Government is applying pressure on operators in South Africa to switch off their legacy 2G and 3G networks. Yet some of the best-selling phones in 2024 still only support 2G, a TechCentral investigation can reveal.

The main reason for this is price. Whereas 4G/LTE handsets typically start at around R1 000, the TechCentral investigation has found that the cheapest phones in the market – those aimed at the mass market – won’t work on anything other than 2G infrastructure (or, at best, 3G).

The Mobicel S2 and Itel 2163 are the cheapest feature phones in South Africa, retailing for just R149 through Vodacom’s retail stores. These devices are light on the budget, as well as on features, with just 32MB of memory and 64MB of storage each. They are able to handle calls, send and receive SMSes, and play FM radio. And that’s about it.

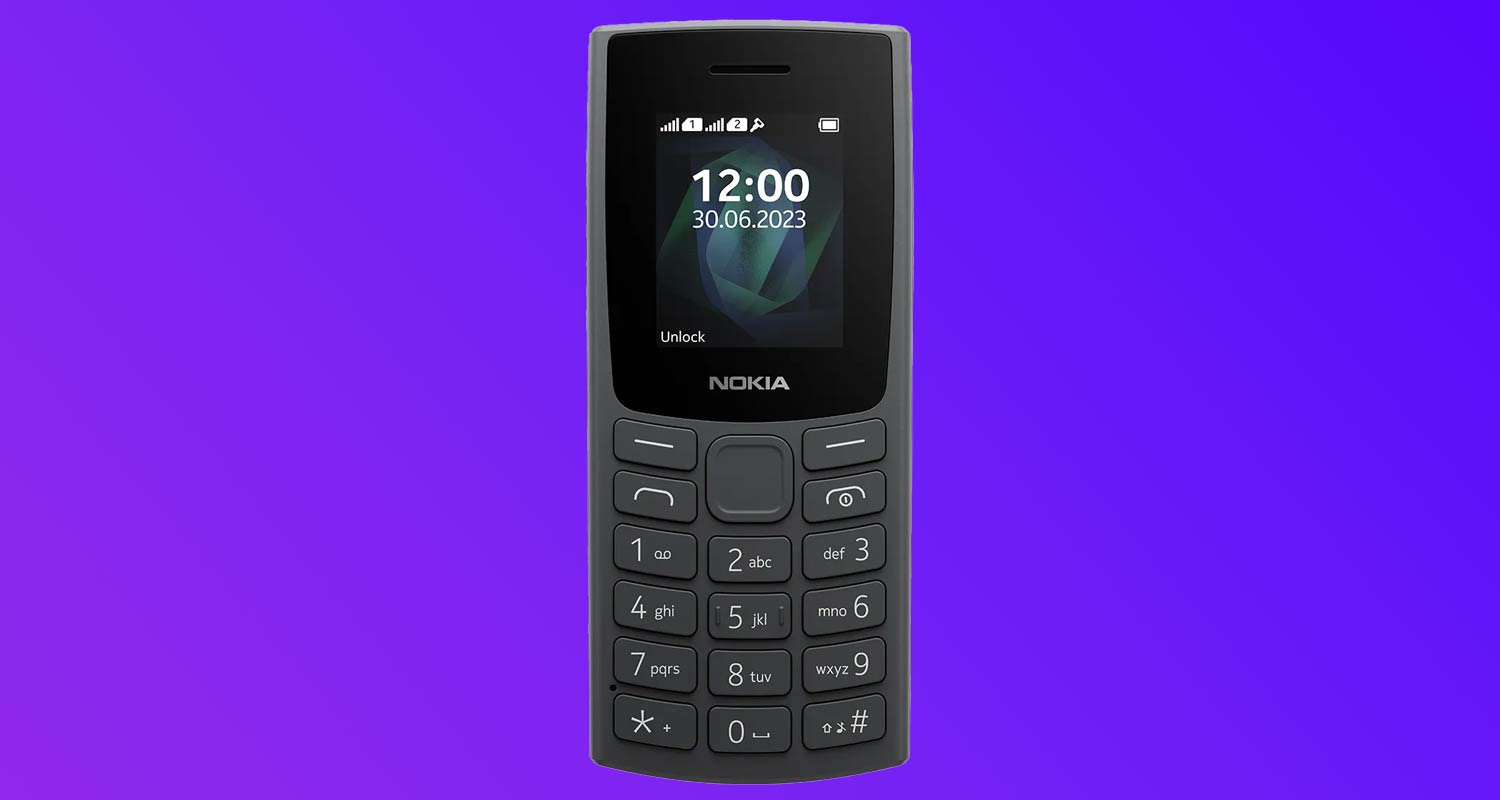

The cheapest dual-Sim feature phone is the Mobicel C1, which retails for R169 through MTN’s channels. Mobicel is a South African brand founded in 2007. Other brands prominent in the feature phone category include Stylo, Dixon and Nokia, whose popular 105 retails for R249 through Takealot and other retailers and offers a rugged build with longer battery life.

Sales of 2G feature phones among South Africa’s network operators and retailers remain strong despite the department of communications & digital technologies’ 2G/3G switch-off deadline being a mere three years away.

A 2022 report by communications regulator Icasa showed that fewer than half of the 103 million devices registered on South Africa’s networks at the time were 4G-capable smartphones. More recent data by market research firm GfK shows that seven in 10 mobile phones sold in South Africa are retailed through Pepkor, the owner of Pep and Pep Cell stores.

‘Considerable demand’

“We sell approximately five million 2G devices annually, which highlights considerable demand,” said John Edwards, Pepkor’s head of cellular, in response to a query by TechCentral. “The affordability and practical benefits of 2G devices make them an attractive option for many South Africans.”

According to Edwards, one of the major reasons feature phones remain popular is their low cost. The cheapest feature phone available through Pep and Pep Cell stores costs R149, while the cheapest 4G device “can be two or three times more expensive”.

4G devices require more complex chipsets and memory to meet the processing demands of the applications these devices support, adding to the cost of their components.

Read: Telecoms industry warns against forced 2G shutdown

But the cost of acquisition is not the only factor driving 2G device sales; feature phones have lower operating costs, too. Users of feature phones don’t have to worry about data costs for app updates, which Edwards described as “a common concern for smartphone users”. Users are also drawn to the relative hardiness of feature phones.

“Feature phones are known for their durability. They are less prone to damage if dropped, are easier and more affordable to repair, and typically have much longer battery life than smartphones,” said Edwards.

According to a Vodacom South Africa spokesman, despite some organic decline in the company’s feature phone sales, 2G and 3G device sales still form a notable portion of the operator’s market. He said the current economic situation, coupled with the high taxation on 4G/5G smartphones, drives ongoing demand for 2G/3G legacy devices across multiple networks.

An MTN South Africa spokeswoman said 29% of the devices sold by MTN in the 2023/2024 period were 2G feature phones. According to MTN, even though these sales are driven largely by lower-income customers, the operator has observed that customers with more purchasing power are also buying feature phones to use as a secondary device.

One the motivations for keeping a “cheap” feature phones is South Africa’s high crime rate, with many users opting to leave their smartphone at home on a night out to avoid theft and reduce the threat of a banking app kidnapping.

Read: Africa has a feature phone problem

From 30 September 2024, Icasa will no longer type approve 2G and 3G devices for import and sale in South Africa, meaning operators will only be able to sell whatever stock they already have before exclusively offering 4G devices to the public.

“As we approach the provisional dates for the phasing out of 2G and 3G devices … we support an outcome that ensures mobile devices are accessible to all South Africans,” said Pepkor’s Edwards. – © 2024 NewsCentral Media

Don’t miss: