same date.