Global sales of smartphones to end users declined for the first time ever in the fourth quarter of 2017, analyst firm Gartner said on Thursday.

Chinese handset manufacturers Huawei and Xiaomi were the only vendors in the top five to grow sales in the fourth quarter, the company said.

“Global sales of smartphones to end users totalled nearly 408m units in the fourth quarter of 2017, a 5.6% decline over the fourth quarter of 2016,” Gartner said. “This is the first year-on-year decline since Gartner started tracking the global smartphone market in 2004.”

Two main factors led to the fall, said research director Anshul Gupta.

Firstly, upgrades from feature phones to smartphones have slowed down due to a lack of quality “ultra-low-cost” devices, with users preferring to buy quality feature phones instead.

Secondly, replacement smartphone users are choosing quality models and keeping them longer, lengthening the replacement cycle.

“While demand for high-quality 4G connectivity and better camera features remained strong, high expectations and few incremental benefits during replacement weakened smartphone sales,” Gupta said.

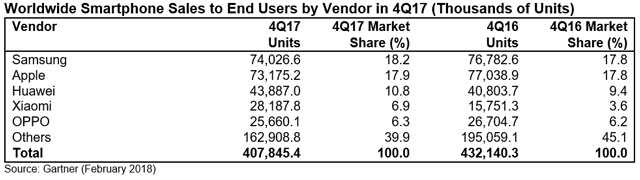

Samsung Electronics saw a year-on-year unit decline of 3.6% in the fourth quarter, though it stayed ahead of Apple in the number one position worldwide (see table below).

Samsung leads

“Despite the start of a slowdown in sales of Samsung’s Galaxy S8 and S8+, the overall success of those models has helped Samsung improve overall average selling price,” Gupta said. “Samsung is poised to announce the successors to its Galaxy series of smartphones at Mobile World Congress this year. The launches of its next flagship devices are likely to boost Samsung’s smartphone sales in the first quarter of 2018.”

Although Samsung’s significant sales volumes lean toward midprice and entry-level models, which now face extreme competition and reducing contribution, its profit and average selling price may further improve if these next flagship smartphones are successful, he added.

At Apple, iPhone sales fell 5%. Despite having three new smartphones — the iPhone 8, 8 Plus and X — its performance in the quarter was overshadowed by late availability of the X as well as component shortages and manufacturing capacity constraints.

“We expect good demand for the iPhone X to likely bring a delayed sales boost for Apple in the first quarter of 2018.”

Huawei and Xiaomi were the only smartphone vendors to achieve year-on-year unit growth (7.6% and 79% respectively).

In 2017 as a whole, smartphone sales to end users totalled more than 1.5bn units, an increase of 2.7% from 2016. Huawei, ranked third overall, raised its share in 2017, continuing to gain on Apple. At the same time, the combined market share of the Chinese vendors in the top five increased by 4.2 percentage points, while the market share of top two, Samsung and Apple, remained unchanged.

In the smartphone operating system market, Google’s Android extended its lead by capturing 86% of the total market in 2017, up 1.1 percentage points from a year ago. — (c) 2018 NewsCentral Media