If Apple is going to make a success of its car project, it has to target the US$230-billion luxury automobile market. Doing so may be the only way to keep investors happy. But displacing 125-year-old incumbents like Mercedes-Benz won’t be straightforward.

The iPhone maker has reignited efforts to build its own vehicle, though it’s at least five years away from production. Since the project started in 2014, Apple has undergone numerous false starts, laying off hundreds of staff in both 2016 and 2019, as costs ballooned and the focus shifted from electric vehicles to self-driving technology and back again. If CEO Tim Cook proceeds, he faces tough choices on how to enter a market with famously meagre profitability.

For all its recent stock market success, Tesla has demonstrated the pitfalls that come from a lack of automotive experience, repeatedly enduring manufacturing snafus and missing production goals. So there’s little doubt Apple would contract the manufacturing out to a third party, such as Magna International.

At one point about five years ago, the Canadian company had close to 100 employees working with Apple, helping steer the tech firm through the engineering process. But the work with Magna never graduated to working out how or where to build a car.

This time around, Magna is not the only option. Foxconn Technology Group, which makes iPhones under contract for Apple, is also stepping into the automotive industry — it established a joint venture last year with Fiat Chrysler Automobiles, the Milan-based automotive giant that’s merging with France’s PSA Group. And perhaps more pertinently, established car makers are now very serious candidates.

First dibs

Indeed on Friday, Korea’s Hyundai Motor Company seemed to confirm a local report it was in discussions with Apple, before walking the statement back. Such a tie-up could help resolve some of the earlier problems Apple faced with components.

In consumer electronics, the Californian company is used to getting first dibs on the best tech. After all, it’s the biggest player around when it comes to generating profit for suppliers. If Apple wants exclusivity on the latest cutting-edge 3D sensor technology, say, suppliers fall over themselves to contribute to the more than 200 million iPhones the company is expected to sell this year.

That’s different when it comes to cars, as Apple learned in 2016. With little visibility into how many vehicles it expected to ship in its first year, or when that might happen, there was little incentive for a supplier to provide any components exclusively when a customer such as Volkswagen would sell some 10 million vehicles that year.

It therefore makes sense for Apple to team up with an established player, and five stand out: VW, the Renault-Nissan-Mitsubishi Alliance, Volvo and its Chinese parent Geely Automobile Holdings, General Motors and, of course, Hyundai’s partnership with fellow Korean manufacturer Kia Motors. All have developed electric vehicle platforms with enough scale to prompt suppliers to scramble for contracts. Some have expressed a willingness to build vehicles for other brands — VW’s already working with Ford, and GM with Honda.

Nonetheless, while teaming up keeps your fixed costs low, it poses a challenge when it comes to profitability. A contract manufacturer usually costs about 10% more than making the vehicle yourself, according to Eric Noble, president of automotive consultancy the Car Lab. And profit margins in car-making are already slimmer than they are for the iPhone. Tesla likely enjoys a gross profit margin of about 30% on the Model 3, Bloomberg News reported in 2018. Apple’s gross margin on the iPhone is almost double that.

The single biggest outlay in electric vehicles is for the battery, which doesn’t benefit from economies of scale due to the fixed cost of raw materials. In the Tesla Model 3, the battery is more than a third of the total manufacturing cost, at some US$13 000 apiece. If, as Reuters suggests, Apple is able to find a way of reducing that cost with new battery technology, car-making becomes a more attractive proposition. But even a 50% cheaper battery would likely leave a car short of Apple’s iPhone profitability if the price point is similar to Tesla’s.

