Crypto has outperformed all other asset classes in recent years but it’s not just a story of bitcoin’s growth.

Crypto has outperformed all other asset classes in recent years but it’s not just a story of bitcoin’s growth.

After increasing 100% in 2019 and 300% in 2020, bitcoin has created more than a few millionaires, however, there are other cryptocurrencies including ethereum, cardano, polkadot and chainlink that have far outperformed an investment in bitcoin alone over the last 12-months.

What’s going on here?

The cryptocurrency market has started 2021 with strong momentum as corporate and institutional interest accelerates. “The next boom has begun,” according to Forbes, and it is easy to see why. Many big names including Tesla, Facebook, PayPal, Blackrock, Fidelity, JP Morgan, MicroStrategy, Harvard’s endowment fund and Square, as well as billionaire investors Paul Tudor Jones and Stanley Druckenmiller, have entered the crypto space driving billions of dollars into the sector.

In fact, the total market value for all cryptocurrencies increased over US$1-trillion (R15-trillion, which is about 2.5 times South Africa’s GDP) over the last 12-months, from $190-billion on 1 January 2020 to over $1.2-trillion today.

Bitcoin and ethereum, the largest two cryptocurrencies, make up over 70% of the entire crypto market’s value and both have repeatedly broken all-time highs. In early February, bitcoin reached a record high of $47 066 (around R720 000) when it was announced that Tesla bought $1.5-billion of bitcoin to hold instead of dollars in its treasury. Ironically, this helped to push bitcoin’s market value ahead of Tesla’s.

These advances have crowned cryptocurrencies as the best-performing investment category of the last decade with a remarkable 46 000% return on investment. This means that a R10 000 investment in the broader crypto market 10 years ago would be worth R4.6-million today.

“We’ve been waiting for institutional players, from payment providers to corporates to hedge funds, to enter the crypto space and this is now happening at a rapid pace,” says Sean Sanders, CEO and founder of crypto investment platform Revix.

