This is part 3 of a series of articles from Revix designed to help you understand the flow of money through crypto investments. In part 3, Revix examines historical trends which appear to drive a predictable sequence of investor behaviours following a bitcoin price rally. You can read part 1 and part 2 here.

This is part 3 of a series of articles from Revix designed to help you understand the flow of money through crypto investments. In part 3, Revix examines historical trends which appear to drive a predictable sequence of investor behaviours following a bitcoin price rally. You can read part 1 and part 2 here.

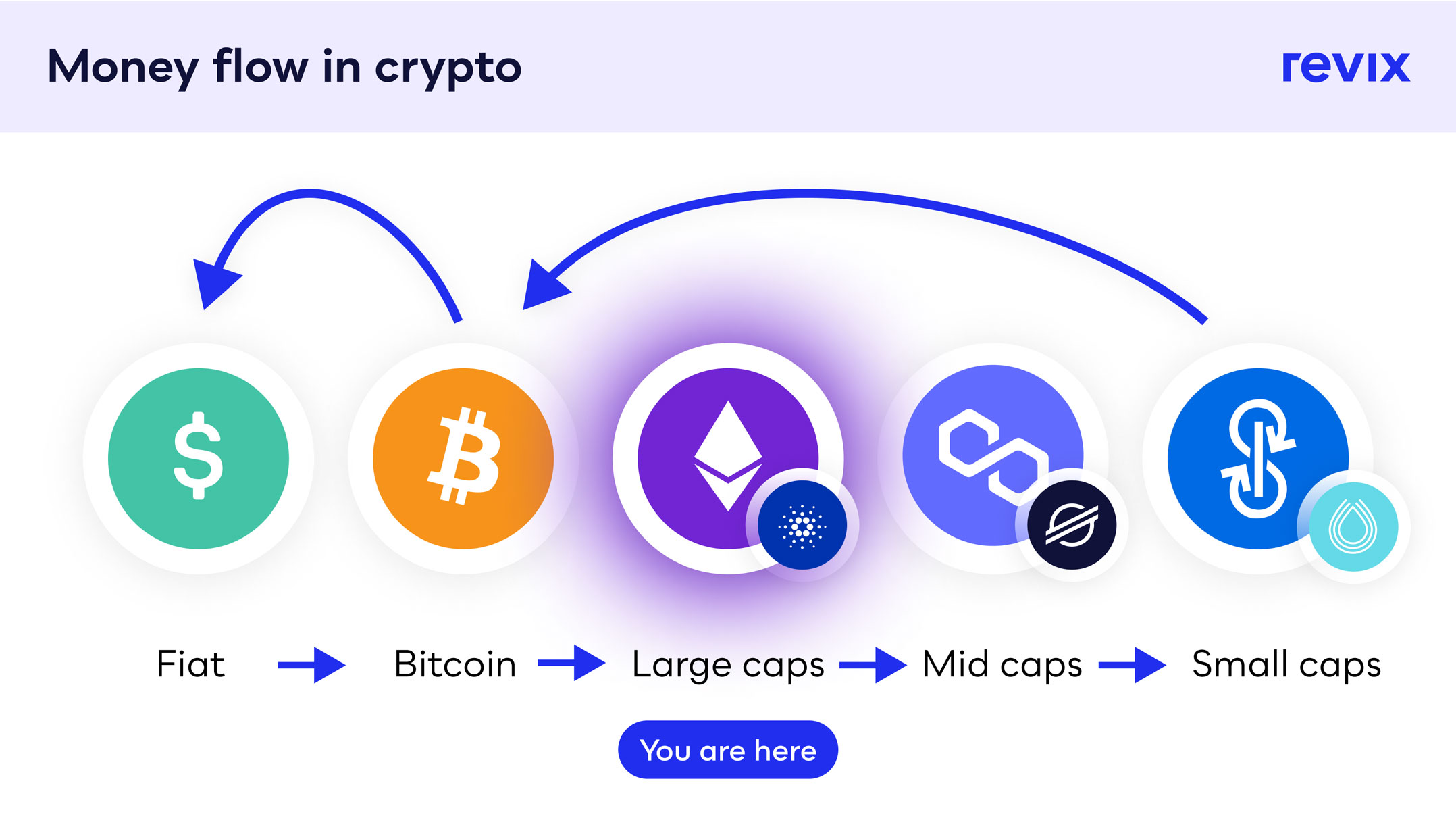

In part 1 of this series, we examined why bitcoin tends to be the first to move, its power to usher first-time crypto investors into the fold and how that has been shown to trigger the flow of money we are discussing in this series. Part 2 looked at why ethereum tends to be next to move. We explained that this is primarily due to its sheer size (ethereum is the second biggest crypto asset by market capitalisation) and because it supports an entire ecosystem of applications and services.