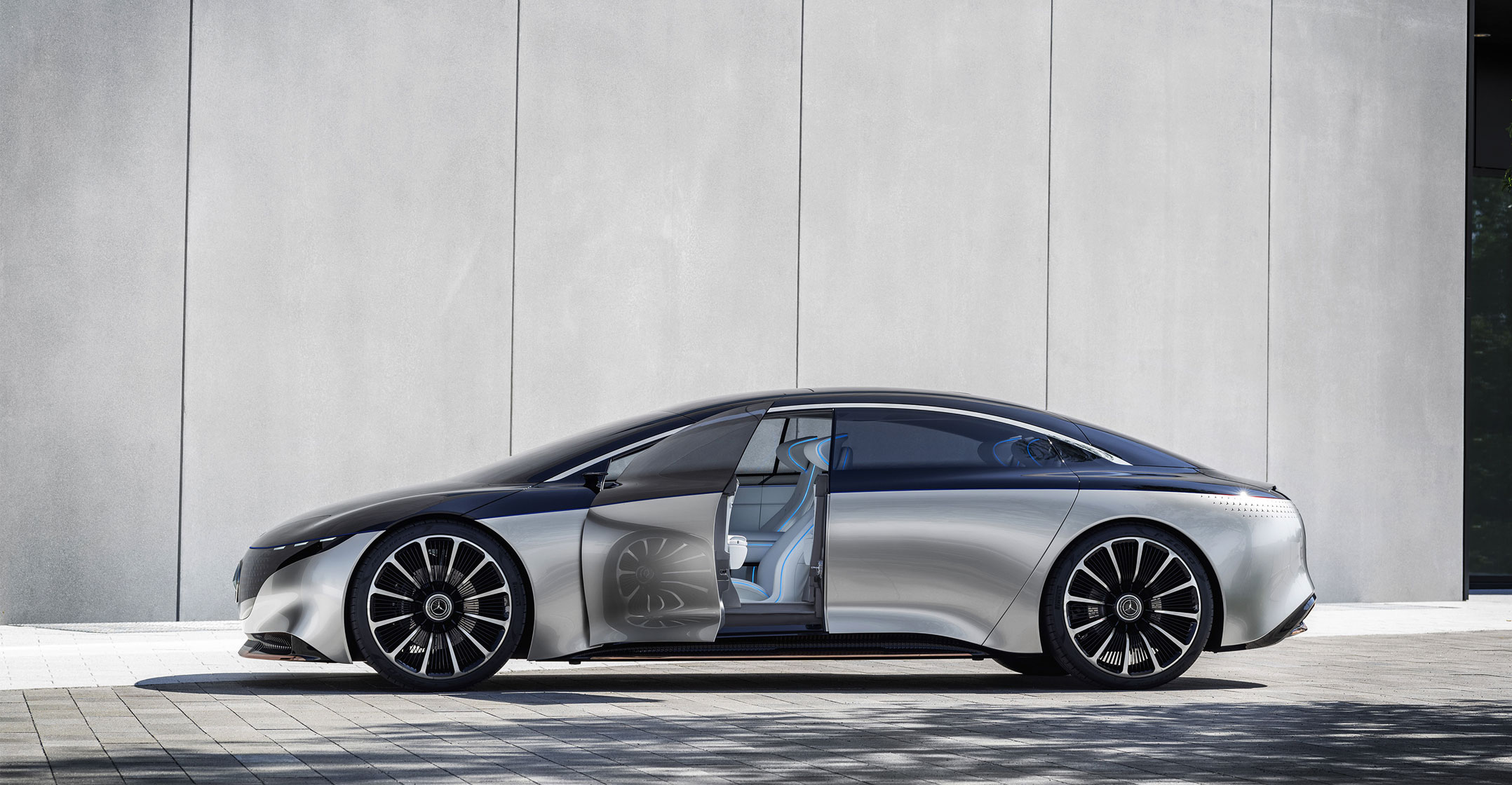

Luxury vehicle

Price is the obvious way to bridge the gap. Apple is not going to make a mass market car. It has to be a luxury vehicle and likely needs to be priced north of $100 000, particularly if it has self-driving capabilities that use sophisticated lidar technology. In theory that would be a similar pricing strategy to the iPhone, but in practice it would target a completely different spending bracket, which wouldn’t be easy. Vacuum-maker Dyson ditched its own vehicle efforts after realising it would need to charge £150 000 apiece.

Apple has a better chance of becoming a serious car maker. It has an edge over incumbents when it comes to software and design, and may even have a jump on battery technology, though such advantages wouldn’t last forever. The best way forward would be with a price point closer to a Ferrari than a Fiat.

The race is on again. — By Alex Webb, (c) 2020 Bloomberg LP