South Africa’s competition authorities are actively doing damage to South Africa’s economic prospects. They need to be reined in.

South Africa’s competition authorities are actively doing damage to South Africa’s economic prospects. They need to be reined in.

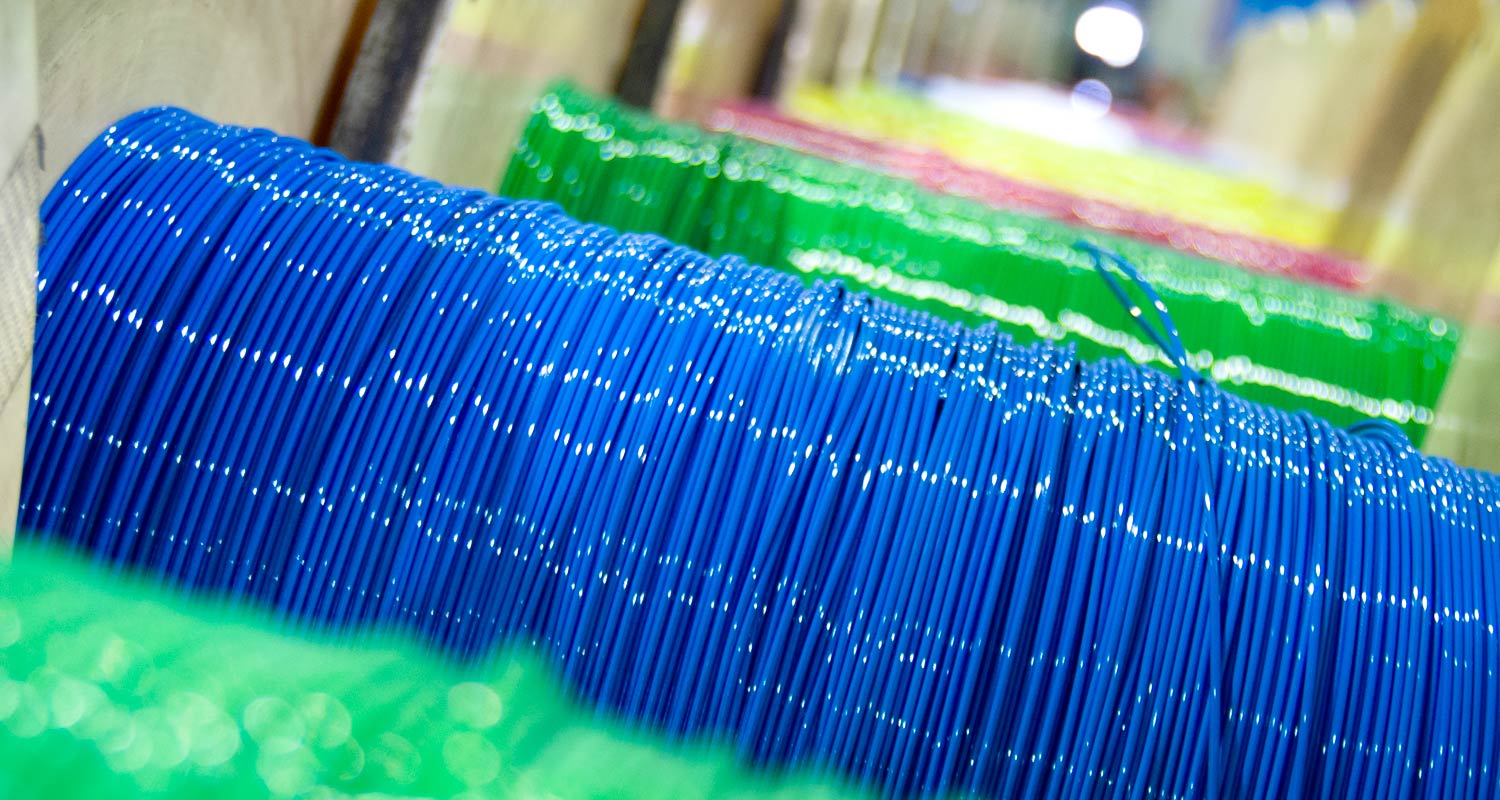

That much is clear after the news emerged on Tuesday that the Competition Tribunal will block Vodacom’s acquisition of a co-controlling stake in fibre operator Maziv, the parent of Vumatel and Dark Fibre Africa, which was going to use the money – R10-billion of it – to invest in fibre broadband, including in poorer, underserved communities.

