Investing in cryptocurrencies has become a controversial and much-talked-about topic. One of the biggest arguments for investing is the volatility of the asset class and the unmatched return potential. This is not a guaranteed feature of cryptocurrencies, though, and there are a few considerations to be made before making your first investment.

Investing in cryptocurrencies has become a controversial and much-talked-about topic. One of the biggest arguments for investing is the volatility of the asset class and the unmatched return potential. This is not a guaranteed feature of cryptocurrencies, though, and there are a few considerations to be made before making your first investment.

Never invest above your means

The nature of the volatile crypto markets provides the opportunity for significant gains — and large losses. Therefore, investing in this asset class is not recommended for anyone wanting to make an investment with money that they are likely to need in the short term.

While there have been small windows lately where cryptocurrencies produce eye-popping returns over a short period of time, the largest and most reliable growth that we see is over the long term. This means that if you don’t have money available that you are able to go without for a longer period of time, you should hold off on investing in cryptocurrencies until you are able to do so comfortably.

Make sure you know what you’re buying

As the Russian proverb says: “Trust, but verify”. We shouldn’t blindly trust anyone. When you buy a car, you make sure that it’s in a roadworthy condition and mechanically sound before handing over your money, and the same principles should be applied to investing in cryptocurrencies.

There are well over 5 000 cryptocurrencies that are actively being traded daily, and a significant amount of them are ERC-20 tokens that are minted on top of the Ethereum blockchain (there are other blockchains like Polkadot or Tron that also provide this functionality). Often, the teams behind these cryptocurrencies are selling vapourware, which means that their product or software has not yet been released or completed.

This makes understanding and research a critical element of the investment process. An appropriate minimum amount of time spent researching a cryptocurrency is around 20 hours — five hours to familiarise yourself with the product, its team and what it wants to accomplish, 10 hours on researching non-blockchain solutions to the same problem that the cryptocurrency aims to solve, and another five hours trying to find holes in the execution plan.

This makes understanding and research a critical element of the investment process. An appropriate minimum amount of time spent researching a cryptocurrency is around 20 hours — five hours to familiarise yourself with the product, its team and what it wants to accomplish, 10 hours on researching non-blockchain solutions to the same problem that the cryptocurrency aims to solve, and another five hours trying to find holes in the execution plan.

You don’t need to be an expert in cryptography, a programmer or an economist to make this evaluation (although it certainly doesn’t hurt); you just need to be able to put in the time to help yourself understand what you are investing in and how comfortable you are making that investment after you have digested the information at hand.

As a simple rule of thumb, if there isn’t enough information out there for you to spend 20 hours researching a specific cryptocurrency, you should avoid the cryptocurrency altogether.

Diversify

There are two main ways to look at diversification:

- Diversification into cryptocurrency

- Diversification of cryptocurrency

Diversification into cryptocurrency is the further diversification of your investment portfolio to include cryptocurrencies.

Ideally, cryptocurrencies should be part of your larger portfolio of investments, such as property, stocks and bonds. This first concept takes a traditional investor from exposure to traditional markets, which are usually correlated (for example, the relationship between a stock of an airline to the price of a commodity like oil) into an asset class that doesn’t have any correlation or relationship to traditional assets (except in some cases where a cryptocurrency is specifically pegged to another asset, such as a cryptocurrency that is pegged to gold).

In some cases, it might even be argued that cryptocurrencies such as bitcoin have a negative correlation to traditional assets and currencies as it slowly becomes a safe-haven asset like gold, which is expected to retain or increase in value over time in times of market turbulence or recession. We can see this idea becoming more popular as businesses such as Tesla and MicroStrategy add billions of dollars of bitcoin onto their balance sheets in place of the US dollar.

In some cases, it might even be argued that cryptocurrencies such as bitcoin have a negative correlation to traditional assets and currencies as it slowly becomes a safe-haven asset like gold, which is expected to retain or increase in value over time in times of market turbulence or recession. We can see this idea becoming more popular as businesses such as Tesla and MicroStrategy add billions of dollars of bitcoin onto their balance sheets in place of the US dollar.

Since there are many barriers to entry into the traditional markets, there is also an increasing trend where newcomers to investing are converting a portion of savings into cryptocurrency investments.

From there, they diversify their cryptocurrency portfolio by buying multiple cryptos to mitigate losses as well as compound gains when a single asset appreciates or depreciates. This is the next logical step after purchasing your first cryptocurrency, which means, yes, you should go back and spend another 20 hours on each cryptocurrency you are considering.

Make notes

It’s essential to keep track of your portfolio and factor in all the costs involved, such as:

- Purchase price

- Trading/purchase fees

- Blockchain fees

- Withdrawal fees

- Bank transfer fees

While not all of these fees always apply to every platform you might use, you will need to properly plan your money flow into and out of cryptocurrencies to accurately measure performance.

Secure your cryptocurrency

If you’re looking at investing in cryptocurrencies, you will have heard about the many hacks that have occurred. Needless to say, securing your cryptocurrencies should be a top priority for a long-term investor.

There are many ways that you can secure your cryptocurrency:

- A mobile wallet on your phone

- On an exchange

- A hardware wallet

- Cold storage

Mobile wallets are quite common. However, there can be serious implications if your phone is lost or stolen, so unless you are planning to spend the cryptocurrency that you keep in your mobile wallet, you should not hold very much crypto on your phone.

