It’s been a banner year for South Africa’s technology industry, one that was defined by major acquisitions, costly legal battles and intense competition.

From telecommunications and broadcasting to intellectual property and platform power, the people on this list shaped outcomes that reached beyond boardrooms – affecting consumers, markets and policy debates.

Traditional incumbents are being reshaped, new competitive dynamics are emerging and long-running battles are being resolved. From the man leading the revival of Telkom to the one who took on a corporate giant and won (eventually), these are the people who, for better or worse, moved the needle in South Africa’s tech sector 2025.

5. Serame Taukobong

Telkom has successfully transformed itself from a lumbering state-owned monopoly into a fierce and nimble competitor, even outpacing larger rivals Vodacom and MTN in South Africa’s prepaid mobile market in the recent past.

When Serame Taukobong took over as group CEO in January 2022, the company was at something of a crossroads: rising debt, a stagnating share price and the heavy capital demands of the 5G era. In his time at the helm, he has helped shift Telkom from being a traditional fixed-line company to a focused, data-led infrastructure player through a strategy he dubbed “OneTelkom”.

By integrating Telkom’s formally siloed mobile, fibre and data centre business units, Taukobong has unlocked cost efficiencies that made Telkom Group more competitive. A key part of the turnaround involved the sale of Swiftnet, the group’s masts and towers business, for R6.75-billion. The move unlocked capital that was then used to strengthen Telkom’s balance sheet.

Indeed, it has been a bumper year for Telkom, with the company reporting a 25% surge in earnings before interest, tax, depreciation and amortisation for the year ended 31 March 2025. The most visible sign of the turnaround was when dividend payments were reinstated following a 62% jump in full year earnings (including proceeds from the Swiftnet sale). By end-September, Telkom’s consumer business, which houses its mobile operations, marked 12 consecutive quarters of service revenue growth as it took market share from rivals.

Taukobong has also invested considerable effort into leadership development. In June, Beauty Apleni, who previously served as chief of staff to Taukobong, was promoted to CEO of Openserve, the group’s fibre business unit.

With a strong leadership team, a successful data-led strategy and a much stronger balance sheet, Taukobong must now ensure that the growth lasts in a market that is highly competitive. – Nkosinathi Ndlovu

4. Shameel Joosub

Vodacom Group CEO Shameel Joosub put the telecommunications operator on a much stronger footing in 2025, earning him a spot on TechCentral’s South African tech newsmakers list. Under his leadership, the Johannesburg-based Vodacom not only finally sealed the long-awaited Maziv fibre transaction after four years of fighting with regulators but also moved to take control of Safaricom in a landmark R36-billion deal – marking two of the most significant milestones in Vodacom’s recent history.

The Maziv deal had been blocked and contested by South Africa’s competition authorities before being overturned by the competition appeal court – after Vodacom made further concessions to appease the Competition Commission. Getting the deal over the line is now expected to kick-start a wave of consolidation in South Africa’s fibre industry, with all eyes on MTN Group to see how it responds.

Then there was Vodacom’s Safaricom transaction. Vodacom agreed to buy additional stakes from the Kenyan government and Vodafone, lifting its holding to 55% and giving it a controlling interest for the first time. The deal allows Vodacom to consolidate Safaricom’s results into its own and strengthen its presence in East Africa’s most dynamic telecoms and fintech market, home to the widely used M-Pesa mobile money ecosystem.

On the operational side, Vodacom delivered what TechCentral characterised as a “powerhouse half year” in November 2025, with strong group revenue growth, expanded financial services uptake and double-digit service revenue increases. Joosub’s emphasis on diversification beyond traditional mobile services is clear, with digital and fintech offerings now making a growing contribution to the group’s performance.

Yet it hasn’t all been smooth sailing. In South Africa’s prepaid market, Vodacom has felt increasing pressure, particularly from Telkom’s data-led prepaid strategy that has helped it grow service revenue and data subscribers more rapidly. Competitive intensity in the domestic mobile segment has weighed on Vodacom’s South African service revenue momentum, tempering what was otherwise a strong group narrative.

What stands out about Joosub in 2025 is that he lets performance speak louder than fanfare – quietly delivering transformational deals and driving sustained operational momentum while navigating tough competition at home. – Duncan McLeod

3. Jorge Mendes

Cell C CEO Jorge Mendes has been leading the mobile operator’s turnaround, with the company successfully listing on the JSE in November. While the initial valuation fell short of pre-listing projections, the share price has remained stable since its market debut. The offer was priced at R26.50/share, raising R2.7-billion through the sale of 102 million shares by The Prepaid Company (TPC), part of Blu Label Unlimited Group.

The deal concludes a multi-year restructuring that included network outsourcing, debt reduction, wholesale contract renegotiations and a full transition to an asset-light operating model.

The co-CEOs of Blu Label, Mark and Brett Levy, were also instrumental in Cell C’s turnaround, with investor optimism about Cell C’s prospects helping Blu’s shares more than double on the JSE in the past year.

