South Africa’s telecommunications operators have not had an easy ride this past year. The coronavirus pandemic saw already immense pressure on margins and cash flow being further compounded, with no immediate signs of relief in sight.

In the battle for market share during this challenging period, some network providers were able to differentiate themselves through pricing or network quality, but the same cannot be said about customer service.

This was one of the key findings of our 2020 South African Telecommunications Sentiment Index, conducted in partnership with Deloitte, which tracked over two million social media posts about the country’s major telcos throughout the year .

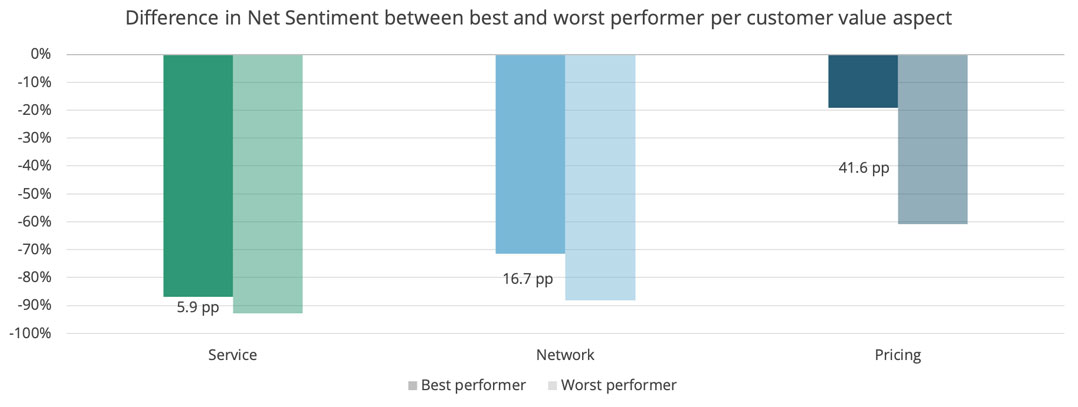

The index revealed only a 5.9 percentage point difference in net sentiment between the best and worst performer in customer service, indicating that there is no clear service leader in the telco space. Compare this to pricing net sentiment, for example, where a 41.6 percentage point difference existed, signifying a clear ranking order of consumer sentiment.

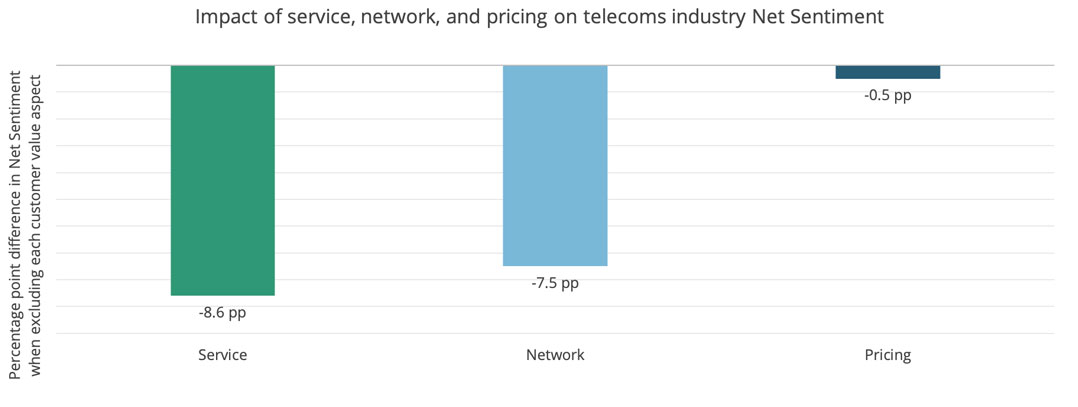

Importantly, however, the index also revealed that pricing had a relatively marginal impact on industry net sentiment in 2020, while customer service emerged as the area that most negatively impacted sentiment towards the operators throughout the year.

