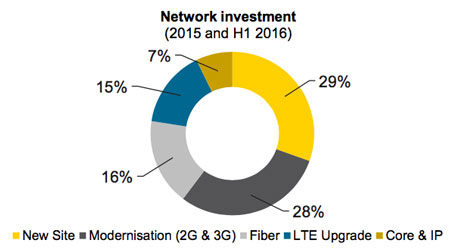

In the 18 months to June 2016, MTN has invested R16bn in its network in South Africa. Nearly a third of this — R4,5bn — was spent on adding 1 300 new physical sites to its footprint. This addition translates into an increase of more than 10% (its overall base was hovering at somewhere around 8 000 sites). It has had to spend as it’s been playing catch-up with Vodacom for the past two years to remedy years of underinvestment.

In the 18 months to June 2016, MTN has invested R16bn in its network in South Africa. Nearly a third of this — R4,5bn — was spent on adding 1 300 new physical sites to its footprint. This addition translates into an increase of more than 10% (its overall base was hovering at somewhere around 8 000 sites). It has had to spend as it’s been playing catch-up with Vodacom for the past two years to remedy years of underinvestment.

Apart from the 1 300 new sites added, it has also provisioned 2 400 3G sites and 4 000 LTE sites in past year and a half. Across the 18 months (call it 16, given the December/January break), this equates to a run-rate of nearly 100 new sites, 150 3G ones and 250 4G/LTE sites per month.

This detail was disclosed in a presentation to UBS’s recent TMT conference by MTN’s group executive for technology and information systems, Babak Fouladi, who has been filling the function of chief technology officer in the South African unit (a role that has been an almost perennial problem for the operator).

It is using 900MHz spectrum for 3G for “greater coverage”, on top of the 2,1GHz bands it already uses.

Despite the high rate of investment, it still trails Vodacom when it comes to 4G coverage. Vodacom, in its interim results presentation to end-September, said its 4G data coverage (measured against population) is 69% (from 47% a year prior), with MTN at 55% (Cell C and Telkom both sit at the 28% level).

The upgrade from 3G to 4G translates into an obvious uplift in usage and, paired with that, average revenue per user. Vodacom puts this at somewhere around 24% — a meaningful number. This investment in its LTE network — which has literally quadrupled in size in less than two years — has translated into “average data throughput speeds” of “up to 11-12Mbit/s”.

The focus, according to a TechCentral interview with MTN South Africa CEO Mteto Nyati, has been largely on eight big cities, “including Johannesburg, Pretoria, Cape Town and Durban, which generate 70% of its revenue and where most of its high-value customers live”.

Beyond its mobile network, MTN has added 1 200 fibre-to-the-home connections in the 18-month period. That gives some idea of how small this business is, in comparison to the mobile one (and to Telkom’s DSL base of over a million lines).

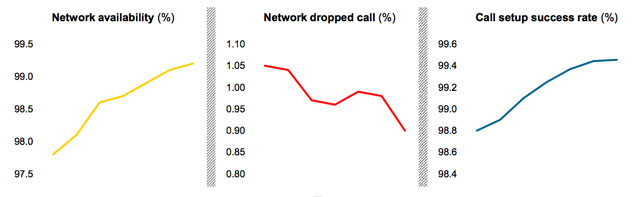

MTN customers, particularly those in the metro areas, will have noticed the network improvements. By its measures, it has seen a more than one percentage point increase in “network availability”, a roughly 50 basis point improvement in call setup success rate and a decline in the percentage of dropped calls because of the network.

In the presentation, it cites speed test results which show it has a healthy lead in the market. There’s no breakdown of methodology, but the high overall average suggests a significant number of tests run on the MTN network which would skew that figure upward. Vodacom, in its interim results presentation, pointed to a benchmarking exercise from Atlo which shows (not surprisingly) that it performs better than its rivals.

Regardless of who’s in front, consumers win. Network speeds have (generally) been improving and data prices are coming down (more on this, soon). But there are limits to what can be achieved without additional spectrum.

MTN South Africa has authorised R11,3bn in capex in South Africa for the whole of 2016, which means there’s another R6,5bn being spent in the second half. In 2017, it’s certainly not slowing down! According to Fouladi, 1 450 new sites are planned for next year, with the LTE roll-out being extended to the rest of the country. The aim is also to have the network ready for 2,6GHz spectrum, which — of course — remains to be allocated by the regulator.

- Hilton Tarrant works at immedia. This column was originally published on Moneyweb and is used here with permission