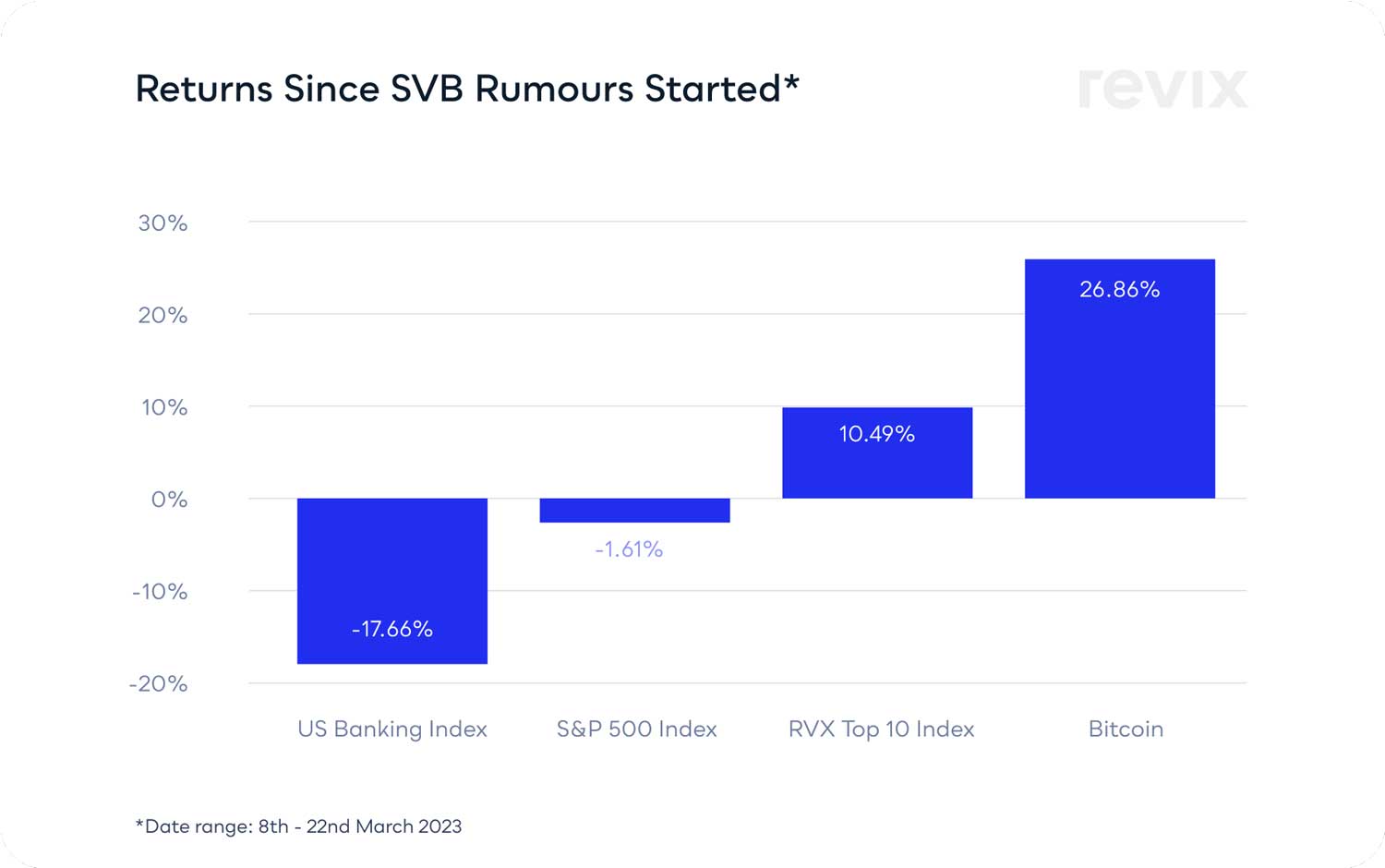

As the dust settles on the second largest banking failure in US history, the cryptocurrency market is one of the only investment classes delivering positive returns. Bitcoin had its best weekly return since 2017 (up 26.3%), and the rest of the cryptocurrency market is following suit.

