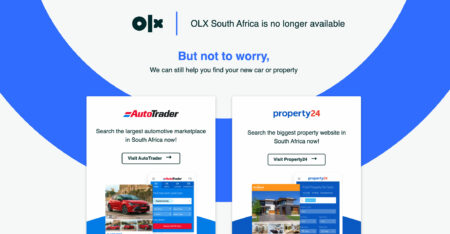

Naspers has closed its OLX in South Africa, saying the move was done so it can focus its customer proposition fully on its property and motor vehicle platforms.

Browsing: Naspers

Prosus CEO Bob van Dijk has purchased about $10-million of the company’s shares on the open market.

MTN Group had a barnstorming 2021. The telecommunications group, despite its size, was the best performer among technology shares in South Africa last year.

Naspers Foundry has invested R54-million in car subscription company Planet42 as part of a R91-million total equity funding round.

SweepSouth, the on-demand home cleaning company backed by Naspers, has acquired 100% of FilKhedma, an Egyptian start-up.

South Africa recorded R557.9-billion of foreign direct investment inflows in the third quarter of 2021.

Meta Platforms has responded to the news last week that several South African publishers are dragging it and Google to the Competition Commission.

South African publishers, including Media24, are taking Google and Meta Platforms to the Competition Commission, seeking compensation for use of their journalism.

Naspers first-half profit climbed 11%, driven by a large contribution from Chinese Internet giant Tencent.

South Africa’s largest e-retailer, the Takealot Group, grew revenues by 36% year on year in the six months to 30 September 2021.