Mendes, a seasoned telecoms executive, left Vodacom in early 2023 to become CEO of Cell C. Under his leadership, the company expanded its role as the leading venue for mobile virtual network operators (MVNOs) in South Africa, including the fast-growing Capitec Connect.

Cell C was the first mobile operator to host an MVNO on its infrastructure and today they have become key to its growth strategy.

For helping lead a credible turnaround and spearheading a successful listing of the business on the JSE, Mendes is a worthy newsmaker on TechCentral’s list for 2025. – Amy Musgrave

2. Maxime Saada

Maxime Saada is not South African, but he earned a place on TechCentral’s local tech newsmakers list anyway. As group CEO of France’s Canal+, he became the public face and strategic driver of one of the biggest media and technology deals ever to play out in Africa: Canal+’s takeover of MultiChoice Group, a transaction that effectively reshapes the broadcasting map across the continent.

Canal+’s thesis – articulated repeatedly by Saada – is that owning MultiChoice gives the combined group scale across Francophone and Anglophone Africa, a bigger subscriber base and more leverage in the expensive, global fight for premium content and sport.

But Saada’s big bet lands in a business under severe strain. MultiChoice has been bleeding linear subscribers as households cut discretionary spending and competition fragments viewing. It plans a wholesale overhaul its content line-up in the coming months in a move that is expected to reshape the way it sells its channel bouquets.

The strategic pressure is also structural: global streamers like Netflix, Disney+ and Amazon Prime Video have been normalising subscription streaming across Africa, investing in local productions and training consumers to expect on-demand viewing at lower monthly price points. That has squeezed DStv’s premium positioning, accelerated “cord cutting” and forced MultiChoice to spend heavily to defend its relevance – including via Showmax’s relaunch and content investment – while still funding expensive sports rights and fighting piracy.

In that context, Saada’s significance is obvious: he didn’t just buy an asset – he placed a multibillion-dollar wager that Africa’s video future will be hybrid (satellite plus streaming), and that scale, local content and distribution muscle can still beat Silicon Valley’s platforms on the ground. Whether that wager pays off will define MultiChoice’s next decade – and it’s a key reason why Saada made TechCentral’s list of South African newsmakers of the year. – Duncan McLeod

