The US is set to add dozens of Chinese companies, including the country’s top chip maker, SMIC, to a trade blacklist on Friday, two people familiar with the matter said.

Browsing: TSMC

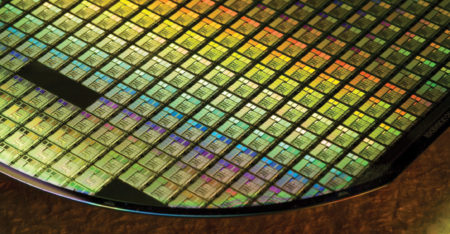

Makers of cars and electronic devices from TVs to smartphones are sounding alarm bells about a global shortage of chips, which is causing manufacturing delays.

Apple is planning a series of new Mac processors for introduction as early as 2021 that are aimed at outperforming Intel’s fastest chips.

Samsung Electronics is pouring $116-billion into its next-generation chip business that includes fabricating silicon for external clients, betting it can finally close the gap on industry leader TSMC.

Apple on Tuesday introduced a MacBook Air notebook and other computers with the first Apple-designed microprocessor, called the M1, a move that will tie its Macs and iPhones closer together technologically.

Semiconductor designer AMD said on Tuesday it would buy Xilinx in a US$35-billion all-stock deal, intensifying its battle with Intel in the data centre chip market.

Huawei quietly spent months racing to stockpile critical radio chips ahead of Trump administration sanctions, ensuring it can keep supplying Chinese carriers in their $170-billion roll-out of 5G technology.

The story of TSMC’s industry dominance steamed ahead unabated on Thursday, with record earnings on the back of booming demand for chips used in smartphones and servers.

For the first time since 2011, Apple didn’t release a version of its flagship iPhone in September. That delay has had a massive ripple effect through its network of vendors.

China has denounced the US’s latest moves to curb Huawei’s access to commercially available chips, the latest blow in an increasingly tense relationship between the world’s two biggest economies.