Vodacom Group continued to perform strongly in the 2018 financial year, adding 4.5m customers in South Africa and 2.5m in its international operations, it said on Monday.

The JSE-listed telecommunications group, which published its annual results for the year ended 31 March 2018, said it now has more than 103m customers across its operations in Southern Africa and East Africa.

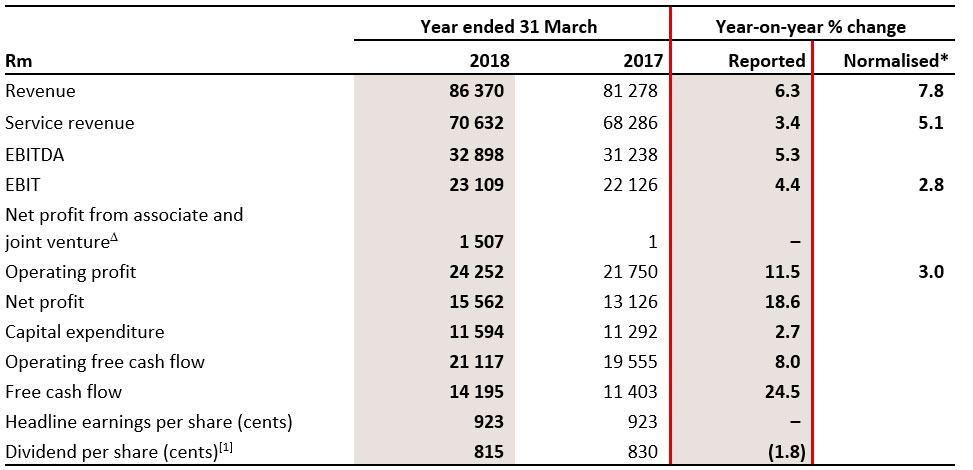

Group revenue climbed by 6.3% to R86.4bn despite tough economic conditions in South Africa, its largest market. Normalised growth, excluding currency translation effects, was 7.8%. Group service revenue grew 3.4% to R70.6bn (5.1% normalised).

Customer numbers in South Africa rose by an impressive 12.1% to 41.6m. Prepaid customers increased by 4.3m, up 13.4%, supporting 6.4% prepaid customer revenue growth. Contract customers grew by 229 000.

Group earnings (before interest and tax) improved by 4.4% (2.8% normalised) to R23.1bn. Net profit increased 18.6%, boosted by the Safaricom acquisition in Kenya and by the profit from the sale of Helios Towers Tanzania. Headline earnings per share remained constant at R9.23, impacted by shares issued to acquire the Safaricom stake.

South African revenue growth accelerated to 8.1%, boosted by strong device sales. Service revenue increased 4.9% to R54.6bn.

The group spent R11.6bn on its networks in 2018, R8.9bn of which was directed to South Africa.

“Despite a tougher economic environment in South Africa, big data-led innovations contributed to robust demand for personalised bundles and a 4.9% growth in service revenue,” said group CEO Shameel Joosub in notes accompanying the full-year results.

“Strong device sales, cost optimisation measures and the effective execution of our pricing transformation programme also played a major role in the sound commercial performance in our largest market.”

He described the performance as “solid”, especially given the revenue impact from reducing out-of-bundle data prices by as much as 50% in October 2017 and early-phase investments in new revenue streams, including fibre, content and financial services.

“Over the past three years, we have reduced effective voice and data prices by 36.3% and 42.5% respectively, while maintaining revenue growth,” Joosub said.

Key figures from the South African operation include:

- Contract average revenue per user declined 4.4% to R390 because of higher roll over of unused data bundles, changes in deal structures and a reduction in out-of-bundle rates;

- Customers using bundles grew 13.9% to 18.7m;

- Data revenue grew 12.8% to R23.4bn, contributing 42.8% of service revenue;

- In the second half, 12% of data revenue was out-of-bundle revenue, down from 22% in the first half. Data traffic growth was 43.7%;

- 4G customers grew 44.8% to 7.3m, while the average megabyte per smart device increased 18.4% to 784MB;

- Data bundle purchases increased 54.7% to 766m. Improved in-bundle usage led to an effective reduction in the price per megabyte of 21.6%.

- Enterprise service revenue grew 10.8%, now contributing 25.7% of service revenue; and

- Margins (calculated using earnings before interest, tax, depreciation and amortisation contracted 1.3 percentage points, impacted by a roaming agreement with Rain diluting margins by 0.7 percentage points.

In its international operations, both Mozambique and Lesotho performed strongly. Safaricom delivered net profit growth of 14.1%, underpinned by strong growth in data and M-Pesa revenues and a 5.1% increase in customers to 29.6m. Safaricom contributed R1.5bn in profit for the eight months since acquisition, after deducting the amortisation of fair valued assets and before minority interest, Vodacom said. — © 2018 NewsCentral Media