As the dust settles on the second largest banking failure in US history, the cryptocurrency market is one of the only investment classes delivering positive returns. Bitcoin had its best weekly return since 2017 (up 26.3%), and the rest of the cryptocurrency market is following suit.

Here are three reasons why the crypto bull market may have returned sooner than expected.

1. The Silicon Valley banking crisis shines light on the fragile US banking system

What happened?

Silicon Valley Bank (SVB) closed down on 10 March after customers rushed to withdraw deposits amid rumours that the bank’s financial position was in jeopardy due to losses on its government bond holdings.

What does this mean?

A bank’s business is to take customer deposits and loan them out to earn interest. Due to a lack of loan demand, SVB had excess deposits that needed to be put to use. These deposits were used to purchase government bonds — a perfectly sensible decision since government bonds are essentially investment loans to the government.

But a critical note about bonds: they lose value as interest rates rise. When inflation reached unprecedented levels in 2022, the US Federal Reserve (Fed) attempted to contain it by implementing history’s fastest interest rate hiking programme. When interest rates rise, bond prices fall, and SVB’s government bonds did just that.

How does this affect crypto?

The closure of SVB brought to light the idea that government actions can have long-term effects on your financial liberties, prompting many to seek alternative financial systems.

Cryptocurrencies were created to provide a more efficient, transparent and decentralised financial system free of government control. After 2008 and now SVB, people are starting to value crypto as an alternative, and investments are leaving banking stocks and flowing into cryptocurrencies.

2. Interest rate increases could be a thing of the past

What happened?

Silicon Valley Bank was not an isolated event. Multiple regional banks in the US are in the same situation. The US Fed has stepped in to help alleviate the situation by providing loans through its Bank Term Funding Programme (BTFP).

The programme enables cash-strapped US banks to use their government bond holdings as collateral and borrow money to help meet their liquidity obligations.

What does this mean for interest rates?

While this programme significantly relieves US banks, it impacts future US interest rate decisions. As a result of rising interest rates reducing the value of bonds, the Fed is now in a position where, if it continues to raise rates aggressively, it will further reduce the value of the government bonds they hold as collateral.

Since the BTFP, the Fed has begun reducing the size of interest rate increases, and for the first time in over a year, rate cuts are expected in 2023.

How does this affect crypto?

As interest rates move lower:

- Investors gain access to cheaper cash in the form of lower-interest-rate loans. With increased investable cash, the demand for riskier assets such as cryptocurrencies increases.

- Safer interest-bearing investments offer less attractive yields, driving demand for riskier assets — like crypto.

3. The crypto market may be due for a positive run

What happened?

