Bitcoin has broken the $17 000 level for the first time since just after the burst of the cryptocurrency bubble almost three years ago.

Browsing: Bitcoin

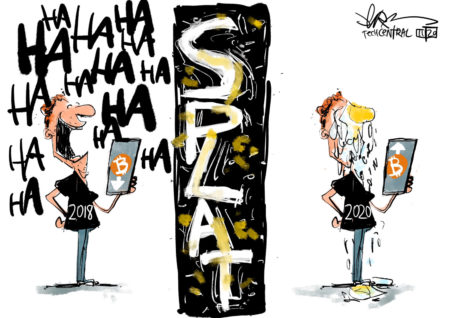

View the latest contribution from TechCentral cartoonist Jerm.

Three years ago, bitcoin’s historic surge dominated dinner conversations. This year, the cryptocurrency is in the midst of another notable rally and yet almost no one’s talking about it.

As bitcoin begins testing levels last seen at the peak of the end-of-2017 bubble, South Africa has yet another cryptocurrency exchange in an increasingly crowded market.

Bitcoin’s surge during US election week has pulled cryptocurrency performance further ahead of major asset classes this year.

Bitcoin is in rally mode once more. Whether it’s uncertainty from the US election, the future of the pandemic or simply more investor interest, the cryptocurrency is at the highest level since January 2018.

South African cryptocurrency traders can expect a tightening tax net in the near future, with the revenue service paying close attention to crypto activity in the country.

Almost $1-billion (R16.2-billion) worth of bitcoin that likely originated from Silk Road is on the move, according to blockchain tracker Elliptic.

As the bitcoin price surged past $13 400 over the last week, an old debate has resurfaced: Is it a bubble and will it burst?

Bitcoin advocates say this time will be different as the virtual coin surges back to price levels last seen in the wake of the collapse of the cryptocurrency market bubble almost three years ago.