The tribunal sided with the Competition Commission’s recommendation that the transaction be blocked on competition grounds. Ideally, what the decision should now trigger is a full review of the powers of the competition regulators, whose overreach in this case threatens economic growth and the roll-out of services to the poor.

Vodacom and Maziv should also challenge the tribunal’s decision at the competition appeal court, not only with a view to getting the deal over the line but to seek to overturn the dangerous precedent that has been set through egregious regulatory overreach.

We don’t yet know on what grounds the tribunal decided the transaction couldn’t go ahead, but it has immediately placed South Africa’s most successful fibre operator in a very difficult position. Maziv needed Vodacom’s fibre assets and capital investment to fund the next stage of its national fibre roll-out – an infrastructure build that is now in serious doubt.

The poor will pay the biggest price of the decision by career bureaucrats in Pretoria who believe they know better than industry about the best way to run a business.

Bizarre

That it took the competition authorities three years to conclude their investigations into the proposed transaction is wholly unacceptable, too. How can any company hope to make strategic deals if the regulator takes 36 months to approve them? There should be a strict time limit on how long these investigations are allowed to take – perhaps no more than six months. In three years, the industry has changed considerably, too.

What’s even more bizarre about the tribunal’s rejection of the deal is that it will actively harm the unconnected and the poor – flying directly in the face of the stated objectives of the government of national unity.

Millions of South Africans could now be deprived of getting an internet service at home for years longer due to bureaucrats who clearly have a view that Vodacom is already too dominant in telecommunications. The fact is, most of these pencil pushers simply don’t have what it takes to run a successful business themselves, yet they are making major decisions impacting companies and the economy.

Read: Vumatel under pressure

As Dobek Pater, MD of Africa Analysis, said in August, the decision to block the deal would have a severely negative impact on the sector – and the economy more broadly.

“As a country, we need large telecoms operators in order to continue building infrastructure where it doesn’t yet exist and to upgrade what is already there,” Pater said.

“If you look at countries similar to South Africa, we need large organisations with the ability to access lots of money and have the economies of scale to remain profitable, while at the same time providing affordable services to consumers,” he said. “The deal would be a positive in that it would create a larger entity able to pool massive resources and take advantage of synergies within the group.”

He said the challenge of delivering connectivity to low-income areas had not been solved. “To solve it, you need to throw money at it, and you also need scale to ensure that these services can be provided to these communities sustainably.”

Vodacom brought that scale.

It will be interesting to see if the tribunal deals with this point in its reasons document – or even reflects on the negative implications of its decision. I’m not holding my breath.

In an unusually strong statement for a major company, Vodacom Group CEO Shameel Joosub described the tribunal’s decision as surprising and disappointing. He said South Africa “desperately needs additional significant investment, especially in digital infrastructure in lower-income areas”.

Joosub must be a frustrated man, having waited three years only for the deal to be blocked, even after making major concessions to get it over the line. If I was in his position, I’d be seething.

The decision will have the impact of crushing investment in South Africa’s fibre industry, at least in the short term. Maziv will have to dial back its ambitions significantly – and the poor, who are waiting for affordable fibre broadband, will suffer most. It’s unclear whether Maziv has another suitor with deep pockets in the wings, but it seems doubtful.

Thorough review

MTN will probably now not pursue a deal to buy a stake in Openserve, Telkom’s wholesale networks subsidiary, an investment that would have capitalised that business and put it in a strong position to challenge Vodacom/Maziv in the market. The fight between these entities would have been hugely beneficial to consumers as these deep-pocketed players moved to wire up the country with advanced broadband.

Instead, investment will suffer, consumers will be worse off and the economic benefits that would have flowed will no longer materialise.

Read: Vumatel’s R99 uncapped fibre now a commercial product

This deal should not have been blocked, and the decision to do so should invite a thorough review of the mandate of South Africa’s competition authorities, which have become an impediment to economic development the country can ill afford. — © 2024 NewsCentral Media

Get breaking news from TechCentral on WhatsApp. Sign up here

- The author, Duncan McLeod, is editor of TechCentral