New research published on Wednesday shows that more than a billion mobile phone users will have made use of their devices for banking by the end of 2017, compared to fewer than 600m this year.

Although the forecast of a billion users by 2017 represents more than 15% of the global mobile subscriber base, around half of all mobile subscribers are actually unbanked, with limited access to traditional frinancial services, according to Juniper Research, which published the report.

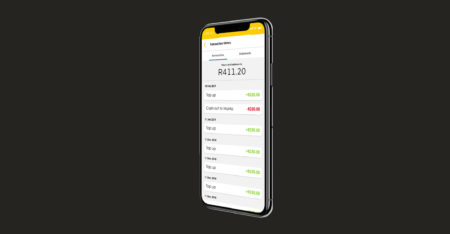

The report, called “Mobile Banking: Handset & Tablet Market Strategies 2013-2017”, finds that most banks have at least one mobile banking offering, either via messaging, mobile browser or a smartphone application-based service. However, a number of larger banks are deploying two or more of these technologies together, particularly where there is significant smartphone and tablet penetration, Juniper says.

“While messaging remains highly popular and relevant in the financial sector, apps will be the dominant access mode in developed markets, with banks reporting an increased number of visits per month on their mobile apps,” says the report’s author, Nitin Bhas.

The Juniper report also finds that the ability to access banking information and make transactions while on the move is a compelling proposition to most banking customers. — (c) 2013 NewsCentral Media