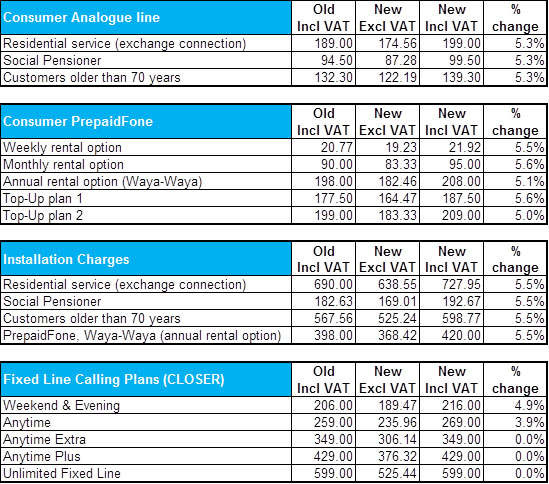

From 1 April, it will cost residential consumers 5,3% more per month to lease a phone line from Telkom. Line rental will increase from R189 to R199/month on that date.

Meanwhile, a residential telephone line installation will rise by 5,5%, from R690 to R727,95.

The new prices are part of Telkom’s fixed-line tariffs for 2017, which are regulated by the Independent Communications Authority of South Africa. More details about residential charges are included in the table further down in this article.

The increases come despite a continued slide in the number of fixed lines in service. In November, Telkom revealed that the number of lines in service had declined to below 3,1m at the end of August 2016, a year-on-year decline of 7%.

The new line rental prices will also put upward pressure on broadband digital subscriber line (DSL) fees as customers are forced to pay basic line rental to Telkom in order to receive DSL.

DSL rental fees, which exclude Internet access — this must be bought from an Internet service provider — remain unchanged at R165, R299, R399, R425, R499 and R599/month for 2Mbit/s, 4Mbit/s, 8Mbit/s, 10Mbit/s, 20Mbit/s and 40Mbit/s speeds.

Installation of a broadband DSL now costs R792, while a self-install option (without a technician on site) costs R469.

The price of business line rental will rise to R262,28/month on 1 April, an increase of 5,4% from R248,95/month, Telkom said. Installation now costs R1 026,95.

“In 2015, we took a decision to file our annual tariff adjustment in April instead of August to coincide with Telkom’s financial year-end,” said company spokeswoman Jacqui O’Sullivan. “In 2015, we filed in the month of May and in 2016 we filed in the month of April.

“This year, our annual rate adjustment will come into effect on 1 April 2017 and we have informed all affected consumer and enterprise customers.” — (c) 2017 NewsCentral Media