This week we examine the next phase, which is playing out a little differently from how it has in the past. Where historically we have seen money flow from ethereum to large-cap altcoins, this time they seem to be moving all at once.

But before we dive into the details, let’s first understand what a large-cap altcoin is.

‘Large-cap altcoins’ … you say what now?

Let’s break it down.

“Large cap” describes a crypto asset with a large market cap. A market cap is simply the total value of a crypto asset. For example, at the time of writing, bitcoin’s market cap is US$1.1-trillion. In other words, the total value of all bitcoin in circulation is $1.1-trillion.

Because bitcoin, the original cryptocurrency, continues to hold the top spot in terms of market cap, essentially every other crypto asset is generally referred to as an alternative to bitcoin. Hence the term “altcoin”. So, large-cap altcoins are essentially any crypto asset with a significant market cap that isn’t bitcoin.

Now that we understand what large-cap altcoins are, let’s look at how the standard money flow started and why this time could be a little different.

It all started with the standard money flow.

Following the market turnaround in late September, we saw bitcoin’s price easily outperform altcoins, posting an impressive 52% return into its all-time highs. Meanwhile, ethereum (29%) , solana (16%), cardano (-6%) and many more were struggling to keep up with the pace of the old guard.

As we learnt in the previous parts of this series, the “standard money flow” suggests that money will flow from bitcoin into ethereum and then feed into the large-cap altcoins.

But what if that’s wrong?

The standard money flow cycle is not so standard anymore. Recent price data is actually showing that money is not flowing solely into ethereum. This time around, large-cap altcoins are moving right alongside ethereum.

This is a fundamental change to the historical flow of money that so many investors have tracked for years, and the answer to why it’s changing is relatively simple.

The battle for the altcoin throne

In the past, the flow from bitcoin to ethereum was a sure bet, like receiving earphones with your new Apple iPhone. And much like you, ethereum is realising that there is less and less in its box.

Many factors are driving this phenomenon, but chief among them is the fact that the large-cap altcoin sector now offers investors a far wider range of ambitious and potentially disruptive technologies to choose from. In the past, ethereum could reasonably have been considered the only viable prospect for a smart contract-based decentralised future, but those days are over. In the smart contract space, for example, solana, cardano and polkadot have become major players, to name just a few.

With the new wave of “ethereum killers” popping up left, right and centre, we are seeing many investors choose to spread their investment over multiple ethereum competitors and, therefore, the standard flow into ethereum is instead being spread among multiple large-cap altcoins that show the same promise.

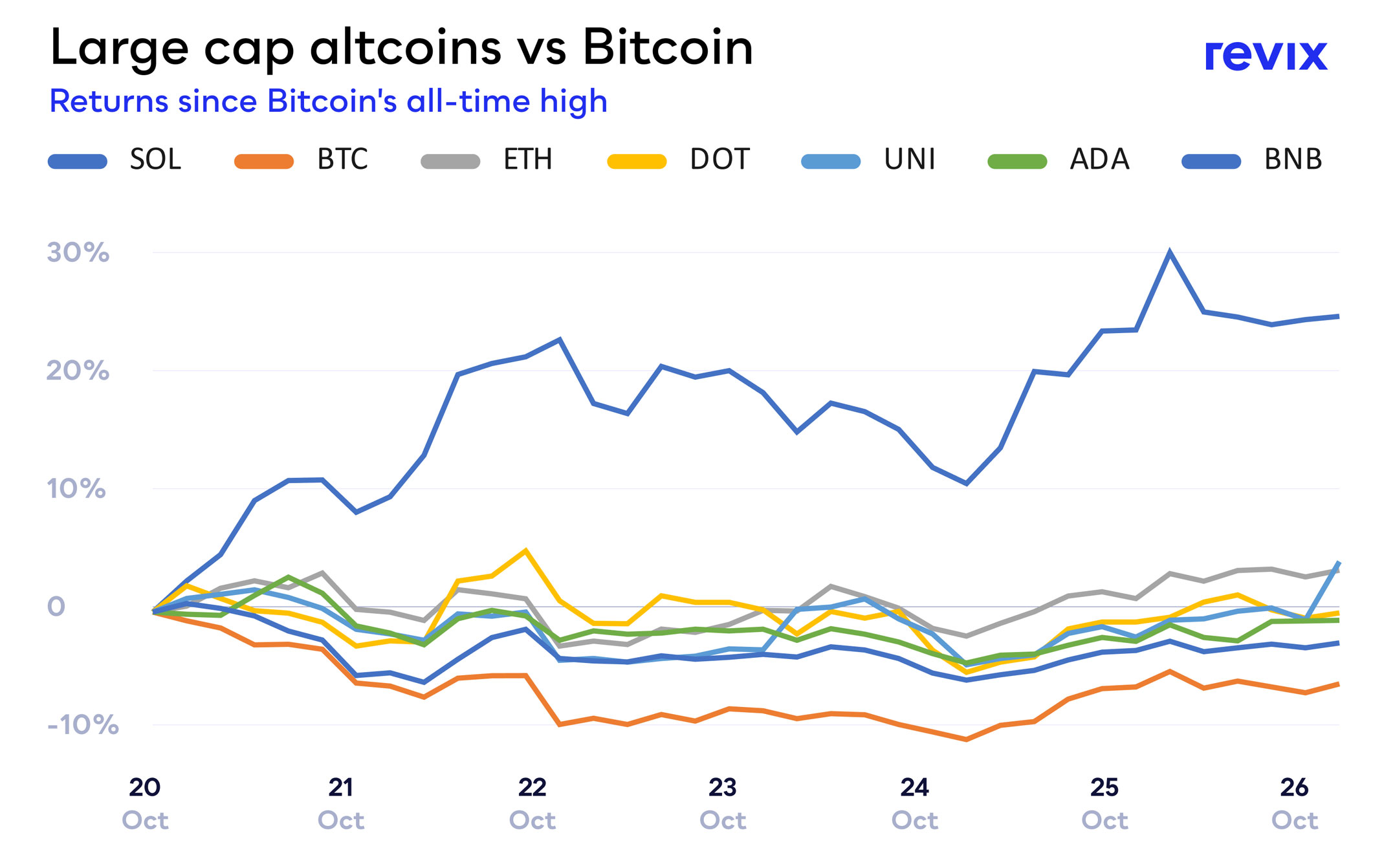

The graph above plots the returns of these large-cap altcoins vs bitcoin since the day bitcoin reached its all-time high and funds started to flow out of it. It’s clear that, in this price cycle, several large-cap altcoins are keeping pace with ethereum (grey line) rather than following it in the next phase. Not only that, but all the large-cap altcoins above are displaying better returns than bitcoin (orange line) itself.

Furthermore, large-cap altcoins are now gaining the attention of investors who are interested in more than just decentralised finance (DeFi) applications like lending and yield-farming. Large-cap altcoins are the infrastructural layer beneath global tech movements, which are garnering massive media coverage and birthing entirely online communities. NFTs, for example, have provided artists with new ways to generate revenue from their work. A recent study by the Crypto Gaming Alliance indicates that half of all crypto wallets in existence are connected to blockchain-based games. The most popular technologies supporting both NFTs and blockchain-based gaming fall into the large-cap altcoin segment.

What’s the smart investment?

It’s clear that deciding where to invest in this phase of the crypto price cycle has become more complicated than it was just a year ago. We’re in the midst of a flat-out race to see who will be the first to genuinely challenge ethereum’s position as the second biggest crypto asset by market cap, and investor opinions on the matter couldn’t be more polarised.

We’re making it easy to get in on the altcoin action at Revix.

Revix, a Cape Town-based crypto investment platform, is offering crypto investors a prime opportunity to add the top-performing large-cap altcoins to their portfolios.

Zero fees on purchases

We start with a one-time-only celebration. From 29 October to 1 November 2021, you’ll pay zero fees when you buy bitcoin, in celebration of the 13th anniversary of Satoshi’s Nakamoto bitcoin white papers, in purchases made with rand or pound sterling.

After that, between 5 November and 11 November, you’ll pay zero fees when you buy cardano, uniswap, polkadot, solana or binance coin in purchases made with rands or pounds.

Back the altcoin you think is going to change the world, or expose your portfolio to all of them. Either way, you pay no buying fees.

Revix is backed by JSE listed Sabvest and offers access to all the individual cryptocurrencies we’ve mentioned in this article, including bitcoin, cardano, ethereum, polkadot, solana and many more.

You can get started with as little as R500. Sign-up is quick and effortless, and you can withdraw your funds at any time.

About Revix

Revix brings simplicity, trust and great customer service when investing in cryptocurrencies. Its easy-to-use online platform allows anyone to securely own the world’s top cryptocurrencies in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

Remember, cryptocurrencies are high-risk investments. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

This article is intended for informational purposes only. The views expressed are opinions, not facts, and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any cryptocurrency.

To learn more, visit www.revix.com.

- This promoted content was paid for by the party concerned