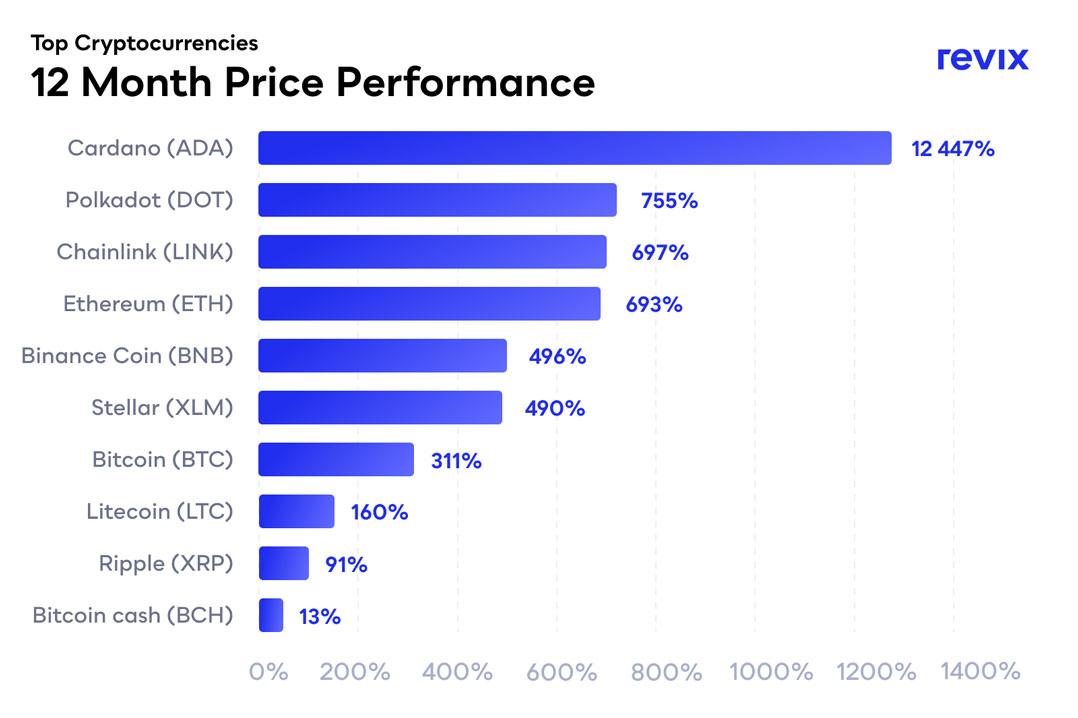

Although bitcoin remains king, cardano (12 447%), polkadot (+755%), chainlink (+697%) and ethereum (+697%) posted remarkable growth over the last 12 months. This is in part thanks to the rise in decentralised finance (DeFi), which is a subsector of the cryptocurrency industry where entrepreneurs are building semi-automated trading and lending systems atop blockchain networks.

These returns are well ahead of bitcoin (+311%), traditional assets like gold (up 18%), the JSE Top40 stock index (+15%) and the S&P 500 stock index (+16%).

The influx of capital into crypto markets comes during a time of extreme and unprecedented economic uncertainty. It marks an important shift in the public’s perception of cryptocurrencies: Rather than being seen solely as a speculative asset for those looking for eye-popping returns, cryptocurrencies now maintain a much broader appeal.

Sign up with Revix and start investing.

What does this mean?

Ethereum’s ether token (ETH) hit an all-time high of $1 800 on 8 February and has pushed the market value of all the existing ether in the world to about $200-billion. At this level, it’s larger than the US financial giants Wells Fargo ($135-billion) and Citigroup ($132-billion) as well as the 86-year-old Wall Street investment bank Morgan Stanley ($137-billion).

“The comparison isn’t perfect, since ethereum works more like a network for companies and developers to build upon rather than the companies themselves. But the exercise does point to the ecosystem’s no-longer-dismissible scale,” explains Sanders.

Why should I care?

“Ethereum has always been the lesser-known rival to bitcoin for a mainstream audience but increased awareness and understanding of what it can offer creates more awareness causing adoption to accelerate — just like we’ve seen with bitcoin,” says Sanders.

“As with all emerging sectors and technologies, the journey for crypto will continue to have its ups and downs. Price corrections are a natural part of any investment market and are especially natural in the crypto ecosystem. But one thing is clear: Crypto has arrived, and the time to get ahead of crypto’s mainstream breakout is starting to run short. If there’s one thing we can learn from the evolution of the Internet and other technologies, it’s that it just takes some time before ideas are turned into actual usable products and crypto seems to be doing just that.”

How can I safely invest?

