Amid the backdrop of escalating interest rates, inflationary pressures and a challenging economic landscape, a robust cash investment strategy that prioritises minimal risk and long-term financial aspirations has never been more compelling.

Amid the backdrop of escalating interest rates, inflationary pressures and a challenging economic landscape, a robust cash investment strategy that prioritises minimal risk and long-term financial aspirations has never been more compelling.

However, the art of successful investment goes beyond merely allocating your funds; it involves the method of investment and the brands in which you place your trust. At Sasfin, we empower our clients to steer their own course because we recognise their dedication to safeguarding their hard-earned money; and while they value expert guidance, they ultimately seek the autonomy to make decisions that resonate with their unique needs, priorities and business endeavours.

Leading the way with exceptional rates

With its basis as an entrepreneurial bank, Sasfin’s legacy is rooted in building strong relationships and comprehending the nuances of businesses. In a landscape where each percentage point can wield substantial influence over returns, Sasfin has deliberately chosen to maintain highly competitive rates, thereby bridging the gap between a good investment and a remarkable one.

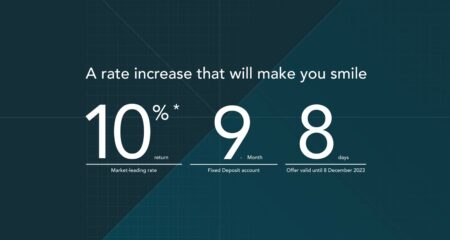

As per Rate Compare, Sasfin secures the top position in terms of annual effective rates for notice deposits spanning 60, 90, and 120 days, alongside fixed deposits extending over 2 to 3 years. When we proclaim our offering of market-leading rates, it’s not mere rhetoric—it’s a commitment that empowers our clients to generate more, achieve more, and channel their funds into their future prospects, financial objectives or business aspirations.

Intelligent moves with notice and fixed deposits

In a diversified investment approach, which is crucial for any portfolio, the inclusion of low-risk fixed or notice deposit cash investments is essential. These deposits, backed by a reliable financial institution such as Sasfin, play a pivotal role in safeguarding capital. They offer superior returns in comparison to conventional savings accounts, and their inherent low-risk nature ensures the security of the principal sum—investors earn interest without compromising their capital.

Further, notice deposits come with an added advantage: they grant convenient access to funds when needed. This flexibility empowers investors to swiftly convert assets into liquid resources to address unforeseen expenses, seize new investment opportunities, or mitigate cash flow disruptions during unforeseen challenges, such as the disruptions witnessed during the recent pandemic.

Unlocking the benefits of term deposits

- Stability: Fixed deposits act as secure havens during economic fluctuations, shielding your funds from market ups and downs while offering guaranteed returns.

- Predictable earnings and future planning: These deposits, with their known interest rates and fixed timeframes, facilitate accurate projections of earnings and strategic planning for future investments.

- Growing returns over time: The longer your funds remain invested in these deposits, the higher the interest accumulation, enhancing potential returns.

- Mitigating market uncertainty: Term deposits act as a buffer against market unpredictability, ensuring your investments remain steady despite external market shifts.

- Harnessing compound interest: Fixed deposits don’t just grow linearly; they leverage the power of compound interest. The longer your funds remain in a term deposit, the more your wealth multiplies.

- Maximising post-tax returns: By structuring notice and fixed deposits thoughtfully, you can optimise post-tax returns. Consult your tax advisor to make the most of these benefits during tax season.

Sasfin: empowering beyond banking

The art of crafting an effective cash optimisation strategy entails a curated mix of products, each calibrated to cater to distinct time horizons and all aimed at achieving your business objectives. With no lurking monthly fees and the rock-solid guarantee of capital preservation, the prowess to harness your money’s potential lies squarely within your grasp. Want to find out how much interest you can earn with our market-leading products? Visit our investment calculator today.

About Sasfin

Sasfin contributes to society by going beyond a bank to enable entrepreneurs and investors to grow their businesses and global wealth, supporting job creation and sustainable socioeconomic development as well as a culture of savings. Our personal touch, digital platforms and agility allow us to compete effectively. Sasfin was listed on the JSE in 1987 and is a bank-controlling company that comprises three business pillars: asset finance, business and commercial banking, and wealth. The group has regional offices in four South African provinces and eight cities. Sasfin is a B-BBEE level-1 contributor.

- Read more articles by Sasfin on TechCentral

- This promoted content was paid for by the party concerned