Snap makes no secret of the fact that compulsive millennial users are its most valuable asset. Their fickle tendencies may also be its biggest risk.

At least, that how it looks in the prospectus for the company’s initial public offering. Snap, the maker of disappearing photo-app Snapchat, on Thursday filed for a US$3bn IPO, which could value the company at as much as $25bn, people familiar with the matter have said.

The filing provides the first look into the company’s financial health, as well as what may keep founder and CEO Evan Spiegel up at night. Following are the top points of concern, out of more than 30 pages of “risk factors” in the prospectus, that the company faces as it heads to a public listing.

Profitability — or lack thereof

Snap has yet to turn a profit since it started operating in 2011, and the company “may never achieve or maintain profitability”. Last year, the net loss widened to $515m — on revenue of $404m — from $373m, and may get even worse. Meanwhile, financial results could fluctuate from quarter to quarter, making them difficult to predict.

User retention

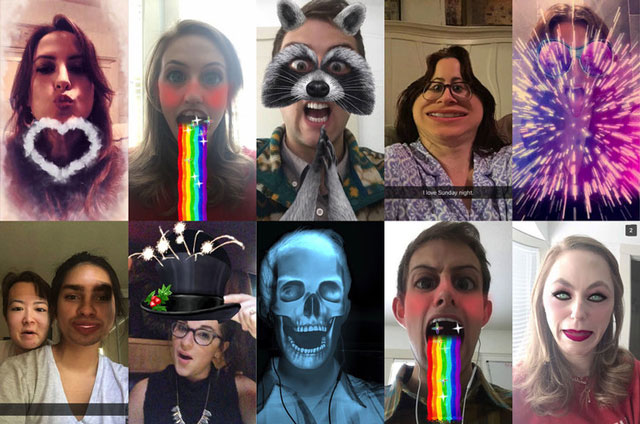

“The growth rate of our user base will decline over time.” That means Snap must keep the folks currently using the app — and keep them happy. Engagement is key to the company’s money-making strategy, so if people aren’t spending time using its products, that’s bad news for Snap’s bottom line. Add to that significant competition — from Twitter to Facebook, with its WhatsApp and Instagram apps — and an 18- to 34-year-old demographic that “may be less brand loyal”, and a simple idea like user retention becomes more tricky.

Founders

Spiegel and co-founder Bobby Murphy, the chief technology officer, control most of the voting rights at the company. In addition, Spiegel is the man for day-to-day management and deciding where the company goes strategically. Investors are going to have to trust the decision-making abilities of the two.

New products

Teaching millennials new tricks and creating new money-making products for that group isn’t easy. Take Spectacles, the camera-embedded glasses Snap already released. While catchy, they haven’t generated significant revenue for the company. As Snap notes: “Because our products created new ways of communicating, they have often required users to learn new behaviours to use our products.”

User metrics

Daily active users and other measures of Snapchat’s reach will be the most watched numbers by investors and analysts tracking the stock. Metrics and other estimates “are subject to inherent challenges in measurement”. Both daily active users and average revenue per user are calculated internally and not verified by a third party. Demographics data — a number advertisers care about — is self-reported and may contain inaccuracies. Twitter stumbled in picking the right metrics to use when it went public and the company has been dealing with the consequences ever since.

Reliance on Google

Snap runs the majority of its technology on Google Cloud. The company has committed to spend $2bn/year in the next five years, and it’s not changing its provider any time soon. Switching to another service “would be difficult to implement and will cause us to incur significant time and expense”. That means any hiccups on Google’s end could “seriously harm” Snap’s business. Google also makes products that compete with Snap. — (c) 2017 Bloomberg LP