Nvidia’s nine-month crypto gold rush is over. Sales of graphics chips to miners of cryptocurrencies like ethereum dried up faster than expected, the company said.

Nvidia’s nine-month crypto gold rush is over. Sales of graphics chips to miners of cryptocurrencies like ethereum dried up faster than expected, the company said.

For a second quarter in a row, investors ignored Nvidia’s growth in its main markets and ditched the stock, which fell about 5% in extended trading.

“Our core platforms exceeded our expectations, even as crypto largely disappeared,” founder and CEO Jensen Huang said on Thursday on a conference call. “We’re projecting no crypto mining going forward.”

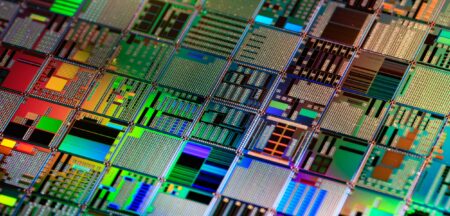

The mining of cryptocurrency tokens, computer code that carries value in online transactions, had helped stoke demand for graphics chips. These types of processors excel at making multiple small calculations at the same time, the type of capability that’s well-suited for the creation of ethereum and other crypto tokens. That helped boost demand for the Nvidia’s GeForce chips that are so prized by gamers for the realism they produce, forcing up prices and causing shortages.

Nvidia said it had expected about US$100-million in sales of chips bought by currency miners in the fiscal second quarter. Instead, the total was $18-million, and revenue is likely to disappear entirely going forward, the company said.

Investors are expressing their concern at the sudden collapse of what had looked like a billion-dollar business. Three months ago, Nvidia said it generated $289-million in sales from cryptocurrency miners, but warned that demand was declining rapidly and might fall by as much as two-thirds. Even that prediction was too high.

Revenue in the fiscal third quarter will be $3.25-billion, plus or minus 2%, the Santa Clara, California-based company said in a statement. That would fall short of analysts’ average estimate of $3.35-billion, according to data compiled by Bloomberg.

Skewed comparisons

The company’s main businesses are doing “terrific” and Nvidia continues to show strong growth on a year-over-year basis, Huang said. The benefit from crypto mining — which only kicked in three quarters ago — was unusual and has skewed comparisons, he said.

Even though crypto-related revenue came in far short of the company’s forecasts, sales surged to a record of $3.12-billion in the period ended 29 July. Analysts on average estimated $3.11-billion.

Huang is reshaping his company to take advantage of trends that are changing computing. He has convinced owners of data centres that modified graphics chips are the best solution to handle the surge in artificial intelligence processing that is fuelling the growing use of voice and image recognition.

Earlier this week, Huang unveiled a new more powerful chip architecture that he said will help Nvidia gain more share in computer-intensive industries such as movie special effects and automotive design. Turing, as it’s called, will also make its way into gamer and data centre chips.

While data centre chips now account for a fifth of revenue and are increasingly a driver of overall growth, the company still gets most of its profit from its GeForce graphics processors. Growth in that market relies on Nvidia’s ability to persuade gamers they need the latest chip to make their experience ever-more realistic. The prospect of the new design coming later this year may be causing some to hold off on purchases.

While data centre chips now account for a fifth of revenue and are increasingly a driver of overall growth, the company still gets most of its profit from its GeForce graphics processors. Growth in that market relies on Nvidia’s ability to persuade gamers they need the latest chip to make their experience ever-more realistic. The prospect of the new design coming later this year may be causing some to hold off on purchases.

Analysts asked the company’s executives to explain why inventory surged. Nvidia ended the quarter with $1.09-billion of unsold parts, up from $797-million three months earlier. Huang said that represents primarily a build-up of cheaper chips that will get sold in computers being manufactured now for the “back-to-school” shopping season.

Still, Nvidia reported that sales from gaming rose 52% to $1.8-billion in the second quarter. Data centre revenue increased 83% to $760-million. Both areas topped analysts’ estimates.

Nvidia had a profit of $1.1-billion, or $1.76/share, in the second quarter, compared to $583-million, or $0.92, in the same period a year earlier.

With the quarter’s results, Nvidia revenue is on course more than double from 2016. Investors have been attracted to the stock, pushing shares up 335 this year compared to a 6.4% advance by the Philadelphia Stock Exchange Semiconductor Index. It’s the second best performer on the index in 2018 behind rival AMD. — Reported by Ian King, (c) 2018 Bloomberg LP