Bitcoin’s tumble worsened over the weekend, putting the 2018 crash within striking distance of the cryptocurrency’s worst-ever bear markets.

Bitcoin’s tumble worsened over the weekend, putting the 2018 crash within striking distance of the cryptocurrency’s worst-ever bear markets.

The virtual currency, conceived just over a decade ago, fell as low as US$3 475 on Sunday, Bitstamp prices show. It was trading at $3 949 as of 11.23am in Hong Kong, according to Bloomberg composite pricing. That’s 7.3% below its level at 5pm New York time on Friday, and about 79% below its closing peak in December.

The crash has now entered the same league as bitcoin’s 93% plunge in 2011 and its 84% rout from 2013 to 2015, during the collapse of Tokyo-based crypto exchange Mt Gox. In dollar terms, the damage this time around has been much bigger: Virtual currencies tracked by CoinMarketCap.com have lost more than $700-billion of value since the market peaked.

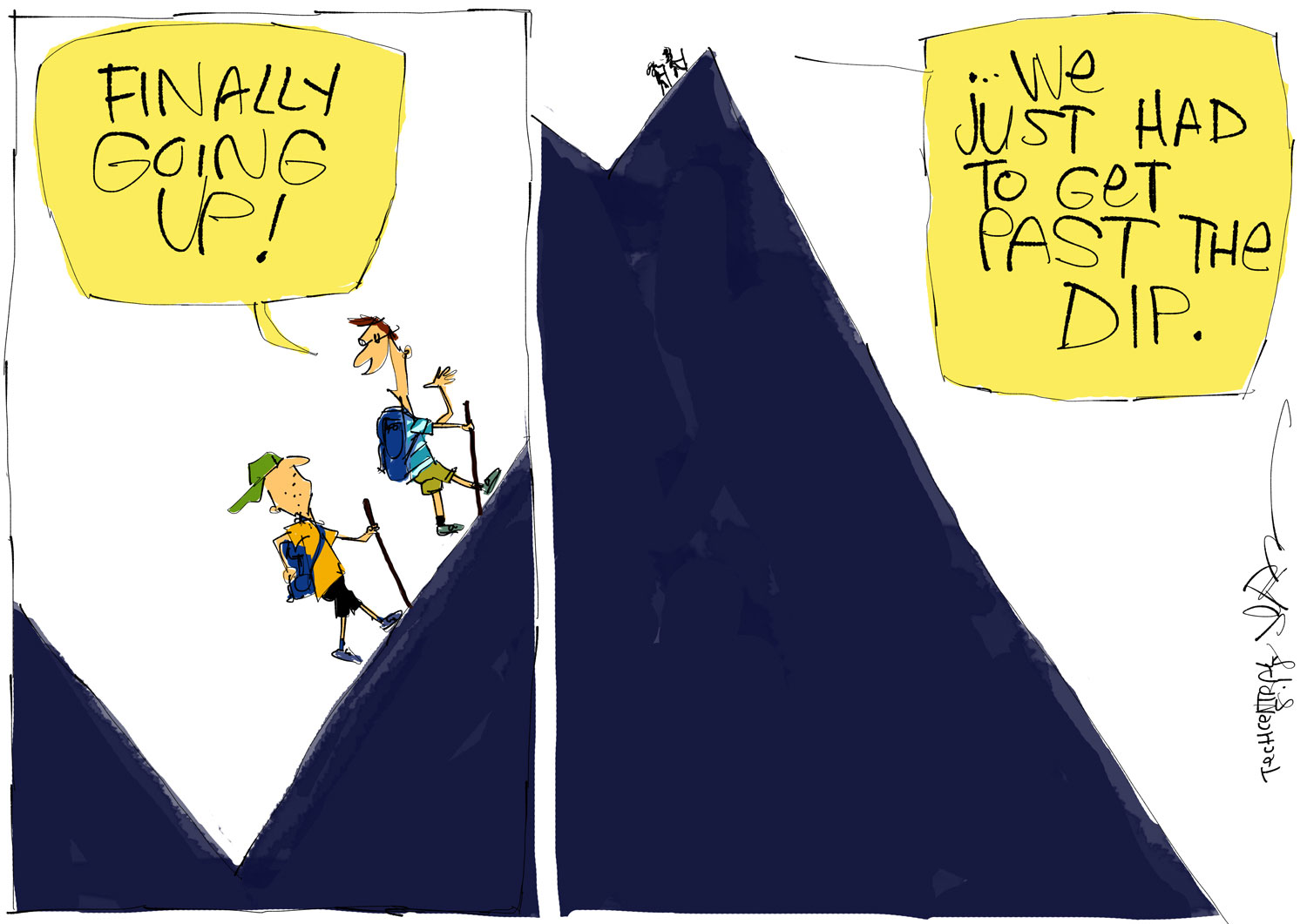

While bulls are betting that demand from institutional investors will spark a rally, most big money managers have stayed on the sidelines amid concerns over exchange security, market manipulation and regulatory risk.

The sell-off is “really testing the faith of a few key players,” Ryan Rabaglia, Hong Kong-based head trader at OSL, a cryptocurrency dealing firm, said in a phone interview. “I do think for this next push, we are going to need that institutional money to come in finally. To lend that support and help with growth.” — Reported by Eric Lam and Matt Turner, (c) 2018 Bloomberg LP