Uniswap is the largest decentralised exchange (DEX) in the cryptocurrency space. It leverages multiple crypto assets, including its native UNI cryptocurrency, to provide a service similar to a traditional exchange. The difference is Uniswap has no one central operator or administrator, making it fully decentralised.

Uniswap is the largest decentralised exchange (DEX) in the cryptocurrency space. It leverages multiple crypto assets, including its native UNI cryptocurrency, to provide a service similar to a traditional exchange. The difference is Uniswap has no one central operator or administrator, making it fully decentralised.

Unlike most exchanges, which are designed to take fees, Uniswap is designed to function as a public good — a tool for the community to trade tokens without middlemen. Also, unlike most exchanges — which match buyers and sellers to determine prices and execute trades — Uniswap uses a simple maths equation and pools of tokens and ethereum to do the same job.

Since Uniswap is built on ethereum, it cannot list tokens built on other blockchains, and thus users can only swap what are known as ERC-20 tokens.

How does it work?

Uniswap’s network is designed to facilitate the buying and selling of crypto assets in a way that mirrors a traditional exchange. It does this by using smart contracts, which allow users (called liquidity providers) to deposit crypto assets into pools. These smart contracts then allow other users (called traders) to buy and sell these assets. Users who trade these pool assets pay a fee that is then distributed to all the liquidity providers proportionally (based on their contribution to the pool).

Uniswap’s liquidity pools explained

Each Uniswap pool holds two tokens, which together represent a trading pair for those assets. Uniswap uses a pricing mechanism called the “constant product market-maker model”. The formula (x*y=k) is used to determine the pricing for the pair, where x and y represent the pool balance of each token, and k is the total constant price of said pool.

In a newly created liquidity pool, the first liquidity provider sets the initial price of the assets in the pool by supplying an equal value of both tokens. Buyers can then swap tokens within the pool based on the formula. Smart contracts running the protocol use the above formula to take the amount of one token from the buyer and send an equivalent amount of another token purchased back to the buyer, keeping the total pool constant stable (k).

Let’s imagine the Uniswap USDC/ether (ETH) liquidity pool contains 10 ETH (x) and 10 000 USDC (y), therefore making the pool constant value 100 000 (k). This implies the pool’s starting price is 1 000 USDC per ETH.

Now let’s imagine a trader comes in and wants to buy 0.1 ETH. The USDC/ETH pool will now have:

- x: 9.9 ETH (10 ETH – 0.1 ETH)

- k: 100 000 (stays constant)

- New y: 10 101.01 USDC (100 000/9.9)

Therefore, the pool would imply a price of 1 010.1USDC per ETH to keep k constant since you had to add 101.01 USDC (10 101.01 USDC — 10 000 USDC) to the pool to buy 0.1 ETH.

As a result of this price shift, if another buyer makes a trade in the same direction, they will get a slightly worse rate for their trade, helping keep the overall system in balance.

In the example above, the next implied rate for ETH will be around 1 020.30 USDC per ETH (10 101.01 USDC/9.9 ETH).

When the price of an asset starts to trade away from market prices, arbitragers see this as an opportunity to make risk-free returns. Therefore, they come in to trade the price back to market rates. This is a vital part of the Uniswap ecosystem.

Why invest in Uniswap?

Why invest in Uniswap?

1. Decentralised exchange growth

With the rise of DeFi, decentralised exchanges have seen immense growth over the last year. Decentralised exchange volume reached US$404.9-billion in the second quarter of 2021. This is an 118x increase year on year. Uniswap is the largest and most successful decentralised exchange, accounting for over 50% of the weekly volume.

2. Revenues

Uniswap has daily revenue that is four times greater than bitcoin and is now the second largest cryptocurrency in terms of revenue, behind ethereum. This cash flow allows Uniswap to be valued by traditional finance metrics and gives Uniswap greater conviction for higher valuations and longevity as a stable project.

3. Decentralised exchange exposure

Uniswap is the world’s largest decentralised exchange cryptocurrency (DEX); therefore, it is a ultimate asset to buy if you are looking to gain exposure to this universe.

4. Potential oracle solution

Uniswap could become more than just a decentralised exchange. Due to its unprecedented nature and success, it is finding utility for other purposes. Vitalik Buterin, the ethereum founder, recently proposed that Uniswap become an “oracle token”, providing reliable price feeds to the smart contracts. Uniswap is suited for that purpose because of its deep liquidity and heavy usage, ensuring that prices aren’t manipulatable on the protocol, and others can benefit from these characteristics. This will benefit the ecosystem, as it will further decentralise the oracle space currently dominated by the chainlink blockchain.