Exchanges are also vulnerable to attack but generally have policies and practices that are in place to mitigate the risks of hacks and vulnerabilities. A good exchange will put stopgaps in place to minimise the risk of losses should they be hacked.

Hardware wallets are wallets where the private keys to your cryptocurrency wallets are stored on the device itself. These wallet types have three main security features:

- They are not connected to any networks unless they are plugged into a device;

- They require a Pin or password to be accessed;

- You need the physical device in order to transact;

- In some cases, custody providers make use of hardware wallets to protect your crypto. However, this method is better suited for personal storage.

Cold storage is the practice of generating cryptocurrency wallets with an airwall — in other words, generating cryptocurrency wallets and storing those private keys on a computer or device that has no Internet access. This creates a scenario where it is impossible for funds in a cold storage wallet to be sent because there is no way for it to connect to a network. Cold storage is one of the most common ways that exchanges, and trading platforms protect their users’ accounts and funds.

Conclusion

Your first introduction to investing in cryptocurrencies need not be as intimidating as it might seem. While there is a lot to learn, there are many resources and platforms that will guide you through the learning curve that is the best-performing asset class of the last decade.

What does Revix offer?

Revix offers three crypto Bundles to reduce the amount of research you need to put into each individual crypto asset by using our proprietary software and Bundle methodology to ensure that you always have the top-performing assets in your portfolio by rebalancing our Bundles monthly.

The Top 10 Bundle is like the JSE Top 40 or S&P 500 for crypto and provides equally weighted exposure to the top 10 cryptocurrencies making up more than 85% of the crypto market.

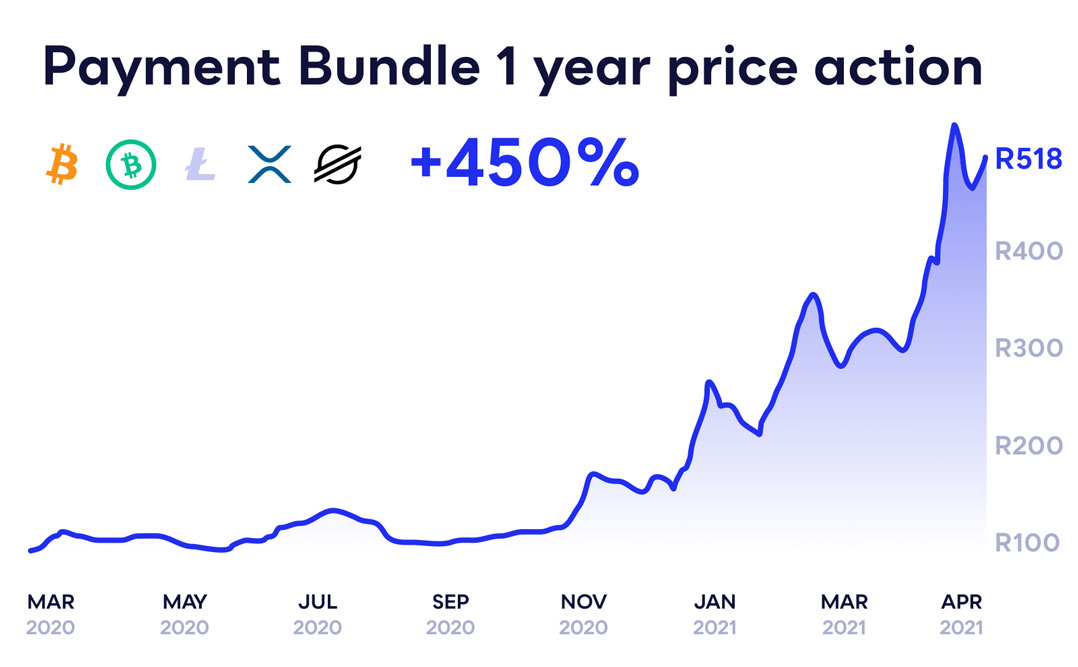

The Payment Bundle provides equally weighted exposure to the top five payment-focused cryptocurrencies looking to make payments cheaper, faster and more global. These cryptos include the likes of bitcoin, ripple, bitcoin cash, stellar and litecoin.

The Payment Bundle provides equally weighted exposure to the top five payment-focused cryptocurrencies looking to make payments cheaper, faster and more global. These cryptos include the likes of bitcoin, ripple, bitcoin cash, stellar and litecoin.

The Smart Contract Bundle provides equally weighted exposure to the top five smart contract-focused cryptocurrencies like ether, EOS or tron that allow developers to build applications on top of their blockchains, similar to how Apple builds apps on top of iOS.

The Smart Contract Bundle provides equally weighted exposure to the top five smart contract-focused cryptocurrencies like ether, EOS or tron that allow developers to build applications on top of their blockchains, similar to how Apple builds apps on top of iOS.

Revix’s Bundles have outperformed an investment in Bitcoin alone over one-, three- and five-year time periods.

Revix’s Bundles have outperformed an investment in Bitcoin alone over one-, three- and five-year time periods.

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

About Revix

Revix brings simplicity, trust and great customer service to investing. Its easy-to-use online platform enables anyone to securely own the world’s top investments in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time. For more information, please visit www.revix.com.

- This promoted content was paid for by the party concerned