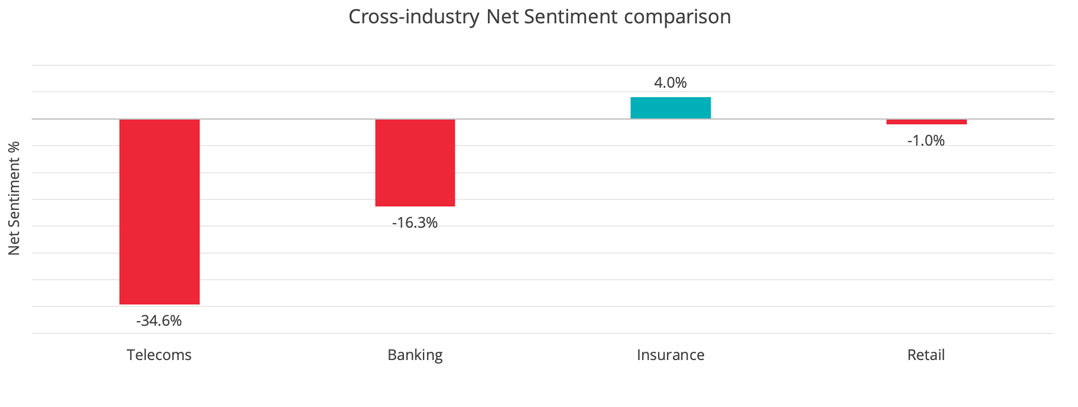

Importantly, however, the index also revealed that pricing had a relatively marginal impact on industry net sentiment in 2020, while customer service emerged as the area that most negatively impacted sentiment towards the operators throughout the year. Considering the telcos’ poor net sentiment performance in relation to other local industries (see graph below), this points at customer service as an area that could greatly hinder network providers’ ability to compete in a market that is increasingly seeing brands adopt a cross-industry strategy.

Considering the telcos’ poor net sentiment performance in relation to other local industries (see graph below), this points at customer service as an area that could greatly hinder network providers’ ability to compete in a market that is increasingly seeing brands adopt a cross-industry strategy. On the flipside, however, the fact that there is no clear service leader in the industry points to customer service as a prime area for brands to gain competitive advantage. While meaningful improvements in customer service are difficult to achieve, they are directly correlated to customer loyalty and positive word of mouth, which compound potential benefits.

On the flipside, however, the fact that there is no clear service leader in the industry points to customer service as a prime area for brands to gain competitive advantage. While meaningful improvements in customer service are difficult to achieve, they are directly correlated to customer loyalty and positive word of mouth, which compound potential benefits.When drilling down into the industry-wide issue of customer service, it became clear that complaints about traditional channels outweighed negative conversation towards digital channels in the telecoms industry, pointing at a higher reliance on traditional touchpoints among telco customers.

In light of this, one of the most effective ways to improve customer service would be to direct more customers away from physical branch and call centre channels – opening up more digital, asynchronous channels that deliver faster and better outcomes. Digital channels also offer a lower “cost to serve”, which would help ease pressure on margins across the industry.

This digital shift will, however, require that telcos continuously monitor, respond to and report on digital channel feedback from consumers – something that evidently needs major work and improvement across the industry.

In fact, the index results show that complaints about turnaround time, lack of response, and having to contact providers on multiple instances and platforms were the industry’s leading drivers of negative customer service conversation. Furthermore, more than half of all customer queries on social media that warranted a response from network providers went unanswered in 2020.

Noise

A likely contributing factor to this poor responsiveness is that only a third of conversations in the telecoms industry required a response from the network provider. This means that two-thirds of online conversation about network providers was essentially noise to social customer service teams, hindering their ability to prioritise the mentions which did warrant a reply.

It is therefore imperative that telcos ensure that they have the required resources, paired with the right capabilities, permissions and tools, to accurately identify priority mentions and ultimately resolve these queries seamlessly. It is this digital customer service capability that will be key to telcos’ future success.

- Nic Ray is CEO of BrandsEye