On the surface, Intel’s strategic pivot comes at an ideal moment. But despite its bold vision, the company is set to face challenges to its grand turnaround plan that will prove extremely difficult to overcome.

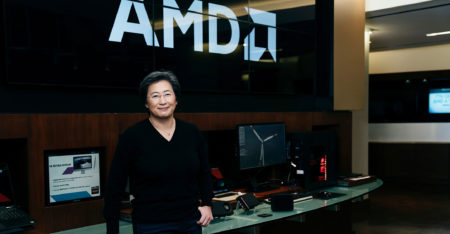

Browsing: AMD

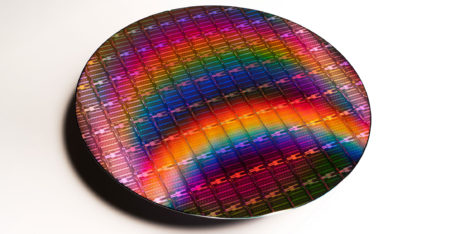

Intel, the world’s largest chip maker, said it’s offering a revamped version of its Xeon range in time for what it sees as the “biggest build-out of technology infrastructure in human history”.

Nvidia forecast better-than-expected financial first quarter revenue on Wednesday, with its flagship gaming chips expected to remain in tight supply for the next several months.

Samsung Electronics rose the most in almost 10 months after Intel was said to be considering asking the South Korean giant and TSMC to make some of its most sophisticated chips.

Apple is planning a series of new Mac processors for introduction as early as 2021 that are aimed at outperforming Intel’s fastest chips.

Samsung Electronics is pouring $116-billion into its next-generation chip business that includes fabricating silicon for external clients, betting it can finally close the gap on industry leader TSMC.

Semiconductor designer AMD said on Tuesday it would buy Xilinx in a US$35-billion all-stock deal, intensifying its battle with Intel in the data centre chip market.

With no short-term catalyst for gains on the horizon, Intel shareholders are now forced to ponder its long-term fundamental prospects, and they frankly remain bleak, even as its rivals prosper.

Intel on Thursday reported that margins tumbled in the latest quarter as consumers bought cheaper laptops and pandemic-stricken businesses and governments clamped down on data centre spending. Its shares tumbled.

AMD is in advanced discussions to buy Xilinx in a takeover that could be valued at US$30-billion, according to people familiar with the matter.