5. Strong community and price performance

Uniswap is integrated with almost all major DeFi protocols due to its importance in providing the core DeFi functionality of asset exchange. Because of this, Uniswap has grown a strong community of followers. Since its inception, the UNI token has performed remarkably well, with returns in excess of 700%.

Uniswap’s performance

Since Uniswap’s inception, it has grown at an astonishing rate. This growth has been driven by two factors:

- The growing interest in the overall cryptocurrency market.

- The growing interest in the DeFi sector, in which Uniswap is the biggest player.

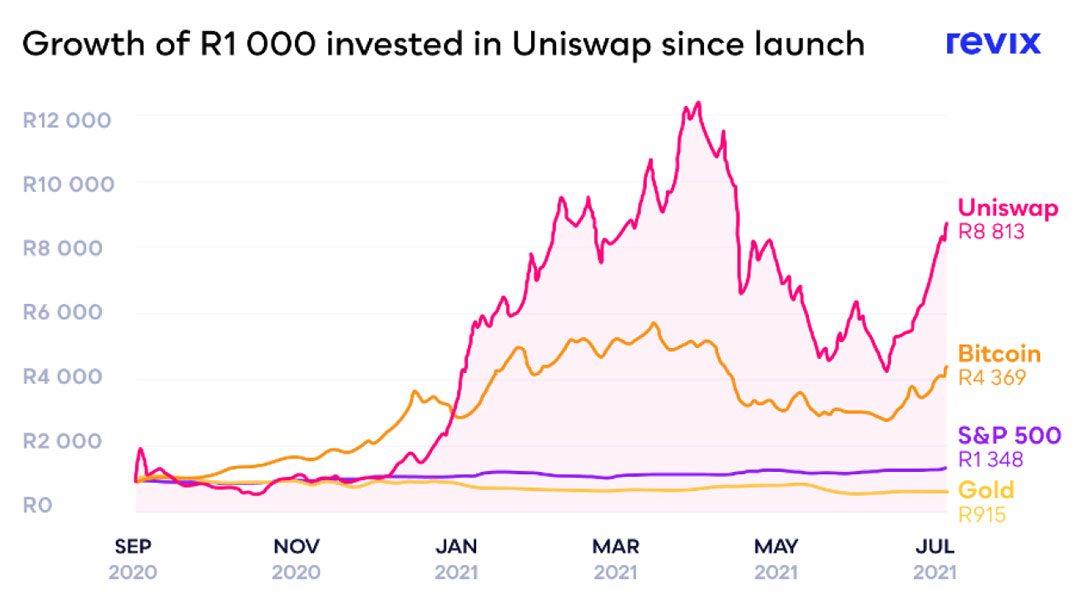

Below we can see how Uniswap has outperformed many other investment assets since the close of its opening trading day.

A single R1 000 investment in Uniswap would have translated into R8 813. This is substantial when compared to many alternative investments. In fact, gold would have actually lost you money over the same period (your R1 000 investment would be worth R915).

A single R1 000 investment in Uniswap would have translated into R8 813. This is substantial when compared to many alternative investments. In fact, gold would have actually lost you money over the same period (your R1 000 investment would be worth R915).

Where do I buy Uniswap?

Investment platform Revix is adding Uniswap to its product offering on Friday, 20 August.

Promotion

Due to the hotly anticipated release of Uniswap, Revix is running a two-fold promotion:

- The first 600 new sign-ups will receive double their initial deposit, up to R500, using the promocode DOUBLEUP. This promotion is valid from 17 to 31 August 2021, so don’t miss it!

- There will be zero buying fees with rands and British pounds on Uniswap purchases for one week (20 to 26 August).

Through Revix, you can also gain access to their ready-made “crypto bundles”. These bundles allow you to own an equally weighted basket of the world’s largest and, by default, most successful cryptocurrencies.

For more information about the company’s saving vault, crypto bundles, or a direct way to invest in bitcoin, ethereum, Pax Gold or USDC, visit Revix.

About Revix

Revix brings simplicity, trust and great customer service to investing. Its easy-to-use online platform enables anyone to securely own the world’s top investments in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time. For more information, visit Revix.

Disclaimer

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience and investment objectives and seek independent financial advice if necessary.

- This promoted content was paid for by the party concerned