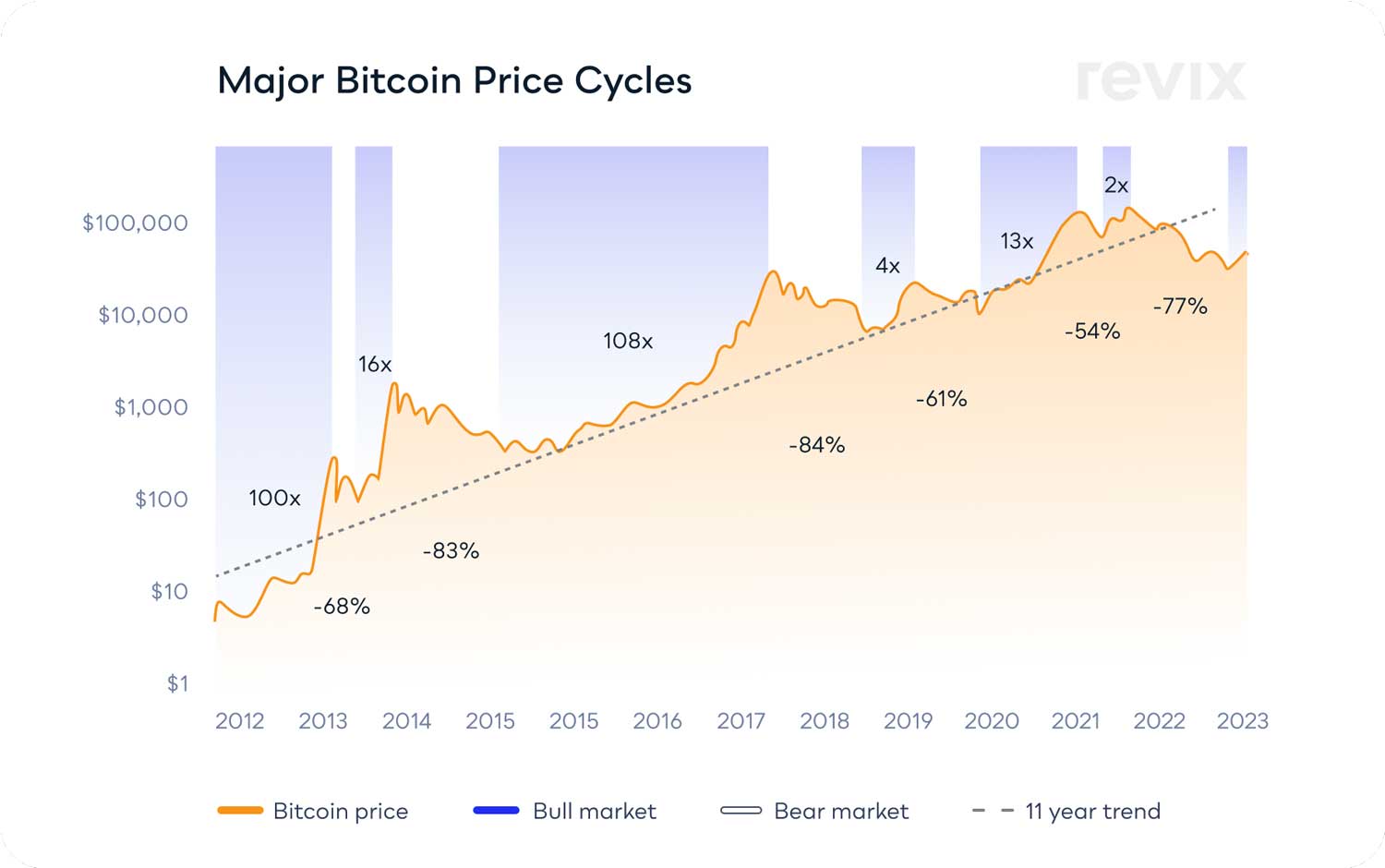

Bull markets and bear markets are a factor in every investment’s life cycle, and crypto is no different.

Bitcoin, and in turn, the crypto market, has seen six bull markets and a subsequent six bear markets.

Bear markets

On average, a bitcoin bear market lasts 264 days, and the price falls around 71%. However, the most recent Bitcoin bear market lasted 376 days — 112 days longer than average. The bitcoin price also fell 77% from its all-time high — 6% more than the average bear market. This is a potential sign that this bear market is overextended in terms of time and price decline.

Bull markets

On average, a bitcoin bull market lasts 407 days, and the price increases around 40x its lowest price point. That means that if we are in the next bull market, we are still in the very early stages — only 110 days in — and when compared to historical averages, bitcoin could see prices rise to the US$600 000 mark (R11.3-million).

What about other cryptocurrencies?

Historically, when bitcoin’s price increases by 1%, the rest of the crypto market increases by 1.3% on average. If bitcoin is on the verge of its next big bull run, investing in the broader crypto market through an index fund-like product can offer a higher return potential while minimising exposure to bitcoin alone.

Where can I get exposure to cryptocurrencies?

Revix, backed by JSE-listed Sabvest, offers an easy-to-use and secure mobile app where investors can access their wide range of cryptocurrencies and flagship Crypto Bundles.

Crypto Bundles are similar to traditional low-cost index-tracking ETFs, enabling investors to effortlessly own a basket of the world’s largest and most successful cryptocurrencies through one investment without building and managing a crypto portfolio themselves. This approach to crypto investing reduces risk as your Crypto Bundle is automatically updated every month based on changes in the crypto market.

Disclaimer

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose, and before investing please take into consideration your level of experience and investment objectives, and seek independent financial advice if necessary. Remember, investing in cryptocurrencies is considered a high-risk investment, meaning you can lose money when investing. For more information, please visit www.revix.com.

- This promoted content was paid for by the party concerned