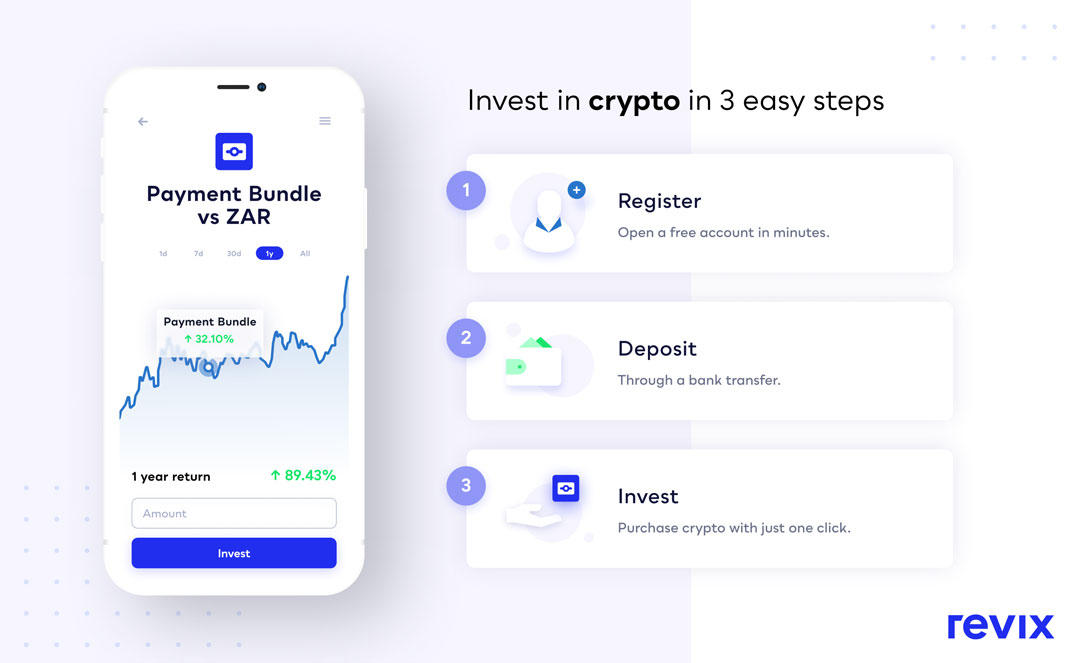

If you’ve been watching this year’s crypto boom from afar, and want to buy bitcoin, ether or a diversified crypto basket, now’s your chance to get started today by signing up for a free account at www.revix.com.

Revix is in the business of making crypto investing secure and effortless. All levels of investors can buy and sell cryptocurrencies with ease on their online platform. Even if you’ve never heard of bitcoin, you can create an account with no obligations, and learn using Revix’s helpful tools and features. Their desktop and mobile-friendly website makes it easy for anyone to buy, sell or hold cryptos just like they would stocks.

