The cost of propping up South Africa’s debt-stricken state power utility is mounting, placing severe pressure on the national budget and exacerbating the risk it poses to the nation’s finances.

The cost of propping up South Africa’s debt-stricken state power utility is mounting, placing severe pressure on the national budget and exacerbating the risk it poses to the nation’s finances.

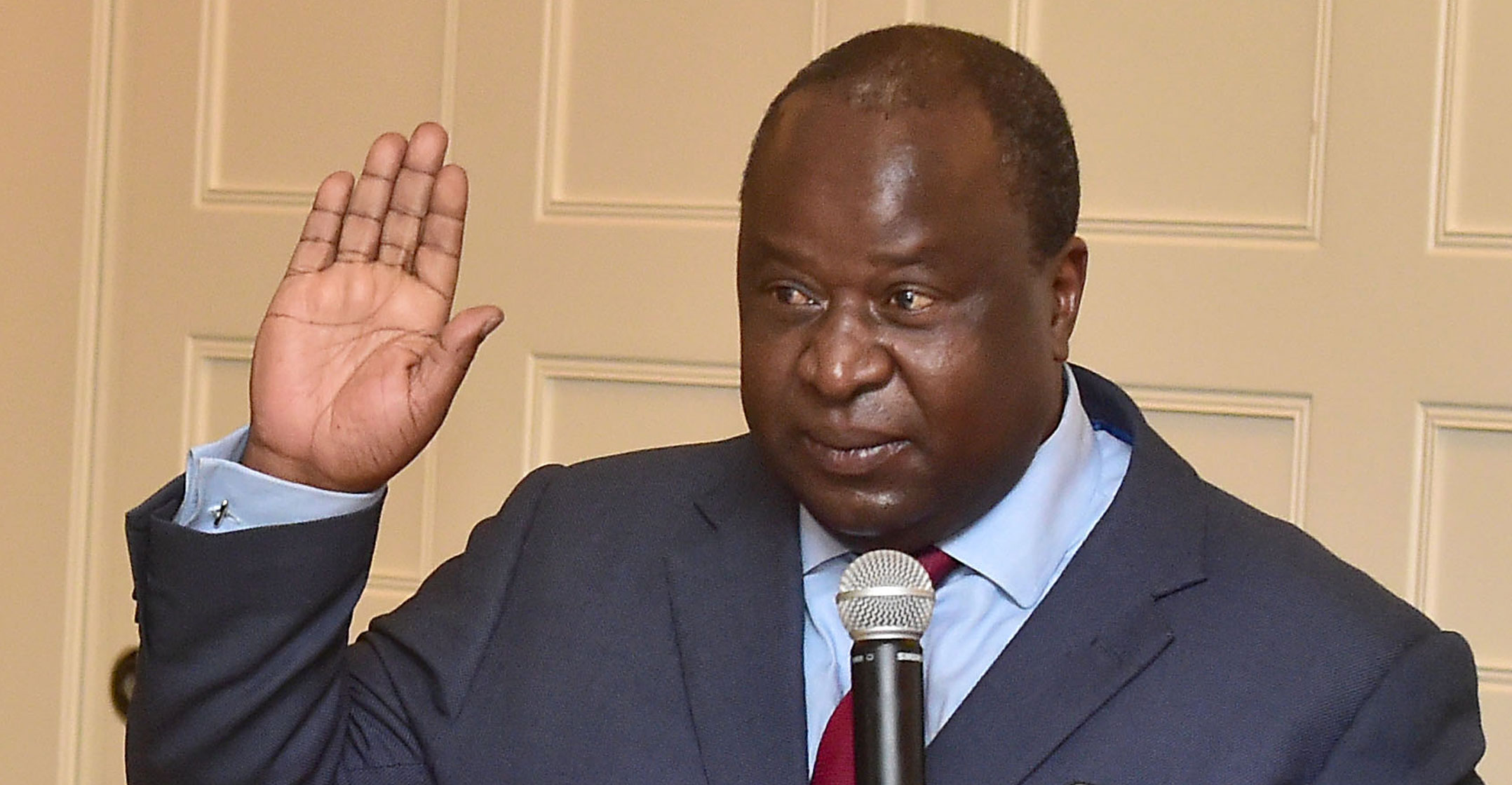

Eskom will receive R138-billion in bailouts through to March 2022, or R10-billion more than previously allocated, according to the medium-term budget policy statement released by finance minister Tito Mboweni on Wednesday. He warned that extra support may be needed if plans to turn the loss-making utility around are delayed.

Eskom has been dogged by years of mismanagement and massive cost overruns at two new plants. The company isn’t generating enough income to cover interest payments on its R450-billion of debt and is struggling to produce enough power to meet demand. The utility supplies about 95% of the nation’s electricity and the government has said it’s too big and important to fail.

“We cannot continue to throw money at Eskom,” Mboweni said in a speech to lawmakers in Cape Town. “Going forward, new cash-flow support will no longer be equity, but in the form of loans.”

The budget update proposes the state give Eskom R49-billion in the current fiscal year — R13.5-billion of which has already been dispensed — R56-billion the following year and R33-billion the year after that. The budget released in February provisionally provided for the utility to get an additional R23-billion in each of the following seven years. The support for the utility would push government debt to more than 80% of GDP by 2027/2028.

The blowout in the debt forecasts will put the nation’s last remaining investment-grade rating at risk. Moody’s Investors Service, which has tended to give the government leeway on stabilising its finances, is due to reassess South Africa’s standing in two days.

Breakup

The government’s plans for fixing Eskom include splitting it into generation, distribution and transmission units under a state holding company. The breakup, which should be completed by the end of 2021, is aimed at reducing costs, optimising infrastructure investments and improving the reliability of the power supply.

National treasury acknowledged that Eskom’s current debt burden is unsustainable and said it had considered various options to reduce it.

“Eskom, with government support, will consult with its funders on detailed plants for debt reorganisation in due course,” it said.

Debt relief will only be considered for the utility after it shows progress in improving cash flow management and operations, setting up the three units with new boards and CEOs with the necessary skills, and ensuring they are run within their means. The process will be managed to ensure the credibility of the fiscal framework is maintained, the state’s contingent liabilities are reduced and all creditors are treated equally, treasury said.

Independent advisers have been appointed to assess Eskom’s daily cash-flow management to eliminate continued requests for state funding, monitor its turnaround plans and assess whether it should halt or delay new investments in light of its precarious financial position, according to treasury. — Reported by Mike Cohen, (c) 2019 Bloomberg LP