MTN South Africa, battered in recent years by the price war in the mobile industry, is showing signs that it could be on the mend.

In the third quarter of 2014, it grew its subscriber base by 5,7% to 26,7m. That’s 1,4m net additions for the quarter. It says the growth was the result of “competitive offers such as ‘rush hour’ and ‘talk free’ in the prepaid segment”.

The prepaid base increased by 7,1% to 21,2m. The volume of voice traffic showed “encouraging growth” in the quarter.

The post-paid segment delivered a “satisfactory performance”. Here, the base grew by 0,3% to 5,5m, 2m of which were telemetry Sims.

Data revenue growth was “muted”. It has blamed a 17,9% decrease in the average effective rate per megabyte for its performance in data, which now contributes 22,7% to revenue.

Data subscribers increased to 16,1m and data usage grew by 55,9%.

Blended average revenue per user decreased by 4,6% to R89,26.

“In addition to improving revenue growth, MTN South Africa continues to focus on various cost containment initiatives and on optimising its operating model,” MTN said in a statement.

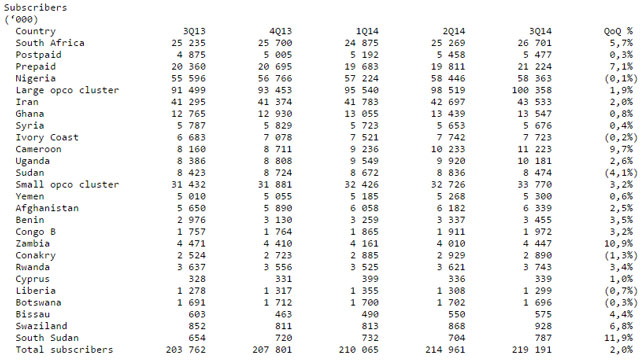

Meanwhile, the MTN group, which operates in 22 markets across Africa and the Middle East, has reported a 2% quarter-on-quarter increase in its subscriber base to 219,2m.

“MTN reported encouraging results for the third quarter,” said group CEO Sifiso Dabengwa. “However, performance was impacted by continued aggressive competition and stringent regulatory requirements. The South African operation delivered an improved performance in the prepaid segment supported by competitive offers while the Nigerian operation faced a challenging regulatory environment resulting in lower-than-expected growth.”

The Nigerian base shrank slightly (0,1% lower) to 58,4m as a result of regulatory restrictions because of MTN’s size in that market as well as unrest in the northern parts of the country.

“While this muted subscriber performance is expected to impact revenue growth for the second half of the year, by mid-September the operation had resolved a number of issues with the regulator resulting in an improvement in subscriber growth.”

In Iran, MTN affiliate Irancell performed well following the launch of 3G services. Data revenue there more than doubled in local currency. It has added 1 291 3G sites and 70 4G sites so far this year.

Irancell’s subscriber base reached 43,5%, an improvement of 2%. — (c) 2014 NewsCentral Media