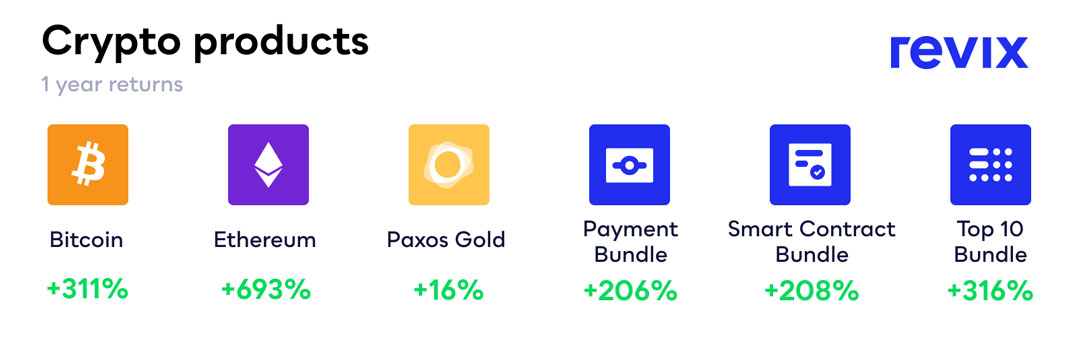

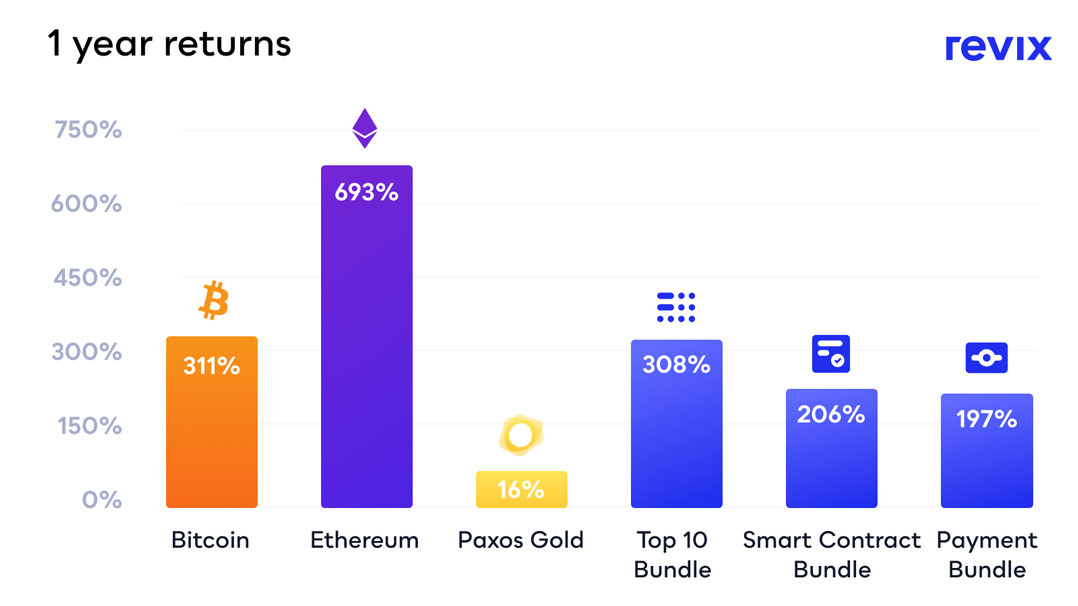

Revix is backed by JSE -listed Sabvest and, in addition to bitcoin and ether, users can buy and sell USDC, a stablecoin fully backed by the US dollar, a gold crypto token called Pax Gold which is fully backed by physical gold held in London Brinks vaults and three ready-made diversified crypto baskets called “Bundles”. Crypto Bundles allow investors to track the broader crypto market performance or a specific sector within the crypto space at a low cost, similar to buying the JSE Top40 index or S&P 500. These crypto Bundles are also automatically updated every month so you don’t have to manually buy and sell to stay up to date with the crypto market.

The minimum starting amount for any investment is only R500, so the platform is accessible to everyone. Sign-up is free, there are no monthly fees and the company’s friendly customer support team are there for you every step of the way. You can sell your crypto investment at any time and withdraw your funds: There are no lock-up periods like there are with other investment funds.

The minimum starting amount for any investment is only R500, so the platform is accessible to everyone. Sign-up is free, there are no monthly fees and the company’s friendly customer support team are there for you every step of the way. You can sell your crypto investment at any time and withdraw your funds: There are no lock-up periods like there are with other investment funds.

There are more and more cryptocurrencies out there, so how do you know which ones to invest in?

“Buying a single cryptocurrency can be easy if you know which one to buy,” says Sanders. “But many people are not confident enough to know which cryptocurrency to back, so buying a Bundle – rather like an ETF or unit trust – takes the guesswork out of it and lets the winners come to you.”

Buying a crypto Bundle rather than a single cryptocurrency makes owning a diversified crypto portfolio more convenient and less risky as you’re not exposed to the price fluctuations of just one crypto asset.

Revix’s crypto products have produced exceptional returns.

Top 10 Bundle

Top 10 Bundle

The Top 10 Bundle spreads your investment equally over the 10 largest cryptocurrencies – which covers about 85% of the crypto market when measured by market capitalisation – with each having a 10% weighting. By default, you are buying the 10 biggest success stories in the crypto space. The weightings are adjusted monthly to ensure no crypto exceeds a 10% weighting.

The Top 10 Bundle spreads your investment equally over the 10 largest cryptocurrencies – which covers about 85% of the crypto market when measured by market capitalisation – with each having a 10% weighting. By default, you are buying the 10 biggest success stories in the crypto space. The weightings are adjusted monthly to ensure no crypto exceeds a 10% weighting.

This Bundle includes the top performing cryptocurrencies: ethereum, polkadot, cardano and chainlink, which have all significantly outperformed bitcoin on a relative basis.

Get started with Revix’s Top 10 Bundle.

Payment Bundle

The Payment Bundle holds the cryptocurrencies which aim to become cash, like rands or dollars. This Bundle provides exposure to the five largest payment-focused cryptocurrencies looking to compete with government-issued fiat currencies to make digital payments cheaper, faster and more global. These cryptos include bitcoin (BTC), litecoin (LTC), bitcoin cash (BCH), stellar (XLM) and monero (XMR).

The Payment Bundle holds the cryptocurrencies which aim to become cash, like rands or dollars. This Bundle provides exposure to the five largest payment-focused cryptocurrencies looking to compete with government-issued fiat currencies to make digital payments cheaper, faster and more global. These cryptos include bitcoin (BTC), litecoin (LTC), bitcoin cash (BCH), stellar (XLM) and monero (XMR).

Get started with Revix’s Payment Bundle.