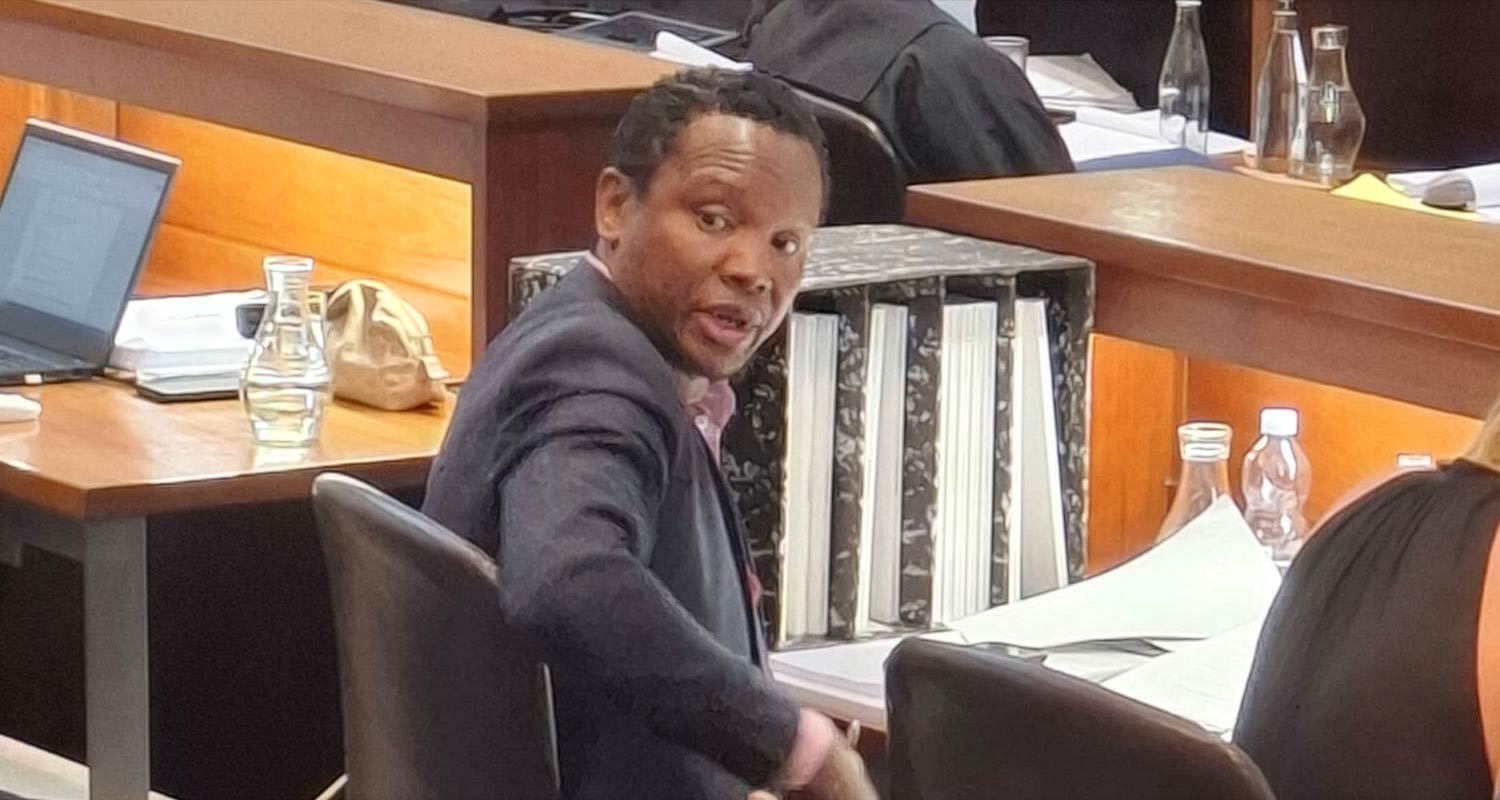

1. Nkosana Makate

The story of Nkosana Makate is defined as much by triumph as it is by difficulty. The legal battle for compensation for the “please call me” concept – which the constitutional court found was his idea – dragged on for 17 years.

The case went through every tier of the South African legal system twice: from the high court to the supreme court of appeal to the constitutional court, only for the entire process to start again at the high court. By the time it was settled out of court, the sheer volume of legal documents was staggering.

In July this year, the constitutional court – the highest in the land – handed down yet another judgment that failed to provide finality, instead highlighting a “failure of justice” in the supreme court’s previous calculation and setting the stage for a new hearing in November. This constant deferral meant Makate was living in a state of perpetual “legal suspension”, where his identity was consumed by his status as a litigant.

As litigation progressed, the “please call me” story changed many times. At first, Vodacom claimed Makate had not come up with the idea, despite a company memo congratulating him for doing so. Further muddying the waters were claims by former Vodacom Group CEO Alan Knott-Craig, made in a memoire, that he – and not Makate – came up with the idea. Meanwhile, Ari Kahn and MTN developed a similar product, dubbed “call me”, before Vodacom – it was even patented, though the patent was later allowed to lapse.

When Makate and Vodacom reached an out of court settlement in November – rumoured to be somewhere between R300-million and R700-million – it seemed Makate had finally laid the matter to rest.

But fresh litigation was brewing in the background.

Within days of the settlement, a third party, Black Rock Mining, filed a lawsuit claiming it was entitled to 40% of Makate’s payout. Black Rock claimed a 2011 agreement for Makate’s legal fees entitled it to the money. Makate denied the contract’s validity, alleging he cancelled all agreements with Black Rock representative Chris Schoeman as Schoeman failed to provide adequate cover for Makate’s legal costs.

Though Makate saw off an urgent application to have his payout frozen, the merits of Black Rock’s case must still be heard in court.

Makate has spent much of his adult life battling a corporate giant, and although he has received a hefty sum for his troubles, this new case threatens to redefine his success, potentially turning it into a pyrrhic victory.

William Shakespeare wrote that “heavy is the head that wears the crown”, and rapper Notorious BIG said “more money, more problems”. Makate may take inspiration from either of these poets, perhaps both, but the lesson is the same. – Nkosinathi Ndlovu

Notable mentions

This year also produced several notable figures whose influence was decisive, if sometimes less visible – shaping long-running industry outcomes that will matter for years to come.

Communications minister Solly Malatsi deserves mention for injecting momentum into policy areas that had stagnated for too long. His policy directive to communications regulator Icasa on equity equivalent investment programmes reopened the door to greater investment by foreign companies – despite the extreme reaction of parties on the political left, including from some in the ANC, including his own deputy, Mondli Gungubele. Malatsi has brought a more pragmatic and growth-orientated approach to digital policy, which is to be welcomed, even though he can be criticised for moving a little too slowly.

Then there’s Lincoln Mali, CEO of Lesaka Technologies in Southern Africa, who has continued to remake the business into one of South Africa’s more interesting fintech and financial services players. After helping refocus the business, Mali’s boldest move came with the acquisition of Bank Zero.

Finally, Remgro’s Pieter Uys earns recognition for his relentless, behind-the-scenes role in pushing the Vodacom/Maziv fibre transaction across the finish line. After years of regulatory setbacks and negotiations, Uys’s dogged persistence proved critical in unlocking a deal that could reshape South Africa’s fibre market. – (c) 2025 NewsCentral Media

Get breaking news from TechCentral on WhatsApp. Sign up here.