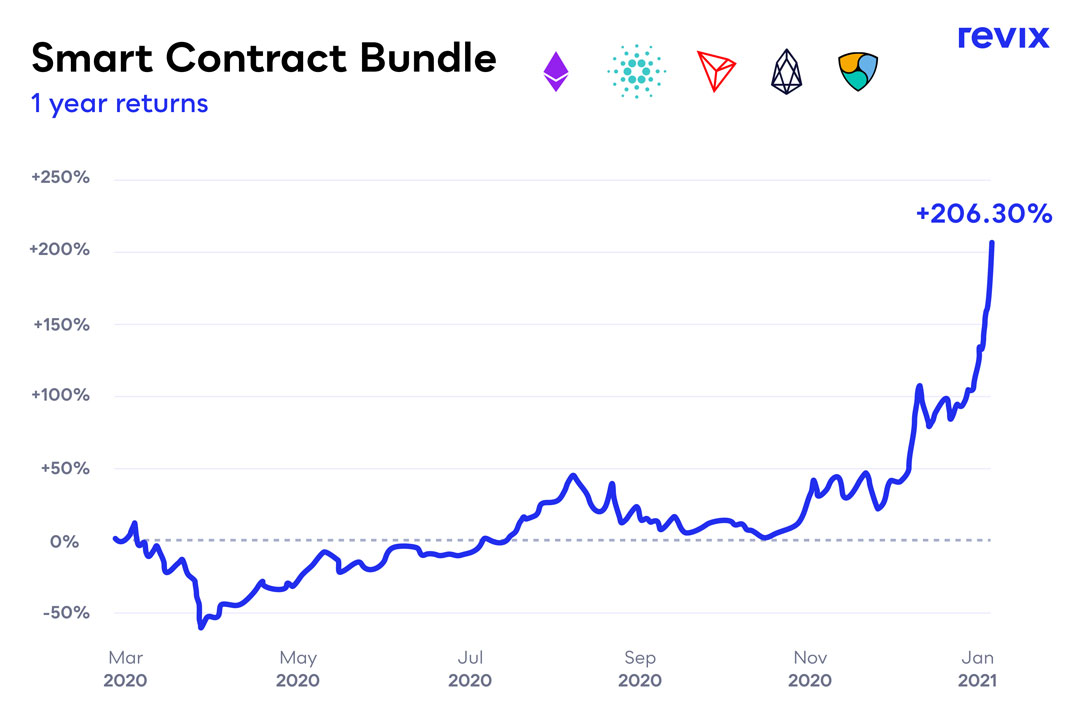

Smart Contract Bundle

The Smart Contract Bundle tracks the cryptocurrencies that aim to offer an open-source, public network without any downtime, fraud, control or interference from third parties. Smart contracts use the blockchain to allow peer-to-peer transactions without the need for third-party verification. This Bundle comprises cryptocurrencies like ethereum that enable developers to build applications on top of their blockchains, much like how developers build mobile apps on top of Apple’s iOS mobile operating system. The cryptos in this Bundle include ethereum, cardano, tron, neo and EOS.

The Smart Contract Bundle tracks the cryptocurrencies that aim to offer an open-source, public network without any downtime, fraud, control or interference from third parties. Smart contracts use the blockchain to allow peer-to-peer transactions without the need for third-party verification. This Bundle comprises cryptocurrencies like ethereum that enable developers to build applications on top of their blockchains, much like how developers build mobile apps on top of Apple’s iOS mobile operating system. The cryptos in this Bundle include ethereum, cardano, tron, neo and EOS.

Get started with Revix’s Smart Contract Bundle.

Low fees

Revix charges no monthly account or subscription fees, but rather a simple 1% transaction fee for both buys and sells and a 0.17%/month rebalancing fee (which amounts to 2.04%/year) on the total Bundle value held (this fee is not levied on single cryptocurrencies like bitcoin or the Pax Gold token).

As the old proverb goes: “Don’t look for the needle in the haystack. Just buy the haystack.” It seems diversification in the rapidly changing world of crypto may be even more important than in other markets.

Here’s how to sign up to Revix:

About Revix

About Revix

Revix brings simplicity, trust and great customer service to investing. Its easy-to-use online platform enables anyone to securely own the world’s top investments in just a few clicks.

Revix guides new clients through the sign-up process, to their first deposit and first investment. Once set up, most customers manage their own portfolio, but can access support from the Revix team at any time.

For more information, visit Revix.

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose, and before investing please take into consideration your level of experience and investment objectives, and seek independent financial advice if necessary.

- This promoted content was paid for by the party concerned